How to Reduce Exposure to Higher post-2012 Taxes on Investment Income and Gains

By Perry Dalesandro CPA perry@dalecpa.com

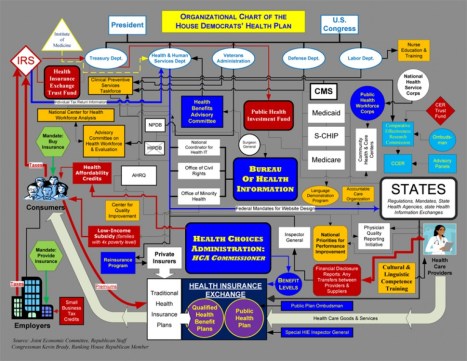

Doctors and most all individuals face the prospect of a darker tax climate in 2013 for investment income and gains. Under current law, higher-income taxpayers will face a 3.8% surtax on their investment income and gains under changes made by the Affordable Care Act. Additionally, if current tax-reduction provisions sunset, all taxpayers will face higher taxes on investment income and gains, and the vast majority of taxpayers also will face higher rates on their ordinary income. This Alert explores year-end planning moves that can help reduce exposure to higher post-2012 taxes on investment income and gains. This first part explains who has to worry about the 3.8% surtax and what it covers. It also briefly discusses key sunset rules, and begins examining some essential year-end moves.

Future parts will describe other planning moves in detail.

Who has to worry about the 3.8% Surtax and what it covers

For tax years beginning after Dec. 31, 2012, a 3.8% surtax applies to the lesser of (1) net investment income or (2) the excess of modified adjusted gross income (MAGI) over the threshold amount ($250,000 for joint filers or surviving spouses, $125,000 for a married individual filing a separate return, and $200,000 in any other case). MAGI is adjusted gross income (AGI) increased by the amount excluded from income as foreign earned income (net of the deductions and exclusions disallowed with respect to the foreign earned income).

Illustration 1: For 2013, a single taxpayer has net investment income of $50,000 and MAGI of $180,000. He won’t be liable for the tax, because his MAGI ($180,000) doesn’t exceed his threshold amount ($200,000).

Illustration 2: For 2013, a single taxpayer has net investment income of $100,000 and MAGI of $220,000. He would pay the tax only on the $20,000 amount by which his MAGI exceeds his threshold amount of $200,000, because that is less than his net investment income of $100,000. Thus, the surtax would be $760 ($20,000 × 3.8%).

Observation: An individual will pay the 3.8% tax on the full amount of his net investment income only if his MAGI exceeds his threshold amount by at least the amount of the net investment income.

Ilustration 3: For 2013, a single taxpayer has net investment income of $100,000 and MAGI of $300,000. Because his MAGI exceeds his threshold amount by $100,000, he would pay the tax on his full $100,000 of net investment income. Thus, the tax would be $3,800 ($100,000 × .038).

The tax is taken into account in determining the amount of estimated tax that an individual must pay, and is not deductible in computing an individual’s income tax.

What is net investment income? For purposes of the Medicare contribution tax, “net investment income” means the excess, if any, of:

(1) the sum of:

… gross income from interest, dividends, annuities, royalties, and rents, unless those items are derived in the ordinary course of a trade or business to which the Medicare contribution tax doesn’t apply (see below),

… other gross income derived from a trade or business to which the Medicare contribution tax does apply (below),

… net gain (to the extent taken into account in computing taxable income) attributable to the disposition of property other than property held in a trade or business to which the Medicare contribution tax doesn’t apply, over

(2) the allowable deductions that are properly allocable to that gross income or net gain.

Trades and businesses to which tax applies. The 3.8% surtax applies to a trade or business if it is a passive activity of the taxpayer, or a trade or business of trading in financial instruments or commodities.

Investment income won’t include amounts subject to self-employment tax. Specifically, net investment income won’t include any item taken into account in determining self-employment income and subject to the self-employment Medicare tax

Observation: Thus, the same item of income can’t be subject to both self-employment tax and the Medicare contribution tax. If self-employment tax applies, the Medicare contribution tax won’t apply.

The tax doesn’t apply to trades or businesses conducted by a sole proprietor, partnership, or S corporation. But income, gain, or loss on working capital isn’t treated as derived from a trade or business and thus is subject to the tax.

Exception for certain active interests in partnerships and S corporations. Gain or loss from a disposition of an interest in a partnership or S corporation is taken into account by the partner or shareholder as net investment income only to the extent of the net gain or loss that the transferor would take into account if the entity had sold all its property for fair market value immediately before the disposition.

Retirement plan distributions. Investment income doesn’t include distributions from tax-favored retirement plans, such as qualified employer plans and IRAs.

