By Dr. David Edward Marcinko MBA MEd CMP™

***

SPONSOR: http://www.MarcinkoAssociates.com

***

What are types of market manipulation schemes?

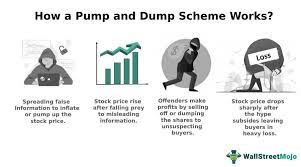

Pump and Dump

- When owners of a security spread false information to pump up the price of the security and subsequently sell off their shares, making a profit—the “dump.”

- Would you like to learn more about pump and dump schemes? Check out some real-world examples.

- PUMP DUMP: https://medicalexecutivepost.com/2022/12/16/pumpers-dumpers-social-media-influencers-charged-in-scheme/

Bear Raids

- Refer to attempts by investors to move the price of a stock opportunistically by selling large numbers of shares short. The investors pocket the difference between the initial price and the new, lower price after this maneuver. This technique is illegal under SEC rules, which stipulate that every short sale must be on an uptick. For more information on this complex tactic, read on in this piece from the Wharton School of Business.

Wash Trading

- Involves the simultaneous or near-simultaneous sale and repurchase of the same security for the purpose of generating activity and increasing the price.

- CHURNING: https://medicalexecutivepost.com/2021/10/25/churning-front-running-and-pumping-dumping/

Matched Orders

- When fraudsters manipulate the market through matched orders, they enter trades to buy or sell securities with the knowledge that a matching order on the opposite side has been or will be entered. During his tenure at the Commission, our partner Jordan Thomas was involved in a case where the SEC won summary judgement and obtained settlements with an astonishing 16 defendants who engaged in matched trades, among other illicit tactics.

Painting the Tape

- Painting the tape refers to placing successive orders in small amounts at increasing or decreasing prices.

Spoofing & Layering

- High frequency traders are known to use the tactics of Spoofing & Layering to manipulate share prices. Spoofing is the placing of a bid or offer with the intent to cancel before execution. Layering is a form of spoofing in which the trader places multiple orders on one side of the book, in order to create a false impression of heavy buying or selling.

- PONZI: https://medicalexecutivepost.com/2021/09/22/what-exactly-is-a-ponzi-scheme/

Read more about stock manipulation.

For further details about other common securities violations, see our Securities Law Primer.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like and Subscribe

***

***

Filed under: "Ask-an-Advisor", CMP Program, Ethics, Experts Invited, finance, Glossary Terms, Investing, Marcinko Associates, Portfolio Management | Tagged: Apple, bear raids, CMP, david marcinko, economy, google, internet, layering, matched order, paintibg the tape, ponzi scheme, pump and dump, SEC, spoofing, stock manipulation, stock market manipulation, Venture Capital, wash trading | Leave a comment »