BREAKING NEWS – MARKET VOLATILITY

By Staff Reporters

***

***

US stocks nosedived on Thursday, with the Dow tumbling more than 1,200 points as President Trump’s surprisingly steep “Liberation Day” tariffs sent shock waves through markets worldwide. The tech-heavy NASDAQ Composite (IXIC) led the sell-off, plummeting over 4%. The S&P 500 (GSPC) dove 3.7%, while the Dow Jones Industrial Average (^DJI) tumbled roughly 3%. [ongoing story].

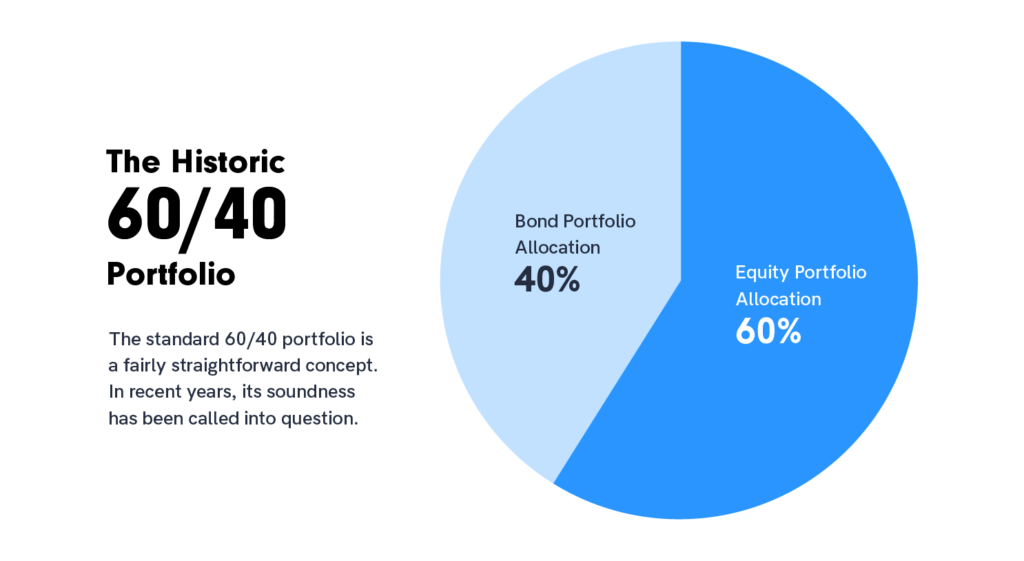

So, does the traditional 60 stock / 40 bond strategy still work or do we need another portfolio model?

***

The 60/40 strategy evolved out of American economist Harry Markowitz’s groundbreaking 1950s work on modern portfolio theory, which holds that investors should diversify their holdings with a mix of high-risk, high-return assets and low-risk, low-return assets based on their individual circumstances.

While a portfolio with a mix of 40% bonds and 60% equities may bring lower returns than all-stock holdings, the diversification generally brings lower variance in the returns—meaning more reliability—as long as there isn’t a strong correlation between stock and bond returns (ideally the correlation is negative, with bond returns rising while stock returns fall).

CORRELATION: https://medicalexecutivepost.com/2024/10/27/correlation-diversification-in-finance-and-investments/

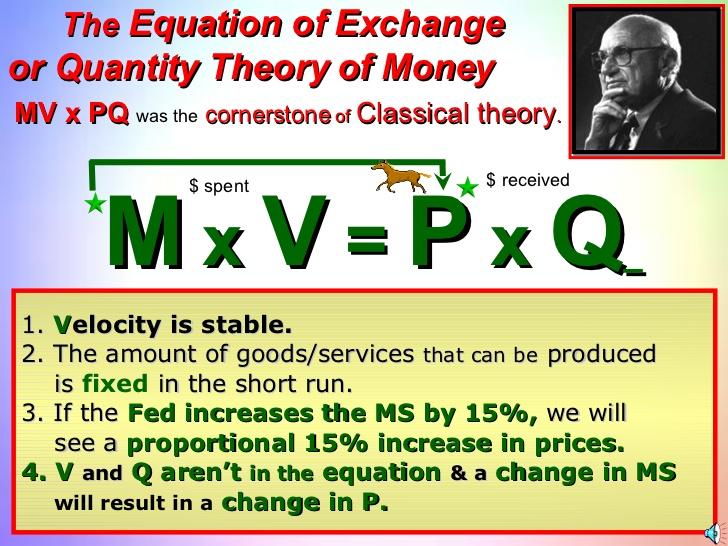

For 60/40 to work, bonds must be less volatile than stocks and economic growth and inflation have to move up and down in tandem. Typically, the same economic growth that powers rallies in equities also pushes up inflation—and bond returns down. Conversely, in a recession stocks drop and inflation is low, pushing up bond prices.

***

- But, the traditional 60/40 portfolio may “no longer fully represent true diversification,” BlackRock CEO Larry Fink writes in a new letter to investors.

- Instead, the “future standard portfolio” may move toward 50/30/20 with stocks, bonds and private assets like real estate, infrastructure and private credit, Fink writes.

- Here’s what experts say individual investors may want to consider before dabbling in private investments.

It may be time to rethink the traditional 60/40 investment portfolio, according to BlackRock CEO Larry Fink. In a new letter to investors, Fink writes the traditional allocation comprised of 60% stocks and 40% bonds that dates back to the 1950s “may no longer fully represent true diversification.“

DI-WORSIFICATION: https://medicalexecutivepost.com/2024/04/09/what-is-financial-portfolio-di-worsification-2/

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit a RFP for speaking engagements: MarcinkoAdvisors@outlook.com

COMMENTS APPRECIATED

Read, Like, Subscribe and Refer

***

***

Filed under: "Ask-an-Advisor", Experts Invited, Financial Planning, Funding Basics, Investing, Marcinko Associates, Portfolio Management | Tagged: BlackRock, bonds, correlation, diversification, Diworsification, finance, Financial Planning, Growth, Harry Markowitz, Investing, investment, Larry Fink, Marcinko, personal-finance, portfolio, Portfolio Management, Private Equity, real estate, recession, stock, stocks | Leave a comment »