Looming Sunsets Would Affect Almost all Taxpayers

Unless Congress acts, the Bush-era tax breaks-those in the EGTRRA and JGTRRA legislation of 2001 and 2003-will come to an end (i.e., they will sunset) at the end of 2012. Depending on how the November elections play out, the sunsets may be: (1) abolished for everyone, (2) deferred for everyone (as they were in December of 2010, when they originally were to sunset), or (3) deferred for all taxpayers other than those with higher incomes. Still a fourth, albeit unlikely, possibility is that the parties will not be able to agree on remedial legislation and the Bush-era tax breaks actually will sunset at the end of 2012 for everyone.

There are scores of income tax rules that would be altered if the Bush-era tax breaks sunset at the end of 2012, but arguably the most important ones are as follows:

… Tax brackets. The 10% bracket will disappear (lowest bracket will be 15%); the 15% tax bracket for joint filers & qualified surviving spouses will be 167% (rather than 200%) of the 15% tax bracket for individual filers; and the top four tax brackets will rise from 25%, 28%, 33% and 35% to 28%, 31%, 36% and 39.6%.

… Taxation of capital gains and qualified dividends. Currently, most long-term capital gains are taxed at a maximum rate of 15%, and qualified dividend income is taxed at the same rates that apply to long-term capital gains. Under the sunset, most long-term capital gains will be taxed at a maximum rate of 20% (18% for certain assets held more than five years). And, dividends paid to individuals will be taxed at the same rates that apply to ordinary income.

If the EGTRRA/JGTRRA sunset rules go into effect at the end of 2012 and dividends and interest are taxed at ordinary income rates up to 39.6% in 2013, it seems highly unlikely that dividends and interest also would be subjected to a 3.8% surtax on net investment income (i.e., Congress would at least repeal the surtax).

Year-end Planning for Investments

Beginning below, and to be continued in future articles, are specific steps that taxpayers can take now in order to reduce or avoid exposure to the 3.8% surtax as well as possibly higher tax rates on capital gains and dividend income.

Accelerate Home Sales

The sale of a residence after 2012 can trigger the 3.8% surtax in one of two ways. It also can expose taxpayers to a higher capital gain tax rate if the sunset rules affect them next year.

- Under Code Sec. 121, when taxpayers sell their principal residences, they may exclude up to $250,000 in capital gain if single, and $500,000 in capital gain if married. Gain on a post-2012 sale in excess of the excluded amount will increase net investment income for purposes of the 3.8% surtax and net capital gain under the general tax rules. And if taxpayers sell a second home (vacation home, rental property, etc.) after 2012, they pay taxes on the entire capital gain and all of it will be subject to the 3.8% surtax.

Recommendation: A taxpayer expecting to realize a gain on a principal residence substantially in excess of the applicable $250,000/$500,000 limit who is planning to sell either this year or the next should try to complete the sale before 2013. Doing so rather than selling after 2012 will remove the portion of the gain that doesn’t qualify for the Code Sec. 121 exclusion from the reach of the 3.8% tax. It also will reduce the taxpayer’s exposure to possibly higher rates of tax on capital gains under the sunset rules.

Illustration 4: A married couple earn a combined salary of $260,000. They plan to sell their principal residence for $1.2 million, and should net a gain of about $700,000, of which $500,000 will be excluded under Code Sec. 121. If they sell this year they will pay a tax of $30,000 (15%) on their $200,000 of taxable residence gain. If they wait till next year to sell, their gain will be fully exposed to the surtax, which in their case equals 3.8% multiplied by the lesser of: (1) $200,000 of net investment income; or (2) $210,000 ($460,000 of MAGI [$260,000 salary + $200,000 of taxable home sale gain] − the $250,000 threshold). Thus, the tax on their gain will be at least $37,600 ([.15 + .038] × $200,000). The tax could be even more if they are subject to a higher capital gains tax next year under the sunset rule (or a modified sunset rule).

Illustration 5: A single taxpayer earns a salary of $170,000 and also has $30,000 of investment income (interest and dividends). He plans to sell his vacation home for $500,000 and will net a gain of approximately $400,000. If he sells this year, he’ll pay a $60,000 tax on his gain (.15 × $400,000). If he waits till next year, his MAGI will swell to $600,000 ($170,000 salary + $30,000 investment income + $400,000 gain). He will pay an additional $15,200 of tax on his vacation home gain (3.8% of $400,000), on top of the regular capital gain tax. Additionally, sale of the vacation home in 2013 will expose his $30,000 of investment income to an additional $1,140 of tax (3.8% of $30,000). |