MEDICAL EXECUTIVE-POST – TODAY’S NEWSLETTER BRIEFING

***

Essays, Opinions and Curated News in Health Economics, Investing, Business, Management and Financial Planning for Physician Entrepreneurs and their Savvy Advisors and Consultants

“Serving Almost One Million Doctors, Financial Advisors and Medical Management Consultants Daily“

A Partner of the Institute of Medical Business Advisors , Inc.

http://www.MedicalBusinessAdvisors.com

SPONSORED BY: Marcinko & Associates, Inc.

***

http://www.MarcinkoAssociates.com

| Daily Update Provided By Staff Reporters Since 2007. How May We Serve You? |

| © Copyright Institute of Medical Business Advisors, Inc. All rights reserved. 2025 |

REFER A COLLEAGUE: MarcinkoAdvisors@outlook.com

SPONSORSHIPS AVAILABLE: https://medicalexecutivepost.com/sponsors/

ADVERTISE ON THE ME-P: https://tinyurl.com/ytb5955z

Your Referral Count -0-

CITE: https://www.r2library.com/Resource

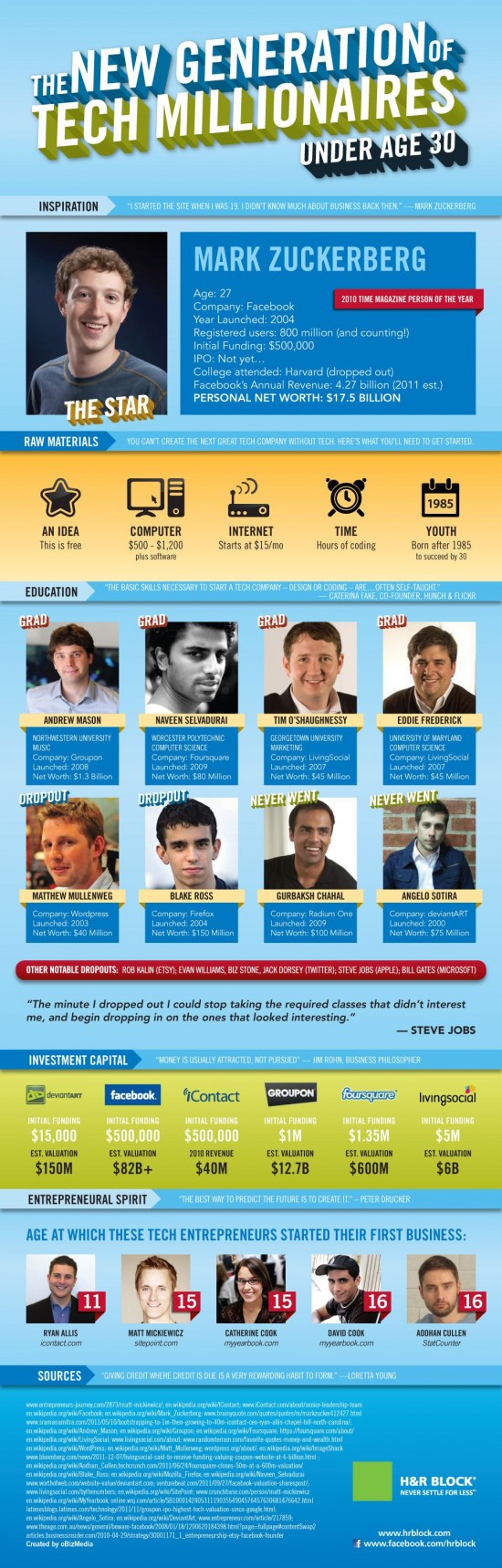

Meta’s antitrust trial resumes: The FTC is accusing CEO Mark Zuckerberg of purchasing Instagram and WhatsApp to gain an unfair monopoly in the social media space, while the defense is expected to argue that the success of those apps is a product of Meta’s acquisition. Testimony will continue this week, with one Vanderbilt law professor telling Quartz that she expects to hear more expert testimony: “Judges tend to put a lot of stock in expert opinion in antitrust cases, especially when it comes to market definition and monopoly power.”

CITE: https://tinyurl.com/2h47urt5

🟢 What’s up

- Netflix rose 1.57% on a strong vote of confidence from Wall Street pros: After last week’s earnings blowout, the streaming service received price target upgrades from JPMorgan, Wells Fargo, Goldman Sachs, Evercore ISI, Morgan Stanley and Piper Sandler today.

- Discover Financial Services climbed 3.53% after its merger with Capital One got the greenlight from regulators. Capital One rose 1.54%.

- MicroAlgo exploded 74.93% after the tech holding company became the latest hot penny stock du jour.

- Gold miners continue to mint big gains as the hot commodity broke yet another record. Barrick Gold gained 1.39%, while Anglogold Ashanti climbed 2.13%.

What’s down

What’s down

- Chipotle sank 3.48% after announcing plans to open its first restaurant in Mexico.

- Hertz Global gave up some of last week’s big gains today, dropping 4.98% as investors took profits following Bill Ackman’s hint that the rental car company may team up with Uber.

- Speaking of, Uber fell 3.08% after the FTC sued the ride-hailing company for “deceptive billing and cancellation practices.”

- Amazon lost 3.11% thanks to a downgrade from Raymond James analysts. They believe the e-commerce titan’s retail and advertising businesses are too exposed to tariffs.

- Salesforce stumbled 4.45% on a downgrade from DA Davidson analysts, who say the SAAS company is too focused on AI and not on its core business.

- Deutsche Post AG, better known as DHL, announced it is suspending shipments worth over $800 as the international shipping company struggles with tariffs. Shares fell 1%.

- Comerica lost 4.36% after the regional bank forecast lower loans and deposits in 2025.

CITE: https://tinyurl.com/tj8smmes

Now that the US government is negotiating drug prices directly with manufacturers, states want to get in on the action, too. These efforts vary by state, but generally involve creating a board to review drugs’ affordability and sometimes setting upper price limits (UPLs). While none have implemented UPLs as of April, as the idea gains momentum, there are questions about UPLs and boards’ legality, practicality, and whether they will actually lower costs for patients.

Visualize: How private equity tangled banks in a web of debt, from the Financial Times.

COMMENTS APPRECIATED

PLEASE SUBSCRIBE: MarcinkoAdvisors@outlook.com

Thank You

***

***

***

***

EDUCATIONAL TEXTBOOKS: https://tinyurl.com/4zdxuuwf

***

Filed under: "Ask-an-Advisor", Drugs and Pharma, Ethics, Information Technology, Investing, Marcinko Associates, Recommended Books, Sponsors | Tagged: anti-trust, Art, DJIA, DOW, down stocks, drug price, Drugs, Facebook, FB, FTC, Marcinko, Mark Zuckerberg, Meta, NASDAQ, PBMs, S&P 500, social media, textbooks, trial, twitter, up stocks, VIX, whatsapp, Zuck | Leave a comment »