Dr. David Edward Marcinko MBA MEd

SPONSOR: http://www.HealthDictionarySeries.org

***

***

The image of the clown—painted smile, exaggerated gestures, boundless energy—has long symbolized joy, whimsy, and comic relief. Yet behind this bright façade lies one of the most enduring and poignant contradictions in human psychology: the Sad Clown Paradox. This paradox captures the tension between outward expressions of happiness and inner experiences of sadness, anxiety, or emotional struggle. It is the phenomenon of individuals who appear cheerful, supportive, and uplifting to others while privately carrying heavy emotional burdens. The paradox resonates across cultures and eras because it reflects a universal truth: people often hide their pain behind a mask of humor or positivity.

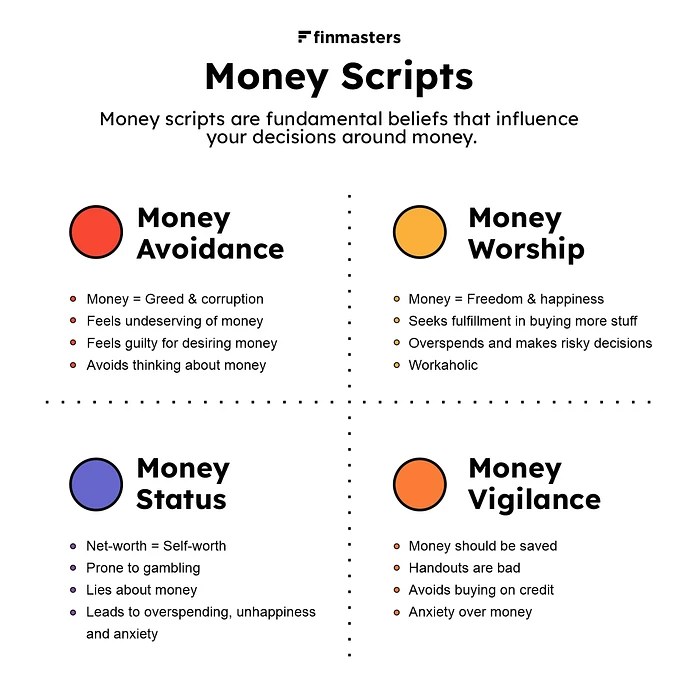

At its core, the Sad Clown Paradox is about emotional dissonance. Humans are social creatures, and we learn early in life that certain emotions are more acceptable to display than others. Joy, enthusiasm, and humor are welcomed; sadness, fear, and vulnerability can feel risky to reveal. For some, humor becomes a shield—a way to deflect attention from their internal struggles. The clown’s painted smile becomes a metaphor for the emotional masks people wear in everyday life. This mask can be protective, allowing someone to function socially or professionally even when they feel overwhelmed. But it can also become isolating, creating a gap between how a person appears and how they truly feel.

One reason the Sad Clown Paradox persists is that humor is an incredibly effective coping mechanism. Laughter can diffuse tension, create connection, and provide temporary relief from stress. Many people who gravitate toward comedic roles—whether professionally or within their social circles—develop a finely tuned ability to read the emotional needs of others. They know how to lighten a room, how to distract from discomfort, and how to make people feel at ease. Yet this sensitivity to others’ emotions often coexists with difficulty expressing their own. The person who makes everyone else laugh may struggle to ask for help, fearing that doing so would disrupt the role they’ve come to play.

***

***

Another dimension of the paradox is the pressure of expectation. When someone becomes known as “the funny one” or “the strong one,” they may feel obligated to maintain that persona even when they are hurting. This expectation can come from others, but it often becomes internalized. The sad clown tells themselves that their value lies in their ability to uplift others, not in their own emotional truth. They may worry that revealing their struggles would disappoint people or burden them. Over time, this can lead to emotional exhaustion, as the effort to maintain the mask becomes heavier than the emotions it was meant to hide.

The paradox also highlights the complexity of emotional expression. People are rarely just one thing. Someone can be genuinely joyful in one moment and deeply sad in another. The sad clown is not necessarily faking their humor; often, their ability to find lightness in dark situations is real and sincere. But sincerity does not erase struggle. The paradox reminds us that outward behavior is not always a reliable indicator of inner experience. A person who seems endlessly cheerful may be using that cheerfulness to navigate their own pain.

In a broader sense, the Sad Clown Paradox speaks to the human tendency to curate our emotional identities. Social media, workplace culture, and even casual conversation often reward positivity and discourage vulnerability. This creates an environment where people feel compelled to present a polished version of themselves. The sad clown becomes a symbol of the emotional labor involved in maintaining that façade. It raises important questions about authenticity, connection, and the ways we support one another.

***

***

Understanding the paradox invites a more compassionate view of others. It encourages us to look beyond surface impressions and recognize that everyone carries unseen struggles. It also challenges the assumption that those who seem the strongest or happiest are immune to hardship. Sometimes the people who give the most comfort are the ones who need it most. The paradox reminds us to check in on the friends who always make us laugh, the colleagues who never complain, and the loved ones who seem perpetually upbeat.

On a personal level, the Sad Clown Paradox invites reflection on the masks we wear ourselves. It encourages us to consider whether we allow others to see our full emotional range or whether we hide behind humor or competence. Acknowledging the paradox does not mean abandoning humor or positivity; rather, it means recognizing that these qualities can coexist with vulnerability. The goal is not to discard the mask entirely but to ensure it does not become a barrier to genuine connection.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like, Refer and Subscribe

***

***

Filed under: Ask a Doctor, Glossary Terms, mental health | Tagged: clown, david marcinko, fun, funny, healing, health dictionary series, life, love, mental health, personal-growth, sad clown, sad clown paradox | Leave a comment »