FRANKLY SPEAKING MY MIND!

By Dr. David Edward Marcinko MBA MEd CMP™

SPONSOR: http://www.CertifiedMedicalPlanner.org

***

SPONSOR: http://www.MarcinkoAssociates.com

***

The vast majority of physicians and medical professionals major in one of the hard science while in college; biology, engineering, chemistry, mathematics, computer science or physics; etc. Few take undergraduate courses in finance, business management, securities analysis, accounting or economics; although this paradigm is changing with modernity. These course are not particularly difficult for the pre-medical baccalaureate major, they are just not on the radar screen for time compressed and highly competitive students; nor are they needed for medical or nursing school admission, or the many related allied health professional schools.

In fact, William C. Roberts MD, originally from Emory University in Atlanta, and former editor for the Baylor University Medical Center Proceedings and The American Journal of Cardiology, opined just a decade ago:

“Of the 125 medical schools in the USA, only one of them to my knowledge offers a class related to saving or investing money.”

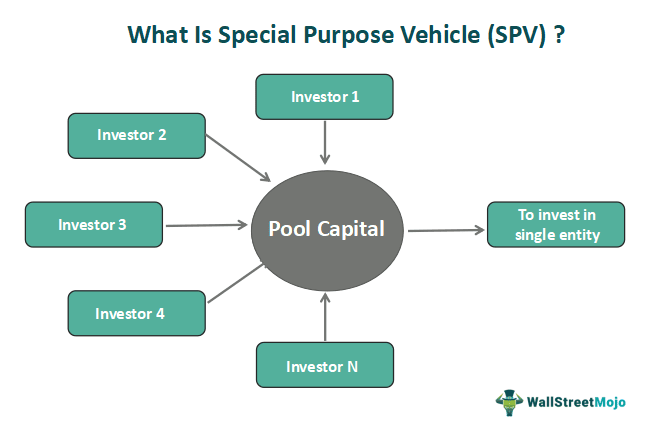

And so, it is important to review some basic principles of economics, finance and accounting as they relate to financial planning in thees two textbooks; and this ME-P.

COMMENTS APPRECIATED

Refer and Subscribe

***

***

***

Filed under: "Ask-an-Advisor", "Doctors Only", Accounting, Experts Invited, Financial Planning, Funding Basics, Glossary Terms, Investing, Marcinko Associates, Op-Editorials, Portfolio Management, Practice Worth, Risk Management, Taxation | Tagged: Accounting, CFP, CMP, education, emory, estate, Financial Planning, Investing, Marcinko, medical school, retirement, Risk Management, tax | Leave a comment »