By Dr. David Edward Marcinko MBA MEd

***

***

Level-funded health care is an increasingly popular option for small to mid-sized businesses seeking a balance between cost control and comprehensive employee coverage. It blends features of fully insured and self-funded health plans, offering employers greater flexibility and potential savings while minimizing risk.

In a traditional fully insured plan, employers pay a fixed premium to an insurance carrier, which assumes all financial risk for employee claims. In contrast, self-funded plans allow employers to pay for claims out-of-pocket, which can lead to significant savings—but also exposes them to unpredictable costs. Level-funded plans sit between these two models, offering a structured and predictable approach to self-funding.

With level-funded health care, employers pay a fixed monthly amount that covers three components: estimated claims funding, stop-loss insurance, and administrative fees. The estimated claims portion is based on actuarial data and reflects the expected health care usage of the employee group. Stop-loss insurance protects the employer from catastrophic claims by capping their financial exposure. Administrative fees cover third-party services such as claims processing and customer support.

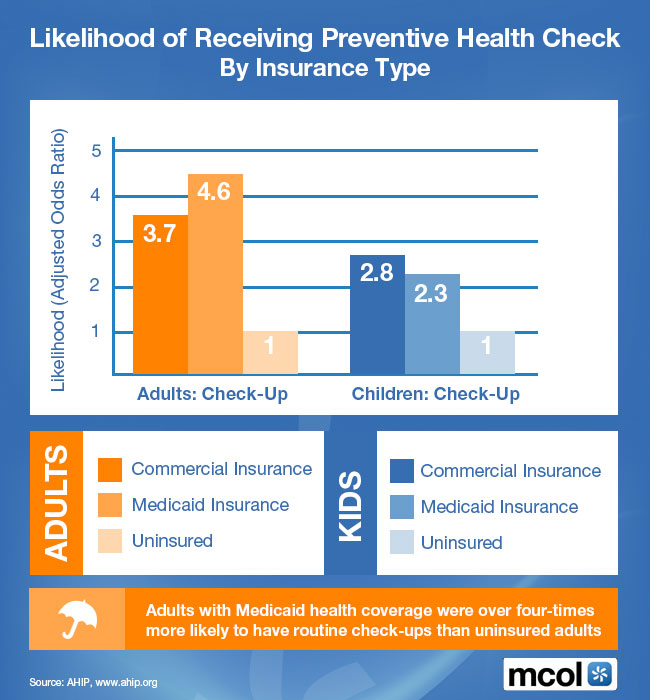

One of the key advantages of level-funded plans is the potential for cost savings. If actual claims fall below the estimated amount, employers may receive a refund or credit at the end of the year. This incentivizes wellness programs and preventive care, as healthier employees lead to lower claims. Additionally, level-funded plans often provide more transparency into claims data, allowing employers to better understand health trends and make informed decisions about benefits.

***

***

Another benefit is flexibility. Level-funded plans can be customized to suit the needs of a specific workforce, offering a range of coverage options and provider networks. This contrasts with the rigid structure of many fully insured plans. Employers also gain more control over plan design, which can help attract and retain talent in competitive job markets.

However, level-funded health care is not without challenges. It requires careful planning and a solid understanding of risk. Employers must be prepared for the possibility that claims may exceed projections, although stop-loss insurance helps mitigate this. Additionally, level-funded plans may not be suitable for very small groups or those with high-risk populations, as the cost of stop-loss coverage can be prohibitive.

Regulatory considerations also play a role. Level-funded plans are typically governed by federal ERISA laws rather than state insurance regulations, which can affect compliance and reporting requirements. Employers should work closely with benefits consultants or brokers to ensure they understand the legal landscape and choose a plan that aligns with their goals.

In conclusion, level-funded health care offers a compelling alternative for businesses seeking to manage costs while providing quality coverage. By combining predictability with the potential for savings and customization, it empowers employers to take a more active role in their health benefits strategy. As the health care landscape continues to evolve, level-funded plans are likely to remain a valuable option for organizations looking to strike the right balance between affordability and employee well-being.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com

Like, Refer and Subscribe

***

***

Filed under: "Ask-an-Advisor", Ethics, finance, Glossary Terms, Health Insurance, Healthcare Finance, Taxation | Tagged: david marcinko, ERISA, health, Health Insurance, health insurance plans, healthcare, insurance, insurance claims, level funded healthcare, level funded insurance, medicare, self fund health plans, stop loss insurance | Leave a comment »