By Rick Kahler; MSFP CFP™

***

***

This month, the U.S. government demanded a direct cut of a company’s foreign sales as the price for letting those sales happen.

Tech companies Nvidia and AMD had been stuck in regulatory limbo over selling their newest AI chips to China. According to an August 12, 2025, Reuters article by Karen Freifeld, Nvidia CEO Jensen Huang had even received a public “green light” for the company’s H20 chip, but the Commerce Department would not issue the export licenses.

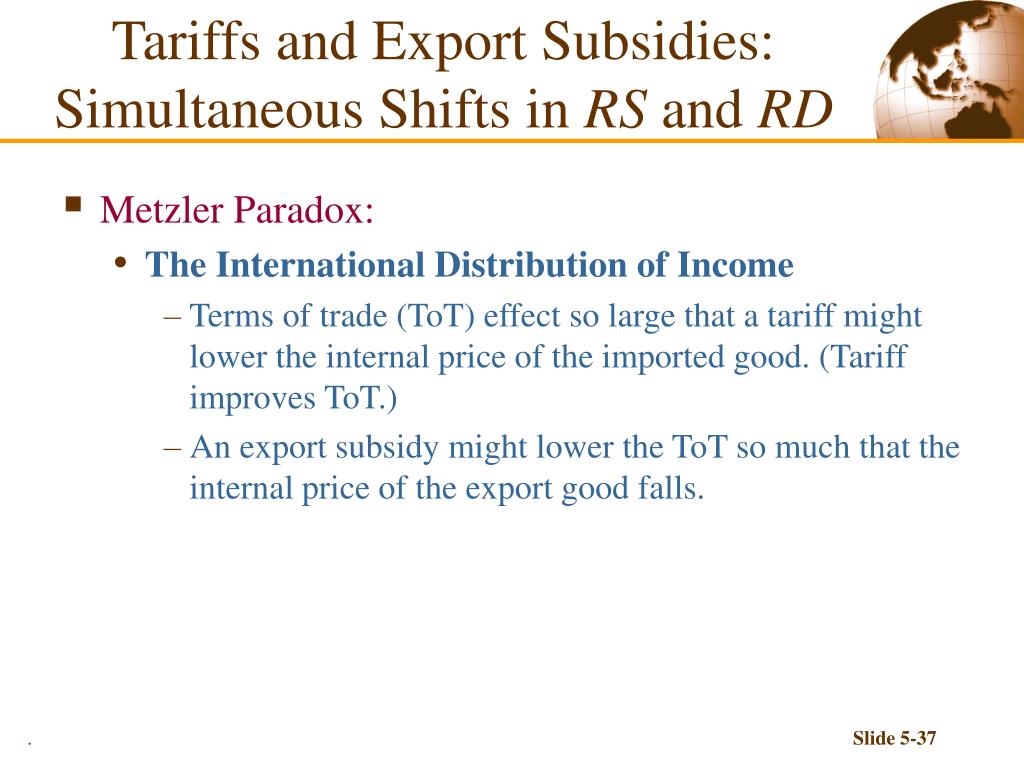

The stalemate ended only after Huang met with President Trump and agreed to a deal: the licenses would be granted, but the U.S. Treasury would get 15% of all H20 revenue from China. AMD agreed to identical terms for its MI308 chip. Two days later, both companies had their licenses.

The numbers are staggering. Bernstein Research estimates Nvidia could sell $15 billion worth of H20 chips in China this year, and AMD about $800 million of MI308s. That is more than $2 billion flowing straight to Washington, not as taxes but as a contractual price for market access. The legality of this arrangement is questionable, and the deal also raises security concerns.

It is worth noting the administration first asked for 20% before “settling” on 15%. This was not a polite request but a “take it or leave it” demand. From a behavioral economics standpoint, the decision was predictable. The pain of losing an entire market is far greater than the pain of losing a fraction of it.

How is this any different from a tariff? A tariff is a standardized, legally defined tax that applies broadly to certain goods and is collected under public trade policy. This 15% cut is a one-off, privately negotiated condition aimed at just two companies, tied to export license approval. It is taken from gross revenue, not profit, meaning the government gets paid on every dollar of sales before the companies cover a single expense.

“Tax farmming” is an old practice where the state sold the right to collect taxes for a fixed sum, allowing the collectors to keep the rest. Its use in France made some people enormously rich, made everyone else furious, and eventually helped spark the French Revolution. Similar systems appeared in Ottoman Egypt, Qing China, and the early Dutch Republic until abuses finally brought them down.

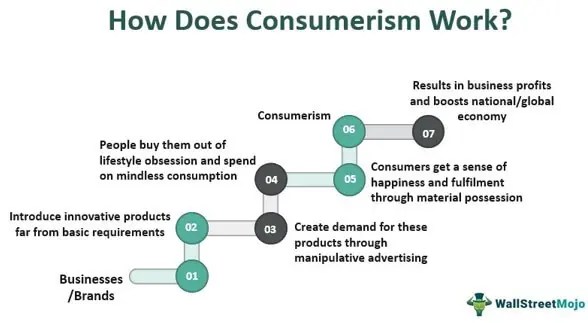

The Nvidia/AMD deal is not exactly tax farming, but it is a similar dynamic. The government’s role is no longer just regulating. It is stepping in as a business partner, taking a direct share of private sales. Supporters might call it a smart use of national leverage. Critics will see a step away from free-market capitalism toward something more political and transactional.

Nor is this deal a one-off. In June, the administration approved foreign investment in U.S. Steel only after securing a “golden share” that gives it veto power over strategic corporate decisions. History teaches us that once a government finds a way to take a cut, it rarely stops with one sector. Today it is steel and AI chips to China. Tomorrow it could be pharmaceuticals, energy, or consumer goods.

What is the likely impact for average Americans? Money flowing to the U.S. Treasury from a source other than taxpayers may seem like a benefit. Yet any company required to give away 15% of its gross revenue, which could equal its entire profit, has to compensate in some way. The most likely result is higher prices. Hiking prices on computer chips sold to China may not seem to be a big deal—until you consider that many of the products that use those chips are sold to U.S. consumers.

COMMENTS APPRECIATED

Subscribe, Like and Refer

***

***

Filed under: "Ask-an-Advisor", Experts Invited, finance, Financial Planning, Investing, Portfolio Management | Tagged: AI, AMD, China, economy, france, H2O chip, Jensen Huang, Karen Freifeld, MI308, money, Nvidia, rick kahler, tariff, tax farming, Technology, Trump, US Steel | Leave a comment »