By Dr. David Edward Marcinko MBA MEd

***

***

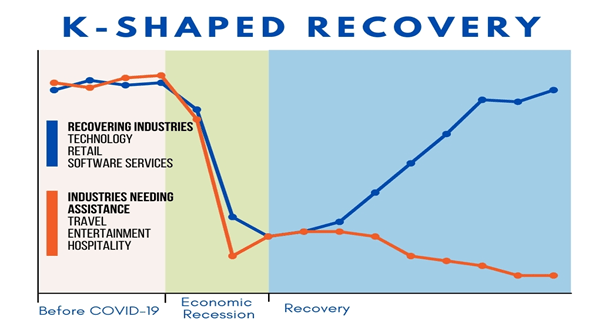

The term “K-shaped economy” emerged during the COVID-19 pandemic to describe a recovery marked by stark divergence—where some sectors and social groups rebound rapidly while others continue to decline. Unlike traditional V-shaped or U-shaped recoveries, which imply uniform economic improvement, the K-shaped model reflects a split trajectory: the upward arm of the “K” represents those who thrive, while the downward arm captures those left behind. This phenomenon has profound implications for economic policy, social equity, and long-term stability.

At the heart of the K-shaped economy is inequality. High-income individuals, white-collar professionals, and large corporations often benefit from technological advances, remote work flexibility, and access to capital. For example, tech giants like Apple, Microsoft, and Alphabet saw record profits during the pandemic, fueled by digital transformation and cloud services. Meanwhile, lower-income workers—especially in hospitality, retail, and service industries—faced job losses, reduced hours, and limited access to healthcare or financial safety nets. This divergence widened existing income and wealth gaps, exacerbating social tensions.

Sectoral performance also illustrates the K-shaped divide. Industries such as e-commerce, software, and logistics surged, while travel, entertainment, and small businesses struggled. The rise of automation and artificial intelligence further tilted the scales, favoring companies that could invest in innovation while displacing low-skilled labor. In education, students from affluent families adapted to online learning with ease, while those from disadvantaged backgrounds faced digital barriers and learning loss. These disparities underscore how economic recovery is not just uneven—it’s structurally imbalanced.

Geography plays a role too. Urban centers with diversified economies and strong tech sectors rebounded faster than rural or manufacturing-heavy regions. Housing markets in affluent areas soared, driven by low interest rates and remote work migration, while renters and first-time buyers faced affordability crises. Even within cities, neighborhoods with better infrastructure and public services recovered more quickly, deepening the urban-suburban divide.

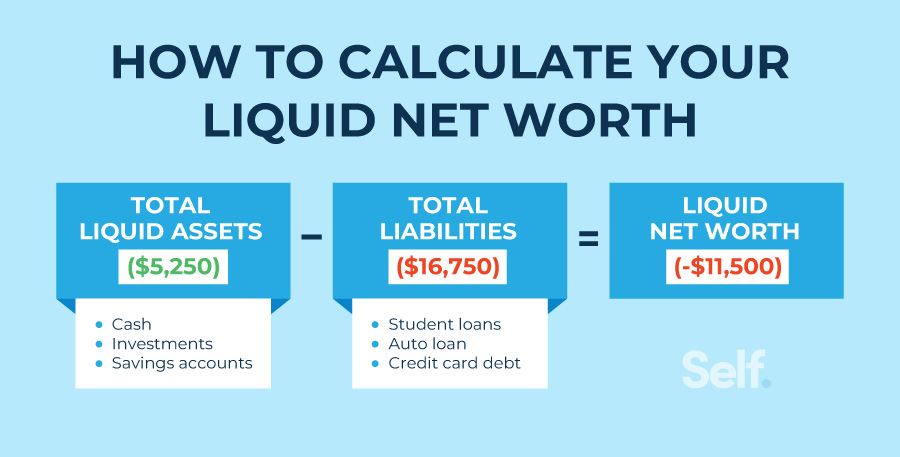

Policymakers face a daunting challenge in addressing the K-shaped recovery. Traditional stimulus measures may not reach the most vulnerable populations without targeted interventions. Expanding access to education, healthcare, and digital infrastructure is essential to leveling the playing field. Progressive taxation, wage support, and small business aid can help bridge the gap, but require political will and fiscal discipline. Central banks must balance inflation control with inclusive growth, avoiding policies that disproportionately benefit asset holders.

The long-term consequences of a K-shaped economy are significant. Persistent inequality can erode trust in institutions, fuel populism, and hinder social mobility. Economic growth may slow if large segments of the population remain underemployed or financially insecure. To build a resilient and inclusive future, governments, businesses, and civil society must collaborate to ensure that recovery lifts all boats—not just the yachts.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like, Refer and Subscribe

***

***

Filed under: "Ask-an-Advisor", economics, Ethics, Financial Planning, Glossary Terms, iMBA, Inc., Investing, LifeStyle, Portfolio Management, Touring with Marcinko | Tagged: blue collar, boats, david marcinko, economics, economy, finance, hih income, history, K economy, K shaped economy, low income, politics, poor, rich, rural, urban, white collar, yachts | Leave a comment »