MEDICAL EXECUTIVE-POST – TODAY’S NEWSLETTER BRIEFING

***

Essays, Opinions and Curated News in Health Economics, Investing, Business, Management and Financial Planning for Physician Entrepreneurs and their Savvy Advisors and Consultants

“Serving Almost One Million Doctors, Financial Advisors and Medical Management Consultants Daily“

A Partner of the Institute of Medical Business Advisors , Inc.

http://www.MedicalBusinessAdvisors.com

SPONSORED BY: Marcinko & Associates, Inc.

***

http://www.MarcinkoAssociates.com

| Daily Update Provided By Staff Reporters Since 2007. How May We Serve You? |

| © Copyright Institute of Medical Business Advisors, Inc. All rights reserved. 2025 |

REFER A COLLEAGUE: MarcinkoAdvisors@outlook.com

SPONSORSHIPS AVAILABLE: https://medicalexecutivepost.com/sponsors/

ADVERTISE ON THE ME-P: https://tinyurl.com/ytb5955z

Your Referral Count -0-

CITE: https://www.r2library.com/Resource

Stocks up

- Lucid exploded 36.24% higher on the news that the EV maker is partnering with Uber to roll out the ridesharing company’s new robotaxis.

- PepsiCo popped 7.45% thanks to a strong quarter for the snack and soda giant, while shareholders cheered the details of its turnaround plan.

- United Airlines may have missed Wall Street’s revenue forecast, but its profits were enough to impress investors. Shares rose 3.11%.

- Reports that Union Pacific is thinking about acquiring a rival sent shares of fellow train operators CSX and Norfolk Southern up 3.73% and 3.65%, respectively.

- Sarepta Therapeutics soared 19.53% after the biotech announced it will lay off 500 employees and restructure its entire business.

- Quantumscape continued its hot streak, rising yet another 19.82% thanks to its recent battery breakthrough.

- Speaking of hot streaks, OpenDoor Technologies rose another 10.74% as retail traders pour into what is quickly becoming the next big meme stock.

Stocks down

- GE Aerospace crushed earnings expectations and raised its fiscal guidance, but it still wasn’t enough to impress investors, who pushed shares of the engine maker down 2.10%.

- US Bancorp sank 1.03% after revenue and net interest income missed forecasts last quarter.

- Abbott Laboratories beat on both top and bottom line guidance, but still fell 8.53% after the pharma company narrowed its fiscal forecasts.

- Elevance Health tumbled 12.22% af

CITE: https://tinyurl.com/2h47urt5

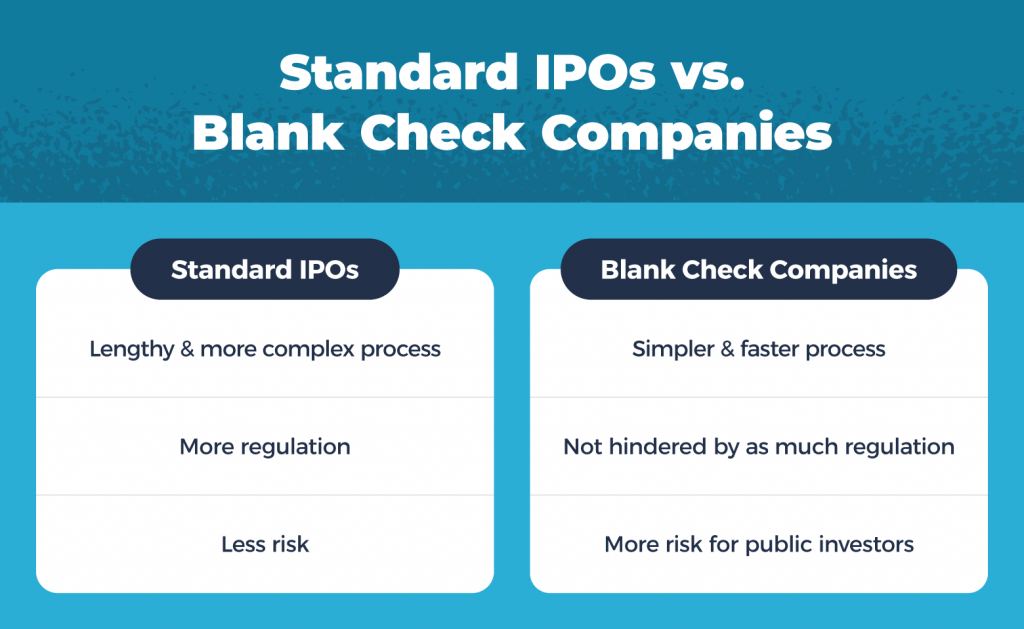

President Trump is expected to sign an executive order in the coming days designed to help make private-market investments more available to U.S. retirement plans, according to people familiar with the matter. The order would instruct the Labor Department and the Securities and Exchange Commission to provide guidance to employers and plan administrators on including investments like private assets in 401(k) plans.

CITE: https://tinyurl.com/tj8smmes

Visualize: How private equity tangled banks in a web of debt, from the Financial Times.

COMMENTS APPRECIATED

PLEASE SUBSCRIBE: MarcinkoAdvisors@outlook.com

Thank You

***

***

***

***

EDUCATIONAL TEXTBOOKS: https://tinyurl.com/4zdxuuwf

***

Filed under: "Ask-an-Advisor", Accounting, economics, Experts Invited, finance, Information Technology, Investing, Marcinko Associates, Portfolio Management, Recommended Books, Sponsors | Tagged: DJIA, DOW, FTC, investments, Labor deprtment, Marcinko, NASA, NASDAQ, news, S&P 500, SEC, Securities Exchange Commission, textbooks, TNX, Trump, VIX | Leave a comment »

Click to play

Click to play