BY DR. DAVID EDWARD MARCINKO: MBA MEd CMP™

***

SPONSOR: http://www.MarcinkoAssociates.com

***

Performance of Growth & Value Stocks

Although many academics argue that value stocks outperform growth stocks, the returns for individuals investing through mutual funds demonstrate a near match.

Introduction

A 2005 study Do Investors Capture the Value Premium? written by Todd Houge at The University of Iowa and Tim Loughran at The University of Notre Dame found that large company mutual funds in both the value and growth styles returned just over 11 percent for the period of 1975 to 2002. This paper contradicted many studies that demonstrated owning value stocks offers better long-term performance than growth stocks.

The studies, led by Eugene Fama PhD and Kenneth French PhD, established the current consensus that the value style of investing does indeed offer a return premium. There are several theories as to why this has been the case, among the most persuasive being a series of behavioral arguments put forth by leading researchers. The studies suggest that the out performance of value stocks may result from investors’ tendency toward common behavioral traits, including the belief that the future will be similar to the past, overreaction to unexpected events, “herding” behavior which leads at times to overemphasis of a particular style or sector, overconfidence, and aversion to regret. All of these behaviors can cause price anomalies which create buying opportunities for value investors.

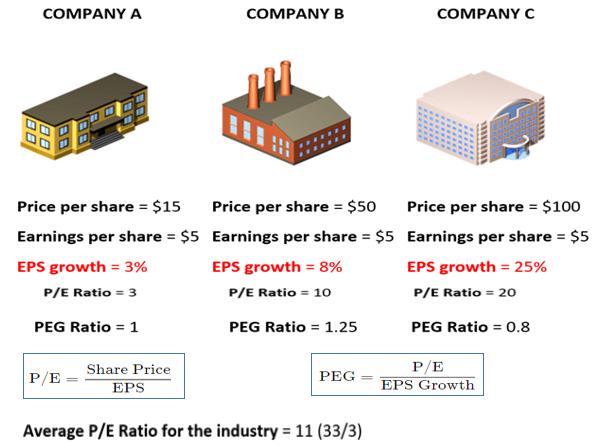

Another key ingredient argued for value out performance is lower business appraisals. Value stocks are plainly confined to a P/E range, whereas growth stocks have an upper limit that is infinite. When growth stocks reach a high plateau in regard to P/E ratios, the ensuing returns are generally much lower than the category average over time.

Moreover, growth stocks tend to lose more in bear markets. In the last two major bear markets, growth stocks fared far worse than value. From January 1973 until late 1974, large growth stocks lost 45 percent of their value, while large value stocks lost 26 percent. Similarly, from April 2000 to September 2002, large growth stocks lost 46 percent versus only 27 percent for large value stocks. These losses, academics insist, dramatically reduce the long-term investment returns of growth stocks.

***

***

However, the study by Houge and Loughran reasoned that although a premium may exist, investors have not been able to capture the excess return through mutual funds. The study also maintained that any potential value premium is generated outside the securities held by most mutual funds. Simply put, being growth or value had no material impact on a mutual fund’s performance.

Listed below in the table are the annualized returns and standard deviations for return data from January 1975 through December 2002.

Index Return SD

S&P 500 11.53% 14.88%

Large Growth Funds 11.30% 16.65%

Large Value Funds 11.41% 15.39%

Source: Hough/Loughran Study

The Hough/Loughran study also found that the returns by style also varied over time. From 1965-1983, a period widely known to favor the value style, large value funds averaged a 9.92 percent annual return, compared to 8.73 percent for large growth funds. This performance differential reverses over 1984-2001, as large growth funds generated a 14.1 percent average return compared to 12.9 percent for large value funds. Thus, one style can outperform in any time period.

However, although the long-term returns are nearly identical, large differences between value and growth returns happen over time. This is especially the case over the last ten years as growth and value have had extraordinary return differences – sometimes over 30 percentage points of under performance.

This table indicates the return differential between the value and growth styles since 1992.

YEARLY RETURNS OF GROWTH/VALUE STOCKS

| Year | Growth | Value |

| 1992 | 5.1% | 10.5% |

| 1993 | 1.7% | 18.6% |

| 1994 | 3.1% | -0.6% |

| 1995 | 38.1% | 37.1% |

| 1996 | 24.0% | 22.0% |

| 1997 | 36.5% | 30.6% |

| 1998 | 42.2% | 14.7% |

| 1999 | 28.2% | 3.2% |

| 2000 | -22.1% | 6.1% |

| 2001 | -26.7% | 7.1% |

| 2002 | -25.2% | -20.5% |

| 2003 | 28.2% | 27.7% |

| 2004 | 6.3% | 16.5% |

| 2005 | 3.6% | 6.1% |

| 2006 | 10.8% | 20.6% |

| 2007 | 8.8% | 1.5% |

| 2008 | -38.43% | -36.84% |

| 2009 | 37.2% | 19.69% |

| 2010 | 16.71% | 15.5% |

| 2011 | 2.64% | 0.39% |

| 2012 | 15.25% | 17.50% |

Source: Ibbottson.

Between the third quarter of 1994 and the second quarter of 2000, the S&P Growth Index produced annualized total returns of 30 percent, versus only about 18 percent for the S&P Value Index. Since 2000, value has turned the tables and dramatically outperformed growth. Growth has only outperformed value in two of the past eight years. Since the two styles are successful at different times, combining them in one portfolio can create a buffer against dramatic swings, reducing volatility and the subsequent drag on returns.

Assessment

In our analysis, the surest way to maximize the benefits of style investing is to combine growth and value in a single portfolio, and maintain the proportions evenly in a 50/50 split through regular rebalancing. Research from Standard & Poor’s showed that since 1980, a 50/50 portfolio of value and growth stocks beats the market 75 percent of the time.

Conclusion

Due to the fact that both styles have near equal performance and either style can outperform for a significant time period, a medical professional might consider a blending of styles. Rather than attempt to second-guess the market by switching in and out of styles as they roll with the cycle, it might be prudent to maintain an equal balance your investment between the two.

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit a RFP for speaking engagements: MarcinkoAdvisors@outlook.com

COMMENTS APPRECIATED

Refer, Subscribe and Like

***

***

Filed under: "Ask-an-Advisor", "Doctors Only", Experts Invited, Financial Planning, Funding Basics, Glossary Terms, Investing, Marcinko Associates, Op-Editorials, Risk Management | Tagged: 50/50, bear, bulls, DJIA, Eugene Fama, fama, Fama and French, finance, french, Growth, growth investors, growth stocks, growth stocks value versus growth stocks, herding, Investing, Kenneth French, Loughran, Marcinko, Mutual Funds, NASDAQ, pe, PE ratio, personal-finance, S&P 500, stock market, stocks, Todd Houge, value, value investors, value stocks | Leave a comment »