MEDICAL EXECUTIVE-POST – TODAY’S NEWSLETTER BRIEFING

***

Essays, Opinions and Curated News in Health Economics, Investing, Business, Management and Financial Planning for Physician Entrepreneurs and their Savvy Advisors and Consultants

“Serving Almost One Million Doctors, Financial Advisors and Medical Management Consultants Daily“

A Partner of the Institute of Medical Business Advisors , Inc.

http://www.MedicalBusinessAdvisors.com

SPONSORED BY: Marcinko & Associates, Inc.

***

http://www.MarcinkoAssociates.com

| Daily Update Provided By Staff Reporters Since 2007. How May We Serve You? |

| © Copyright Institute of Medical Business Advisors, Inc. All rights reserved. 2024 |

REFER A COLLEAGUE: MarcinkoAdvisors@outlook.com

SPONSORSHIPS AVAILABLE: https://medicalexecutivepost.com/sponsors/

ADVERTISE ON THE ME-P: https://tinyurl.com/ytb5955z

Your Referral Count -0-

Three UnitedHealth-owned insurance companies must pay over $165 million for misleading thousands of customers in Massachusetts into paying for additional health insurance, a state judge has ruled.

CITE: https://www.r2library.com/Resource

Nvidia stock (NVDA) tumbled more than 6% Tuesday, a day after shares closed at a record high in anticipation of CEO Jensen Huang’s keynote at the tech industry’s annual CES trade show in Las Vegas.

CITE: https://tinyurl.com/2h47urt5

Dow ends down nearly 180 points, NASDAQ tumbles 1.9% as Treasury yields surge after job-openings, ISM services data

