By Staff Reporters

SPONSOR: http://www.CertifiedMedicalPlanner.org

***

***

SPONSOR: http://www.MarcinkoAssociates.com

QUESTION: What is a Hedge Fund?

A hedge fund is a limited partnership of private investors whose money is pooled and managed by professional fund managers. These managers use a wide range of strategies, including leverage (borrowed money) and the trading of nontraditional assets, to earn above-average investment returns. A hedge fund investment is often considered a risky, alternative investment choice and usually requires a high minimum investment or net worth. Hedge funds typically target wealthy investors.

MANAGERS: https://medicalexecutivepost.com/2025/05/23/hedge-fund-hiring-separate-managers/

The hedge fund manager I am considering also runs an offshore fund under a “master feeder” arrangement.

A PHYSICIAN’S QUESTION: What does this mean? In which fund should I invest?

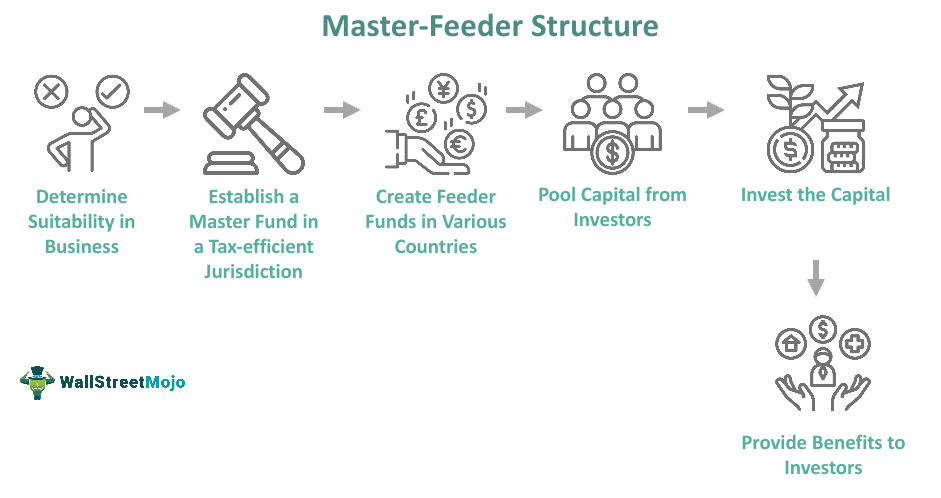

The master feeder arrangement is a two-tiered investment structure whereby investors invest in the feeder fund. The feeder fund in turn invests in the master fund. The master fund is therefore the one that is actually investing in securities. There may be multiple feeder funds under one master fund. Feeder funds under the same master can differ drastically in terms of fees charged, minimums required, types of investors, and many other features – but the investment style will be the same because only the master actually invests in the market.

A master feeder structure is a very popular arrangement because it allows a portfolio manager to pool both onshore and offshore assets into one investment vehicle (the master fund) that allocates gains and losses in an asset-based, proportional manner back to the onshore and offshore investors. All investors, both offshore and onshore, get the same return. In this manner, the portfolio manager, despite offering more than one fund with different characteristics to different populations, is not faced with the dilemma of which fund to favor with the best investment ideas.

PENSION PLANS: https://medicalexecutivepost.com/2025/05/18/medical-practice-pension-plan-hedge-fund-difficulties/

A manager may offer an offshore fund because there is demand for that manager’s skill either abroad, where investors may wish to preserve anonymity, or more commonly where investors simply do not wish to become entangled with the United States tax code. American citizens should generally avoid the offshore fund, since American citizens are taxed on their allocated share of offshore corporation profits whether or not a distribution occurs. Therefore, there is no benefit for most American taxpayers investing in an offshore fund.

Tax-exempt institutions, such as medical foundations, in the United States may have reason to consider an offshore hedge fund, however. Domestic tax-exempt organizations are generally not subject to unrelated business taxable income (UBTI) – the portion of hedge fund income that comes about as a result of the use of leverage – when investing with an offshore corporation. If the same tax-exempt organization were to invest in a domestic fund, and if UBTI was generated, then the organization would have to pay taxes on that UBTI. Most domestic hedge funds generate UBTI.

FEES: https://medicalexecutivepost.com/2025/04/05/hedge-fund-wrap-fees/

COMMENTS APPRECIATED

Read, Review, Like, Refer and Subscribe

***

***

Filed under: "Ask-an-Advisor", CMP Program, Experts Invited, Financial Planning, Funding Basics, Glossary Terms, Investing, Marcinko Associates, Portfolio Management | Tagged: Alternative Investments, CMP, Health Insurance, hedge funds, life insurance, Marcinko, master feeder, Mike Burry MD, mutual fund, nifty, personal-finance, retirement, suiability, UBTI, unrelated business taxable income | Leave a comment »