By Dr. David Edward Marcinko MBA MEd

BASIC DEFINITIONS

***

***

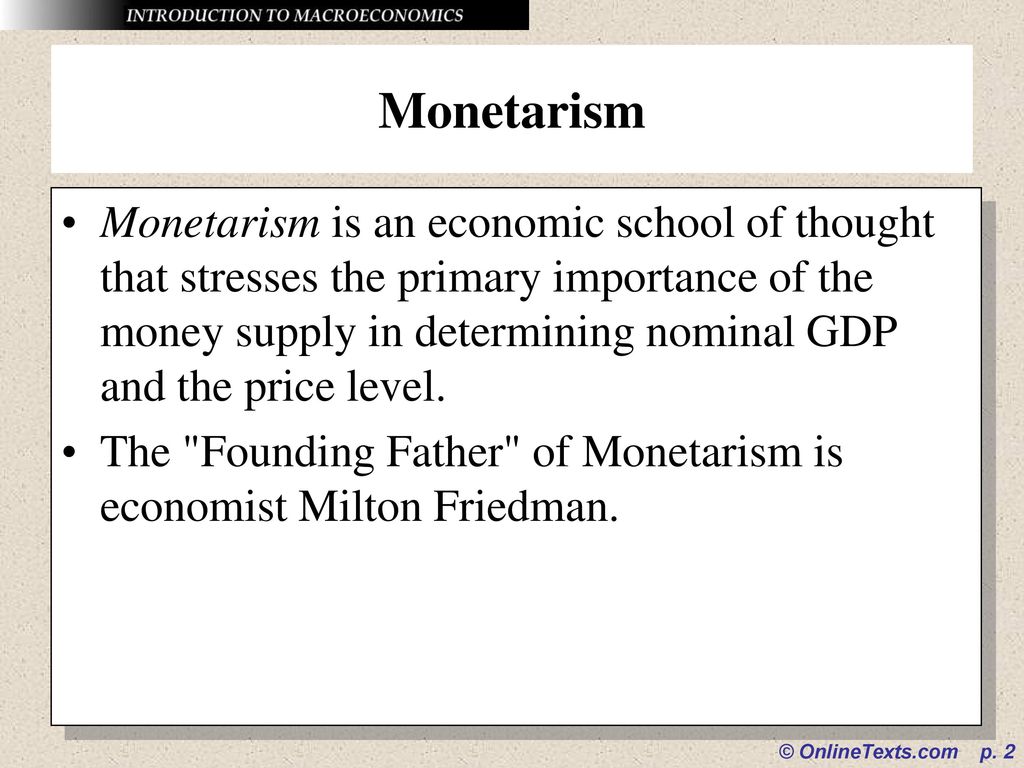

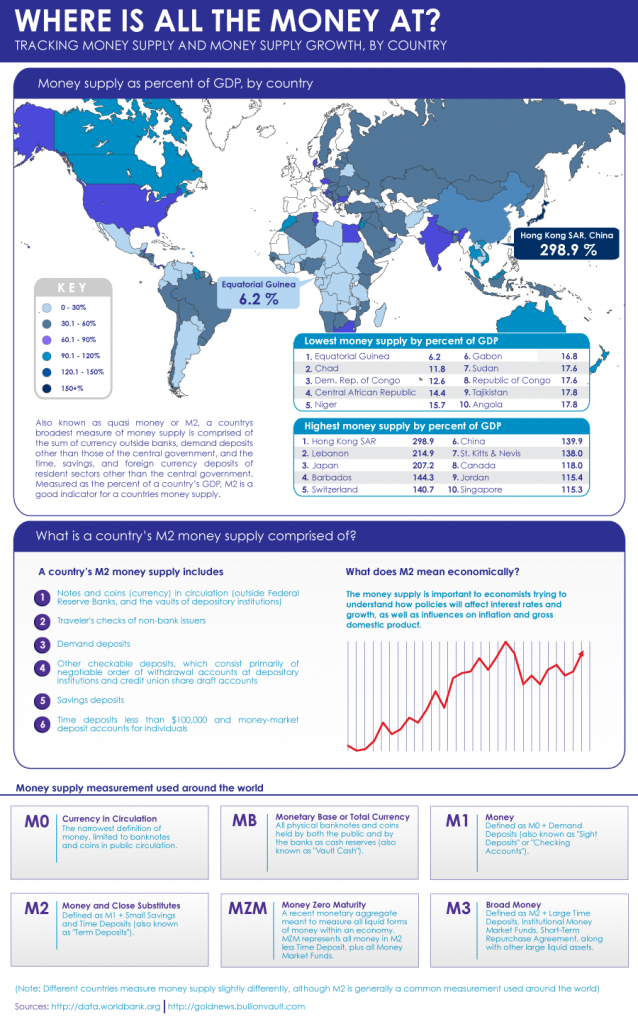

Money supply measures—M0, M1, M2, and M3—are essential tools used by economists and policymakers to assess liquidity, guide monetary policy, and understand economic health. Each measure reflects a different level of liquidity and plays a unique role in financial analysis.

