Turn Financial A-Ha Moments Into Lasting Change With Memory Re-Consolidation

By Rick Kahler MSFS CFP™

***

***

Have you ever had a light bulb moment about money?

Maybe you leave a workshop, a therapy session, or a conversation with a financial advisor, feeling as if you have finally cracked the code. You understand why you keep overspending. You see the pattern that keeps you procrastinating about saving and investing. You feel the reason you panic about money, even when you know you are okay. In that moment, it all seems so clear.

Yet a week later, you are right back at it. Swiping the credit card. Avoiding the budget. Losing sleep over the same worries you thought you had just solved. What happened to that breakthrough? Why did it not last?

BRAIN ANCHORING: https://medicalexecutivepost.com/2024/10/22/anchoring-initial-mental-brain-trickery/

I’ve experienced this myself, more times than I’d like to admit. Recently, I found a book that explains why: Unlocking the Emotional Brain by Bruce Ecker, Robin Ticic, and Laurel Hulley. The authors explain that lasting change happens through something called “memory re-consolidation.” It is the brain’s way of updating emotional patterns we have carried for years—often since childhood.

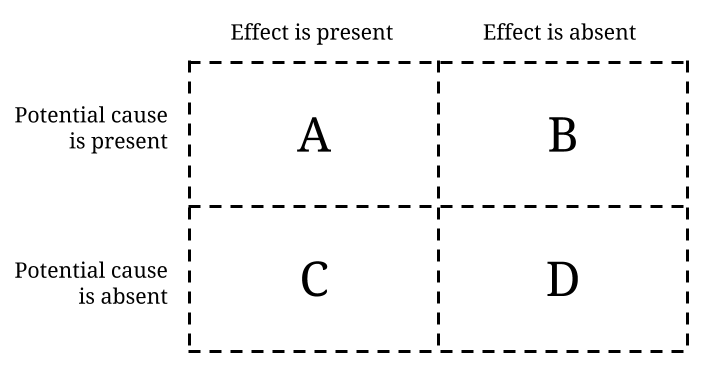

Most of us have old money stories tucked away in our emotional memory. Suppose, for example, as a child you were scolded for asking a neighbor how much money they earned. This and other similar experiences that left you feeling shamed or dismissed taught you that it was rude to talk about money.

Such early experiences are filed away as emotional truths. They shape what feels true, even years later as an adult, whether or not that “truth” is still relevant.

NEUROLINK: https://medicalexecutivepost.com/2023/03/07/neurolink-brain-chips-rejected-by-the-fda/

As an adult, you may have come to understand that talking about money is often essential for your emotional and financial well being. But when the moment comes to have a money conversation, your body still freezes up. That is not weakness. That is your brain pulling up the old file.

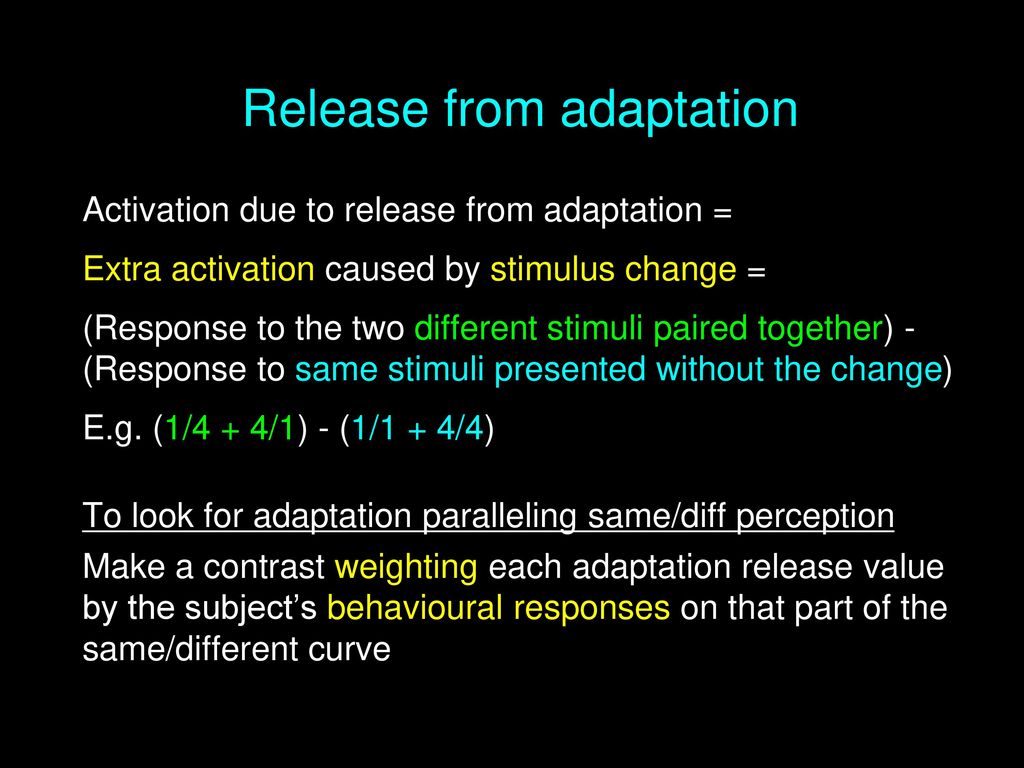

Here is where memory re-consolidation comes in. The brain does not update the file just because you think new thoughts. It updates when you have a new experience that feels different. Maybe someone listens without judgment, or you realize you are talking about money and still feel safe. That emotional mismatch tells the brain, “Maybe this file is not true anymore.”