CITE: https://tinyurl.com/tj8smmes

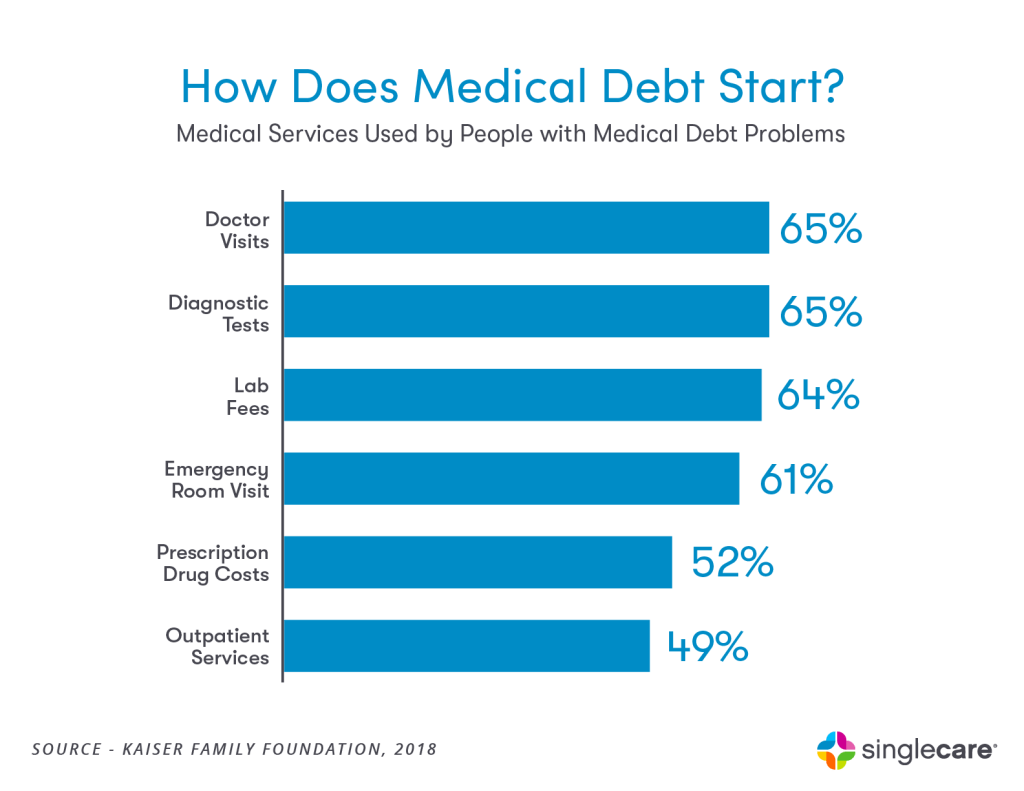

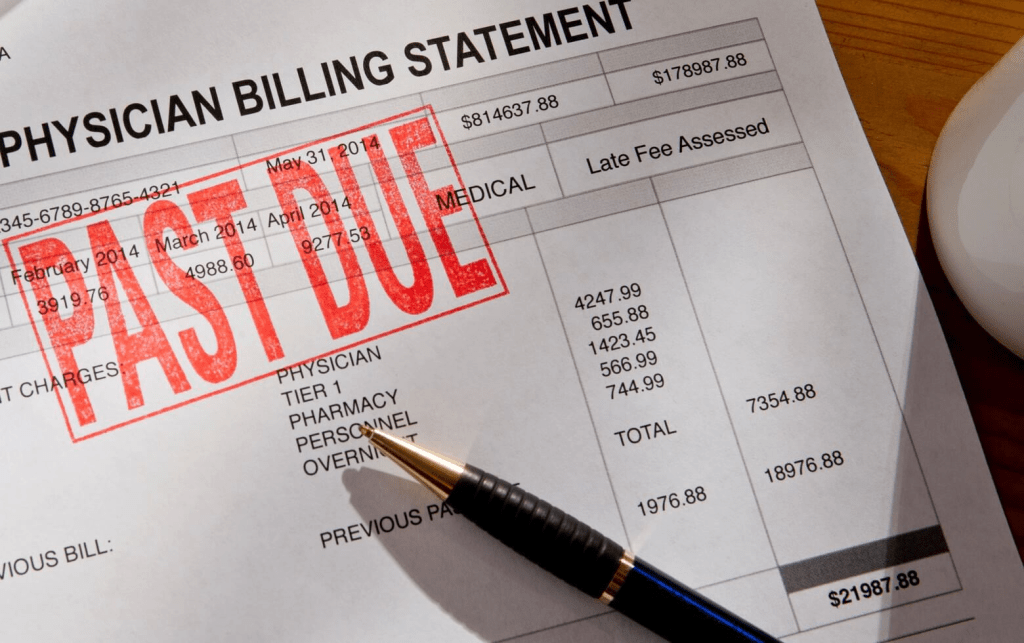

The Biden administration’s Consumer Financial Protection Bureau (CFPB) issued a new rule Tuesday that will hide an estimated $49 billion in medical debt from credit reports. The rule, which is slated to affect 15 million Americans, prohibits the inclusion of medical bills on credit reports and bars creditors from using medical information in making lending decisions. The policy specifically targets national credit-reporting companies Equifax, Experian and Transunion, which provide detailed evaluations of consumer finances to banks, employers and landlords.

COMMENTS APPRECIATED

PLEASE SUBSCRIBE: MarcinkoAdvisors@outlook.com

Thank You

***

***

***

***

EDUCATIONAL TEXTBOOKS: https://tinyurl.com/4zdxuuwf

***

Filed under: Drugs and Pharma, Experts Invited, Funding Basics, Health Economics, Health Insurance, Health Law & Policy, Healthcare Finance, Information Technology, Investing, Marcinko Associates, Recommended Books, Sponsors | Tagged: AI, Biden, CES, CFPB, Consumer Financial Protection Bureau, DJIA, DOW, Equifax, Experian, ism, Marcinko, medical bills, medical creditors, NASA, NASDAQ, news, Nvidia, S&P 500, Technology, textbooks, TNX, TransUnion, UnitedHealth, VIX, WSJ | Leave a comment »