By Staff Reporters

SPONSOR: http://www.MarcinkoAssociates.com

***

***

“THE INVESTOR’S CHIEF problem—even his worst enemy—is likely to be himself.” So wrote Benjamin Graham, the father of modern investment analysis.

With these words, written in 1949, Graham acknowledged the reality that investors are human. Though he had written an 800 page book on techniques to analyze stocks and bonds, Graham understood that investing is as much about human psychology as it is about numerical analysis.

In the decades since Graham’s passing, an entire field has emerged at the intersection of psychology and finance. Known as behavioral finance, its pioneers include Daniel Kahneman, Amos Tversky and Richard Thaler. Together, they and their peers have identified countless human foibles that interfere with our ability to make good financial decisions. These include hindsight bias, recency bias and overconfidence, among others. On my bookshelf, I have at least as many volumes on behavioral finance as I do on pure financial analysis, so I certainly put stock in these ideas.

At the same time, I think we’re being too hard on ourselves when we lay all of these biases at our feet. We shouldn’t conclude that we’re deficient because we’re so susceptible to biases. Rather, the problem is that finance isn’t a scientific field like math or physics. At best, it’s like chaos theory. Yes, there is some underlying logic, but it’s usually so hard to observe and understand that it might as well be random. The world of personal finance is bedeviled by paradoxes, so no individual—no matter how rational—can always make optimal decisions.

As we plan for our financial future, I think it’s helpful to be cognizant of these paradoxes. While there’s nothing we can do to control or change them, there is great value in being aware of them, so we can approach them with the right tools and the right mindset.

Here are just seven of the paradoxes that can bedevil financial decision-making:

- There’s the paradox that all of the greatest fortunes—Carnegie, Rockefeller, Buffett, Gates—have been made by owning just one stock. And yet the best advice for individual investors is to do the opposite: to own broadly diversified index funds.

- There’s the paradox that the stock market may appear overvalued and yet it could become even more overvalued before it eventually declines. And when it does decline, it may be to a level that is even higher than where it is today.

- There’s the paradox that we make plans based on our understanding of the rules—and yet Congress can change the rules on us at any time, as it did just last year.

- There’s the paradox that we base our plans on historical averages—average stock market returns, average interest rates, average inflation rates and so on—and yet we only lead one life, so none of us will experience the average.

- There’s the paradox that we continue to be attracted to the prestige of high-cost colleges, even though a rational analysis that looks at return on investment tells us that lower-cost state schools are usually the better bet.

- There’s the paradox that early retirement seems so appealing—and has even turned into a movement—and yet the reality of early retirement suggests that we might be better off staying at our desks.

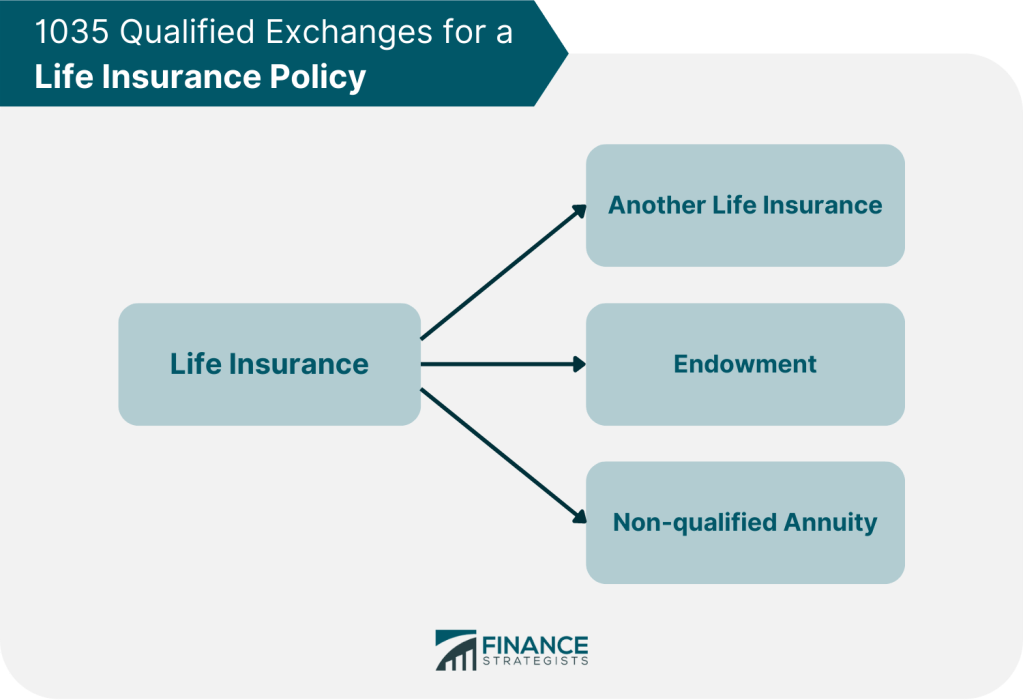

- There’s the paradox that retirees’ worst fear is outliving their money and yet few choose the financial product that is purpose-built to solve that problem: the single-premium immediate annuity.

How should you respond to these paradoxes? As you plan for your financial future, embrace the concept of “loosely held views.”

In other words, make financial plans, but continuously update your views, question your assumptions and rethink your priorities.

COMMENTS APPRECIATED

Subscribe, Refer and Like

***

***

Filed under: "Ask-an-Advisor", Accounting, Financial Planning, Funding Basics, Glossary Terms, Investing, Taxation, Touring with Marcinko | Tagged: annuity, Ben Graham, Buffett, Carnegies, Daniel Kahneman, diversificayion, economics, finance, financial, Financial Planning, Gates, growth investing, Index Funds, Investing, Marcinko, Mutual Funds, paradoxes, personal-finance, Richard Thaler, Rockefeller, stock market, stocks, value investing | Leave a comment »