But the update is not finished. To make the change stick, you have to hold both the old belief and the new experience together for a little while. It is like showing your brain two pictures: here is how it used to feel, and here is how it feels now. That moment of holding both is when the rewrite happens.

Even more interesting, the brain keeps the file open for several hours after the shift. What you do in that window can help the change settle in—or not. If you rush back into busyness or distractions, you might accidentally let the old version save itself again.

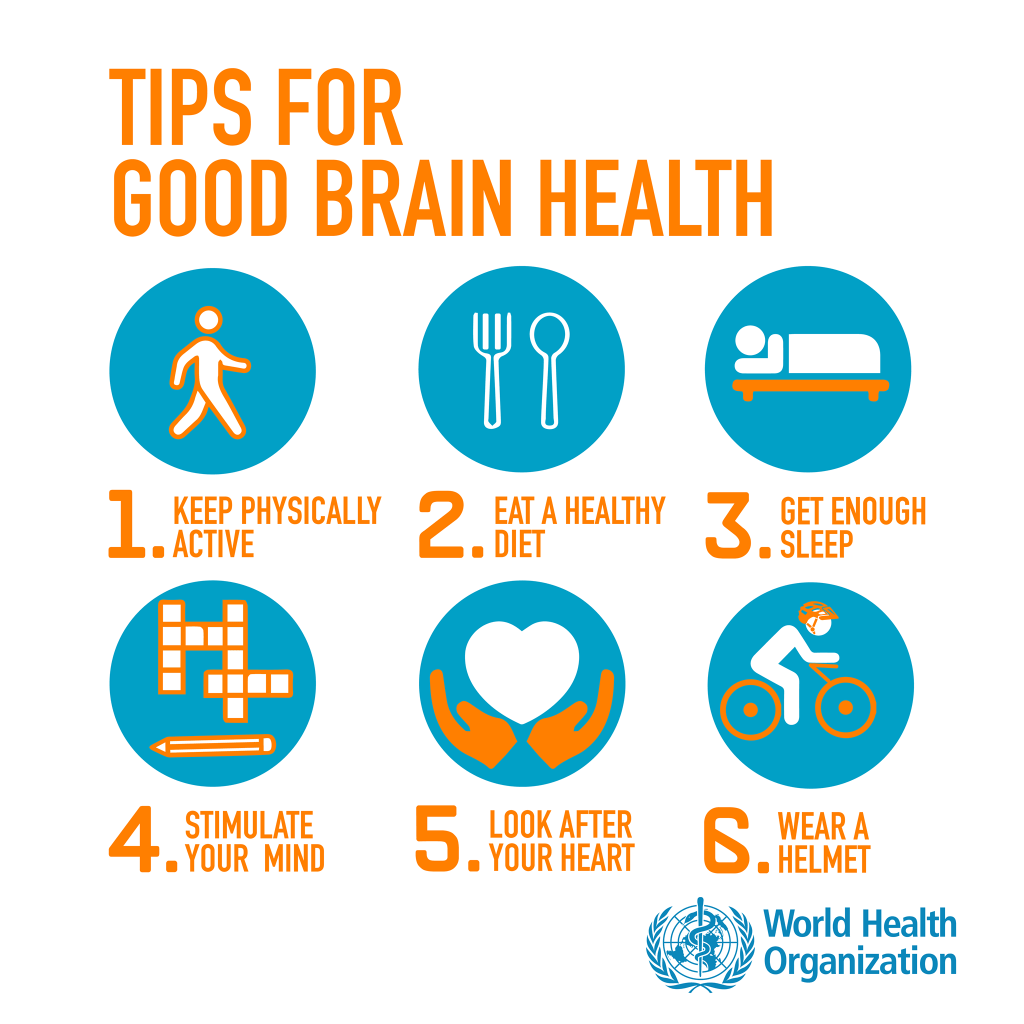

BRAIN HEALTH: https://medicalexecutivepost.com/2025/02/19/brain-health-bilingualism/

So what can we do to give those shifts a better chance of sticking? I have noticed that insights gained during a retreat or workshop, with ample time to focus and reflect, are more likely to last. Even in our everyday lives, we can slow down, even for a few minutes, to write about what we felt, check in with our bodies, or talk with someone who supports us. We can protect a little bit of quiet space before diving back into the noise.

The next time you have a money breakthrough, try giving yourself that space. Consciously notice both the old belief and the new experience. Give the re-consolidation time to settle in.

Then, the next time your brain pulls up that old money story, you’ll have access to the updated, more accurate version.

COMMENTS APPRECIATED

Like and Refer

***

***

Filed under: "Ask-an-Advisor", Ethics, Experts Invited, Financial Planning, Investing, mental health, Op-Editorials, Portfolio Management | Tagged: A-HA moment, brain, brain anchoring, brain health, Bruce Ecker, CFP, emotional brain, Ethics, financial advisor, light bulb moment, Lurel Hulley, mental health, money, money stories, neurolink, old money, rick kahler, Robin Ticic | Leave a comment »