Beating Medical Trends

[By William Rusteberg]

www.RiskManagers.us (click on WEBLOG)

Medical inflation continues to rise at a rate above the growth rate in the economy. Facing rate increases year after year, plan sponsors, with their financial backs to the wall, have historically resorted to cost shifting. These continued failed attempts to control costs have driven some to seek alternate means to restore pricing sanity to health care. To many, the cost of health insurance can mean the difference between profit and loss.

The Problem

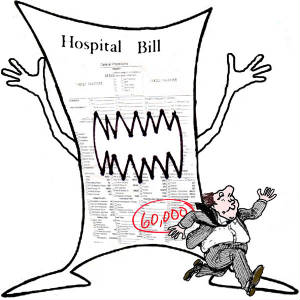

Understanding the cost of health care is directly related to what we agree to pay, more and more employers are questioning managed care contracts upon which their health care costs are based. Many are discovering the truth for the first time. Secretive contracts between health care givers and third party intermediaries contain provisions that guarantee continuous and systematic cost increases. Shared savings side agreements and other schemes found in the health industry economic chain help fuel raging health insurance costs.

Known as medical trend, cost increases have proven to be consistent and predictable. The expected rise in the cost of medical services over time is expressed as an annual percentage increase and is an important element in underwriting future risk. Medical trend is a dominant cost driver in rate making. The annual compounding effect can double or triple health care costs in just a few years.

“For managed care plans, the medical care inflation part of trend is a function of the changes in provider reimbursement rates that are negotiated. To the extent that such negotiations entail factors such as outliers and provider bonuses, the trend rate may be materially more than simply the weighted average increase in fees.” Kevin Gabriel, MBA, FSA, MAAA, Chief Actuary of Sierra Berkshire Associates, Inc.

Photo of hands of businesspeople during discussing

The Solution

Moving away from managed care contracts, more and more employers are embracing a myriad of reference based pricing models. These models can vary in scope and reach; however all share certain common characteristics in conformance with prudent business practices. Price transparency and claim benchmarking are key elements.

In 2007 – 2008 we approached several of our clients to suggest something different to control costs. The concept was simple. Eschew managed care contracts in lieu of claim benchmarking off multiple data points such as Medicare reimbursement rates. Removing managed care contracts, i.e, PPO, and paying providers quickly, fairly and directly had an immediate impact on claim costs.

After 15 months we performed a study by running 100% of claims back through the prior PPO network reimbursement rates. This exercise proved a net savings of 43% above and beyond the PPO discounts we would have otherwise experienced. Instead of doing the same thing year after year, our clients did something different and it worked.

It has been seven years since our first client exited the managed care world. Subsequently more clients have embarked on the same journey, most with equally good results. None have returned to the world of managed care.

The Evidence

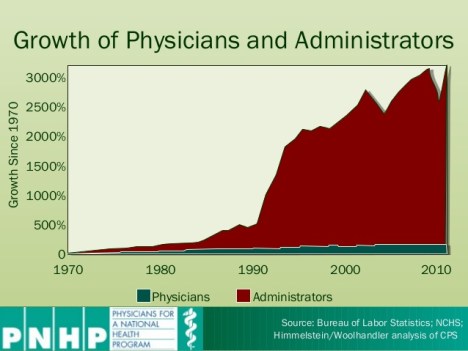

Skeptics may ask “How have your clients fared over time? Have they won the battle against medical trend?” The answer may be found by reviewing the experience of four of our clients who have been on a reference based pricing model for five years or more.

Our study is based on actual paid, mature medical claims through succeeding plan years starting in the first year on reference based pricing benchmarked off the prior year under a managed care plan. All claims above stop loss levels have been excluded.

This abbreviated analysis does not recognize changing demographics and plan changes. For example the leveraging effect of higher deductibles will increase trend factors. Of particular importance it should be noted that plan changes occurred in each case through improved benefits supported by claim savings. This study includes medical claims only.

One must understand that medical trend is just one of the factors used to calculate renewal rates for health plans and stop loss insurance. Each year carriers set their own trend level based on various factors, including the current health care inflation rate, analysts’ forecasts and their own experiences. However, our clients are self-funded and thus bear most risk with actual trend directly affecting costs without the benefit of pooling to any significant degree.

“Over the past several years, trend rates have consistently run 8-10% nationally, though certain regions have seen significantly higher or lower figures. Prescription drug trends (which are a component of this) have been more volatile. In the early 2000’s these trends were above 15%. They then fell back to single digit levels. But they have now returned to the teens.” – Kevin Gabriel, MBA, FSA, MAA

In comparing our client’s experience with average medical trend, we relied upon Heffernan Benefit Advisory Services – 2013 Trend Report; Historical Trend Factors. Based on this report, we are using 9.615% as average annual medical only trend factor.

