By Staff Reporters

***

***

Oak Street Health, headquartered in Chicago and a wholly-owned subsidiary of CVS Health since 2023, has agreed to pay $60 million to resolve allegations that it violated the False Claims Act by paying kickbacks to third-party insurance agents in exchange for recruiting seniors to Oak Street Health’s primary care clinics.

Part C: https://medicalexecutivepost.com/2024/05/03/eschew-medicare-advantage-part-c-plans-now/

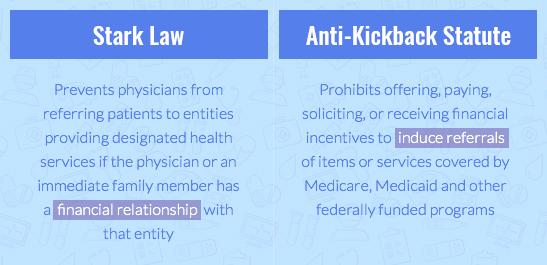

The Anti-Kickback Statute prohibits anyone from offering or paying, directly or indirectly, any remuneration — which includes money or any other thing of value — to induce referrals of patients or to provide recommendations of items or services covered by Medicare, Medicaid and other federally funded programs. Under the Medicare Advantage (MA) Program, also known as Part C, Medicare beneficiaries have the option to obtain their health care through privately-operated insurance plans known as MA plans. Some MA Plans contract with health care providers, including Oak Street Health, to provide their plan members with primary care services.

Medicare Advantage Rates: https://medicalexecutivepost.com/2025/04/28/medicare-advantage-plan-rates-substantially-increased-for-2026/

The United States alleged that, in 2020, Oak Street Health developed a program to increase patient membership called the Client Awareness Program. Under the Program, third-party insurance agents contacted seniors eligible for or enrolled in Medicare Advantage and delivered marketing messages designed to generate interest in Oak Street Health. Agents then referred interested seniors to an Oak Street Health employee via a three-way phone call, otherwise known as a “warm transfer,” and/or an electronic submission.

In exchange, Oak Street Health paid agents typically $200 per beneficiary referred or recommended. These payments incentivized agents to base their referrals and recommendations on the financial motivations of Oak Street Health rather than the best interests of seniors. The settlement resolves allegations that, from September 2020 through December 2022, Oak Street Health knowingly submitted, and caused the submission of, false claims to Medicare arising from kickbacks to agents that violated the Anti-Kickback Statute.

US Department of Justice: https://www.justice.gov/archives/opa/pr/oak-street-health-agrees-pay-60m-resolve-alleged-false-claims-act-liability-paying-kickbacks

COMMENTS APPRECIATED

Like and Refer

***

***

Filed under: "Advisors Only", "Doctors Only", Ethics, Experts Invited, Health Economics, Health Insurance, Health Law & Policy, Healthcare Finance, Insurance Matters | Tagged: anti-kickback, capitation, CVs, Department of Justice, false claims act, health, Health Insurance, healthcare, insurance, insurance agent, insurance agents, Medicaid, medicare, Medicare Advantage, Oak Street Health, Part C, recruitment scheme, seniors | Leave a comment »