MEDICAL EXECUTIVE-POST – TODAY’S NEWSLETTER BRIEFING

***

Essays, Opinions and Curated News in Health Economics, Investing, Business, Management and Financial Planning for Physician Entrepreneurs and their Savvy Advisors and Consultants

“Serving Almost One Million Doctors, Financial Advisors and Medical Management Consultants Daily“

A Partner of the Institute of Medical Business Advisors , Inc.

http://www.MedicalBusinessAdvisors.com

SPONSORED BY: Marcinko & Associates, Inc.

***

http://www.MarcinkoAssociates.com

| Daily Update Provided By Staff Reporters Since 2007. How May We Serve You? |

| © Copyright Institute of Medical Business Advisors, Inc. All rights reserved. 2025 |

REFER A COLLEAGUE: MarcinkoAdvisors@outlook.com

SPONSORSHIPS AVAILABLE: https://medicalexecutivepost.com/sponsors/

ADVERTISE ON THE ME-P: https://tinyurl.com/ytb5955z

Your Referral Count -0-

***

CITE: https://www.r2library.com/Resource

Nvidia: Worth 4-trillion dollars.

CITE: https://tinyurl.com/2h47urt5

Stocks up

- Hims & Hers Health gained 4.62% after announcing it will sell generic semaglutide in Canada when Novo Nordisk’s patent for Ozempic and Wegovy expires in January.

- Merck shareholders applauded its move to buy respiratory drugmaker Verona Pharma for $10 billion, sending its stock up 2.88%.

- Rhythm Pharmaceuticals popped 36.63% thanks to a promising new trial for its oral obesity treatment.

- AES, a renewable power company that counts Microsoft among its clients, jumped 19.87% after Bloomberg reported it was considering a sale.

- Fashion names Ralph Lauren (+2.10%) and Coach owner Tapestry (+3.31%) hit record highs.

Stocks down

- WPP cut its guidance and watched its stock fall 18.11% as a result. The ad giant is dealing with a laundry list of challenges, from AI disrupting the industry to clients spending less to finding a new CEO.

- Medical device maker RxSight plunged 37.84% after slashing its full-year revenue forecast.

- T-Mobile ticked 1.55% lower after getting a downgrade from KeyBanc, which said its weakness in fiber internet would prevent it from catching up to rival AT&T.

- Mobileye, which makes self-driving tech and was spun out of Intel, fell 7.08% when Intel said it was selling 45 million shares.

CITE: https://tinyurl.com/tj8smmes

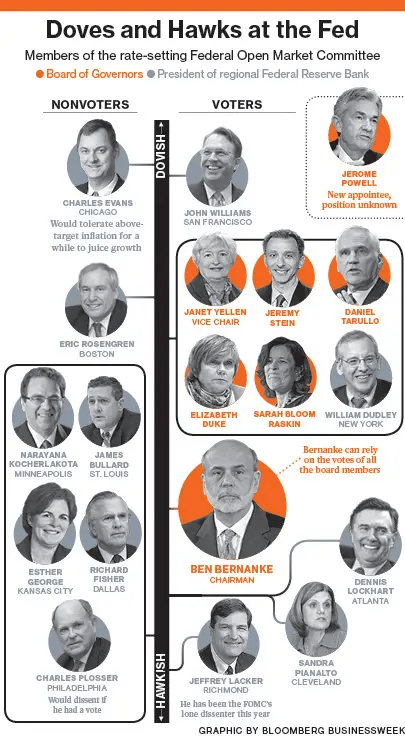

Visualize: How private equity tangled banks in a web of debt, from the Financial Times.

COMMENTS APPRECIATED

PLEASE SUBSCRIBE: MarcinkoAdvisors@outlook.com

Thank You

***

***

***

***

EDUCATIONAL TEXTBOOKS: https://tinyurl.com/4zdxuuwf

***

Filed under: Drugs and Pharma, Ethics, Information Technology, Investing, Marcinko Associates, Recommended Books, Sponsors | Tagged: DJIA, DOW, Investing, Marcinko, money, NASA, NASDAQ, Nvidia, PBMs, S&P 500, stocks, stocks down, stocks surge, stocks up, textbooks, VIX | Leave a comment »