Political Subdivision – 400 Employee Lives

This case has been on RBP for 7 years. They experienced poor claim years in 2010 and 2012. In 2012, for example, there were 14 large claims that approached or exceeded $125,000. Medical PEPM for 2014 and 2015 (to date) is less than 2008. Benefits have been improved; no deductible or co-insurance features with all benefits subject to co-pays only. Funding increase over seven years has been 15.6% or 2.23% per year.

Beating Medical Trends

Public School District – 900 Employee Lives

This case has demonstrated a consistent downward claim trend. Current PEPM (2015) is less than 2008-2009. No benefit reductions. Some benefit improvements. Plan funding has remained essentially static for the past five years.

Beating Medical Trends

Medical Industry – 280 Employee Lives

Plan year 2012-2013 experienced an outlier year with several large claims and 34 pregnancies. Current medical PEPM is 16% higher than under managed care plan in 2008-2009, representing a 2.66% increase per year (sans outliers). This illustrates that higher utilization and outlier claims will result in increasing cost which would occur under either managed care or RBP model. However, RBP trend factor continues below industry benchmarks.

Beating Medical Trends

Retail Business – 818 Employee Lives

This case has consistently been well below medical trend. Current medical PEPM is significantly lower than plan year 2008-2009. This case has not raised plan contributions in seven years.

Beating Medical Trends

Conclusion

Managed care has failed. Medical costs continue to soar. Providers are charging more and we continue to agree to blindly pay up through secretive contracts negotiated by vested interests. Medical trend has, and continues to be, consistently at double digits or close to it.

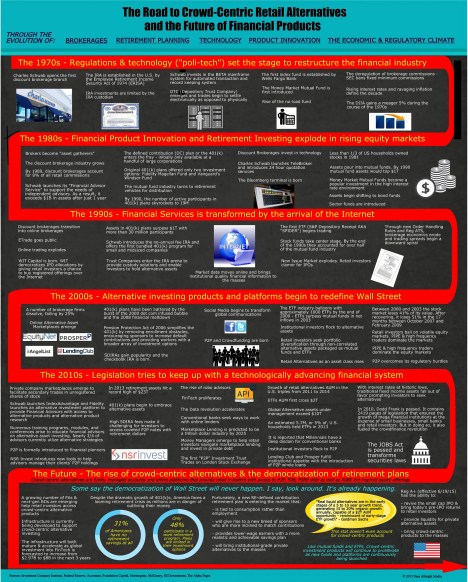

Cost plus insurance / reference based pricing is a proven method to maintain and even improve comprehensive coverage while at the same time keeping costs reasonable, predictable and consistent. Industry sources estimate reference based pricing plans represent 10% market share and rising. An east coast hedge fund, seeking opportunities in reference based pricing models, predicts reference based pricing will gain 60% market share within the next five years.

“What moves things is innovation. But it’s not easy to innovate in stagnant, hyper-regulated, captured sectors” – Max Borders (www.fee.org) Cost shifting under the Affordable Care Act will continue to fail to control costs.

Reference Based Pricing represents the last frontier in innovation to control health care costs in a tightly regulated and controlled market.

Plan sponsors can reasonably expect to reduce their health care costs below medical trend without benefit reductions or cost shifting of any kind.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

“Navigating a course where sound organizational management is intertwined with financial acumen requires a strategy designed by subject-matter experts. Fortunately, Financial Management Strategies for Hospital and Healthcare Organizations: Tools, Techniques, Checklists and Case Studies provides that blueprint”

—David B. Nash MD MBA Jefferson Medical College, Thomas Jefferson University, PA

Filed under: Health Economics, Health Insurance, Healthcare Finance | Tagged: healthcare costs, Managed Care vs Reference Based Pricing, medical inflation, William Rusteberg | 3 Comments »

To evaluate the legitimacy of an authority it is necessary to:

To evaluate the legitimacy of an authority it is necessary to: In order for these organizations to maintain power it is necessary that their authoritative opinion remain unquestioned and unchallenged. Consciously manufactured propaganda has persuaded regulatory and public opinion of their value and to maintain power it is necessary that this authority remain insulated from outside evaluation because the entire system is based…

In order for these organizations to maintain power it is necessary that their authoritative opinion remain unquestioned and unchallenged. Consciously manufactured propaganda has persuaded regulatory and public opinion of their value and to maintain power it is necessary that this authority remain insulated from outside evaluation because the entire system is based…