By Staff Reporters

SPONSOR: http://www.CertifiedMedicalPlanner.org

***

***

The history of U.S. recessions reflects the nation’s evolving economy, shaped by wars, financial crises, policy shifts, and global events. Since 1857, the U.S. has experienced over 30 recessions, each offering lessons in resilience and reform.

The United States has endured a long and varied history of economic recessions, defined as periods of significant decline in economic activity lasting more than a few months. These downturns are typically marked by falling GDP, rising unemployment, and reduced consumer spending. Since the mid-19th century, recessions have been triggered by a range of factors—from banking panics and inflation to global conflicts and pandemics.

The earliest recorded U.S. recession began in 1857, sparked by a banking crisis and declining international trade. This was followed by the Long Depression of 1873–1879, which lasted a staggering 65 months, making it the longest in U.S. history. The downturn was triggered by the collapse of a major bank and a speculative bubble in railroad investments.

The Great Depression remains the most severe economic crisis in American history. Beginning in 1929 after the stock market crash, it lasted until 1933 and saw unemployment soar to 25%. The Depression reshaped U.S. economic policy, leading to the creation of Social Security, the FDIC, and other New Deal programs aimed at stabilizing the economy and protecting citizens.

Post-World War II recessions were generally shorter and less severe. The 1945 recession, for example, lasted eight months and was caused by the transition from wartime to peacetime production. The 1973–75 recession, however, was more prolonged, driven by an oil embargo and stagflation—a combination of stagnant growth and high inflation.

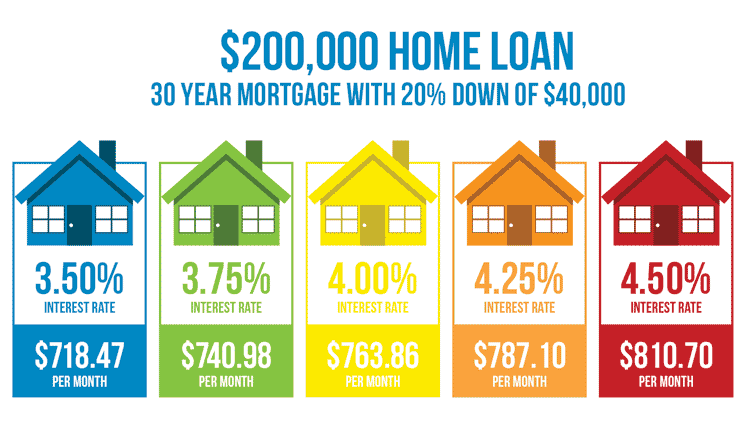

The early 1980s recession was triggered by the Federal Reserve’s aggressive interest rate hikes to combat inflation. Though painful, it ultimately helped stabilize prices and set the stage for a long period of growth. The early 1990s recession followed a savings and loan crisis and a slowdown in defense spending after the Cold War.

The Great Recession of 2007–2009 was the most significant downturn since the Great Depression. It was caused by the collapse of the housing bubble and widespread failures in financial institutions. Unemployment peaked at 10%, and the crisis led to sweeping reforms in banking and mortgage lending practices.

Most recently, the COVID-19 recession in 2020 was the shortest in U.S. history, lasting just two months. Despite its brevity, it was severe, with unemployment briefly reaching 14.7% due to lockdowns and global supply chain disruptions.

Throughout its history, the U.S. has shown remarkable resilience in recovering from recessions. Each downturn has prompted changes in fiscal and monetary policy, regulatory reform, and shifts in public perception about the role of government and markets. As the economy becomes more interconnected globally, future recessions may be shaped by international events as much as domestic ones.

COMMENTS APPRECIATED

SPEAKING: ME-P Editor Dr. David Edward Marcinko MBA MEd will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like, Refer and Subscribe

***

***

Filed under: "Ask-an-Advisor", business, CMP Program, economics, finance, Financial Planning, iMBA, Inc., Portfolio Management | Tagged: 1945 recession, banks, CMP, covid recession, depression, economy, Federal Reserve, finance, FOMC, GDP, inflation, interest rates, loan crisis, mortgage, recessions, stagflation | Leave a comment »