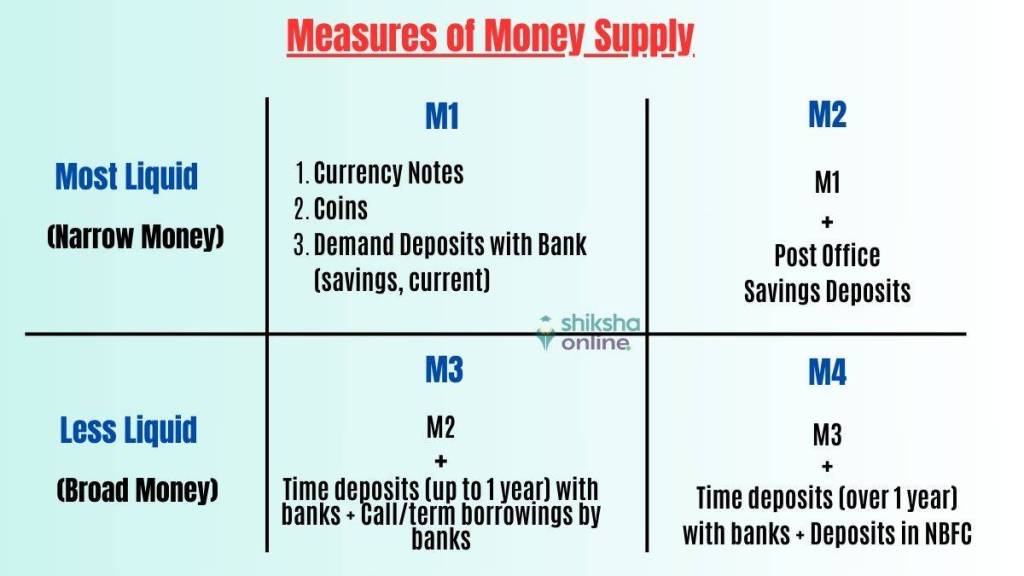

The money supply refers to the total amount of monetary assets available in an economy at a specific time. It includes various forms of money, ranging from physical currency to more liquid financial instruments. To better understand and manage economic activity, central banks and economists categorize money into different measures based on liquidity: M0, M1, M2, and M3.

M0, also known as the monetary base or base money, includes all physical currency in circulation—coins and paper money—plus reserves held by commercial banks at the central bank. It represents the most liquid form of money and is directly controlled by the central bank through tools like open market operations and reserve requirements.

M1 builds on M0 by adding demand deposits (checking accounts) and other liquid deposits that can be quickly converted into cash. It includes:

- Physical currency held by the public

- Traveler’s checks

- Demand deposits at commercial banks

M1 is a key indicator of immediate spending power in the economy. A rapid increase in M1 can signal rising consumer activity, while a decline may indicate tightening liquidity.

M2 expands further by including near-money assets—those that are not as liquid as M1 but can be converted into cash relatively easily. M2 includes:

- All components of M1

- Savings deposits

- Money market securities

- Certificates of deposit (under $100,000)

M2 is widely used by economists and the Federal Reserve to gauge intermediate-term economic trends. It reflects both spending and saving behavior, making it a critical tool for forecasting inflation and guiding interest rate decisions.

M3, though no longer published by the Federal Reserve since 2006, includes M2 plus large time deposits, institutional money market funds, and other larger liquid assets. M3 provides a broader view of the money supply, especially useful for analyzing long-term investment trends and credit expansion. Some countries, like the UK and India, still track M3 for macroeconomic planning.

These measures are not just academic—they have real-world implications. For instance, during the COVID-19 pandemic, the U.S. saw a historic surge in M2 due to stimulus payments and quantitative easing. This expansion raised concerns about future inflation, which materialized in subsequent years. Monitoring money supply helps central banks adjust monetary policy to maintain price stability and support economic growth.

In conclusion, money supply measures offer a layered view of liquidity in the economy, from the most liquid (M0) to broader aggregates (M3).

Understanding these categories helps policymakers, investors, and businesses anticipate economic shifts, manage inflation, and make informed financial decisions.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like, Refer and Subscribe

***

***

Filed under: "Ask-an-Advisor", Financial Planning, Funding Basics, Glossary Terms, Investing, Marcinko Associates, Portfolio Management | Tagged: base money, bonds, CASH, david marcinko, demand deposits, economy, fed, finance, FOMC, Investing, large time deposits, liquidity, MMFs, monetary base, money supply, money supply liquidity, stock market, stocks | Leave a comment »