Dr. David Edward Marcinko; MBA MEd

SPONSOR: http://www.MarcinkoAssociates.com

***

***

Origins and Core Assumptions

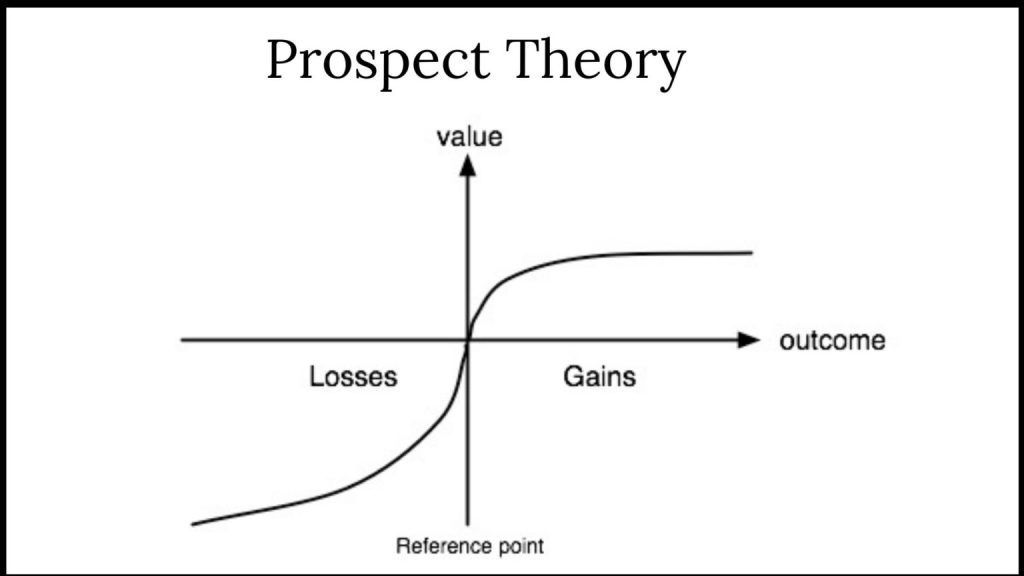

The theory emerged during a period when stock trading was dominated by institutions and wealthy individuals. Small investors, who could not afford 100‑share blocks, often purchased odd lots. Analysts observed that these traders tended to enter the market after prices had already risen significantly and to sell only after declines had already occurred. The odd‑lot theory formalized this observation into a broader claim: odd‑lot investors consistently act on emotion rather than analysis, making them a useful signal of crowd psychology.

Two assumptions sit at the heart of the theory:

- Odd‑lot traders are generally uninformed. They are presumed to lack access to research, professional advice, or disciplined strategies.

- Their behavior is reactive rather than predictive. They buy after feeling confident and sell after feeling fearful, which often means they are late to major turning points.

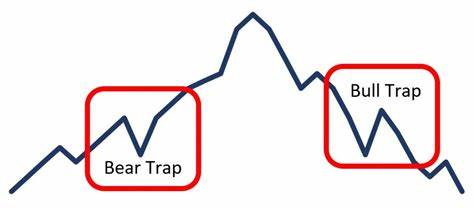

From these assumptions, analysts concluded that odd‑lot buying was a bearish sign and odd‑lot selling was bullish.

How the theory was used

Market services once tracked odd‑lot purchases and sales, publishing weekly statistics. Analysts interpreted these numbers in several ways:

- Odd‑lot buying as a sell signal. If small investors were aggressively buying, it suggested optimism had peaked.

- Odd‑lot selling as a buy signal. Heavy selling implied capitulation, a point at which fear had driven out the last hesitant holders.

- Odd‑lot short selling as a bullish sign. Because odd‑lot traders were thought to be poor market timers, their attempts to short the market were interpreted as a sign that prices were likely to rise.

These interpretations were not mechanical rules but sentiment cues. The theory functioned similarly to modern contrarian indicators such as surveys of investor confidence or measures of retail trading activity.

Why the theory gained traction

The odd‑lot theory resonated for several reasons. First, it aligned with the broader belief that markets are driven by cycles of fear and greed. Small investors, lacking experience, were seen as especially vulnerable to these emotional swings. Second, the theory offered a simple, intuitive tool for identifying market extremes. In an era before sophisticated data analytics, any observable pattern in investor behavior was valuable. Finally, the theory fit the narrative that professional investors were more rational and disciplined, reinforcing the idea that the “smart money” moved opposite the crowd.

Limitations and criticisms

Despite its historical appeal, the odd‑lot theory has significant weaknesses.

- Its assumptions about small investors are overly broad. Not all odd‑lot traders were uninformed; many simply lacked the capital to buy round lots.

- Market structure has changed dramatically. Fractional shares, online brokerages, and algorithmic trading have blurred the distinction between small and large investors.

- Retail investors today are more diverse. Some are inexperienced, but others are highly sophisticated, using advanced tools and strategies.

- Empirical support is inconsistent. Studies over time have shown mixed results, with odd‑lot activity not reliably predicting market turning points.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like, Refer and Subscribe

***

***

Filed under: "Ask-an-Advisor", economics, finance, Financial Planning, Funding Basics, Glossary Terms, Marcinko Associates, Portfolio Management, Risk Management | Tagged: bears, bulls, buy, david marcinko, economy, finance, Investing, odd lot theory, odd lots, ODD-LOT: Stock Trading Theory, retail investors, sell, stock market, stock markets, stocks | Leave a comment »

STUPID COMMENTS: Financial Advisors Say to Physician Clients

BY DR. DAVID EDWARD MARCINKO; MBA MEd CMP®

***

***

SPONSOR: http://www.MarcinkoAssociates.com

***

Some Stupid Things Financial Advisors Say to Physician Clients

A few years ago and just for giggles, colleague Lon Jefferies MBA CFP® and I collected a list of dumb-stupid things said by some Financial Advisors to their doctor, dentist, nurse and and other medical professional clients, along with some recommended under-breath rejoinders:

So, don’t let these aphorisms blind you to the critical thinking skills you learned in college, honed in medical school and apply every day in life.

COMMENTS APPRECIATED

Refer, Like and Subscribe

***

EDUCATION: Books

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit a RFP for speaking engagements: CONTACT: MarcinkoAdvisors@outlook.com

***

***

Share this:

Filed under: "Advisors Only", "Doctors Only", Ethics, Jokes and Puns, LifeStyle | Tagged: bears, bulls, crypto, DO, doctor clients, DPM, dumb comments, finance, financial advisors, financial planners, Investing, Lon Jefferies, Marcinko, MD, personal-finance, Physician Clients, physicians, Ponzi, stocks, stupid comments, Wall Street | Leave a comment »