By AI

***

The National Debt Explained

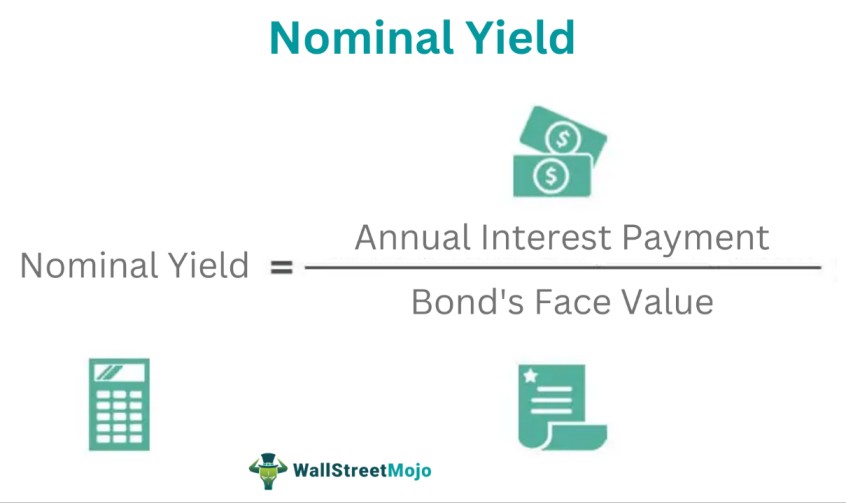

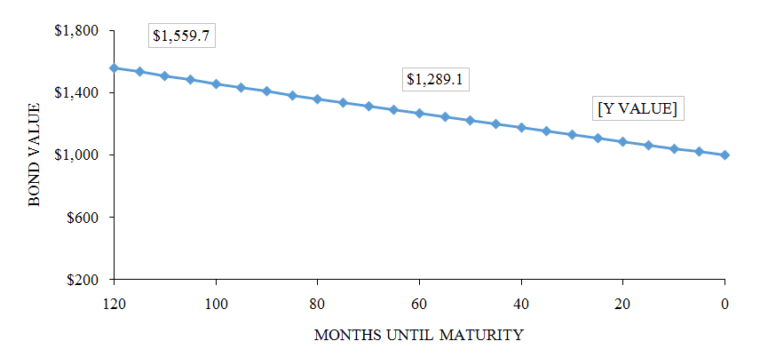

The national debt is the amount of money the federal government has borrowed to cover the outstanding balance of expenses incurred over time. In a given fiscal year (FY), when spending (ex. money for roadways) exceeds revenue (ex. money from federal income tax), a budget deficit results. To pay for this deficit, the federal government borrows money by selling marketable securities such as Treasury bonds, bills, notes, floating rate notes, and Treasury inflation-protected securities (TIPS).

ELDERLY CPI: https://medicalexecutivepost.com/2024/07/13/what-is-the-elderly-cpi/

The national debt is the accumulation of this borrowing along with associated interest owed to the investors who purchased these securities. As the federal government experiences reoccurring deficits, which is common, the national debt grows.

MEDICAL DEBT: https://medicalexecutivepost.com/2024/07/25/on-medical-debt/

Simply put, the national debt is similar to a person using a credit card for purchases and not paying off the full balance each month. The cost of purchases exceeding the amount paid off represents a deficit, while accumulated deficits over time represents a person’s overall debt.

STAGFLATION: https://medicalexecutivepost.com/2022/10/14/what-is-stagflation/

COMMENTS APPRECIATED

Like and Subscribe

***

***

Filed under: "Ask-an-Advisor", finance, Funding Basics, Glossary Terms | Tagged: CPI, deficit, FY, GDP, national debt, stagflation, TIPs | Leave a comment »