By Dr. David Edward Marcinko MBA MEd

***

***

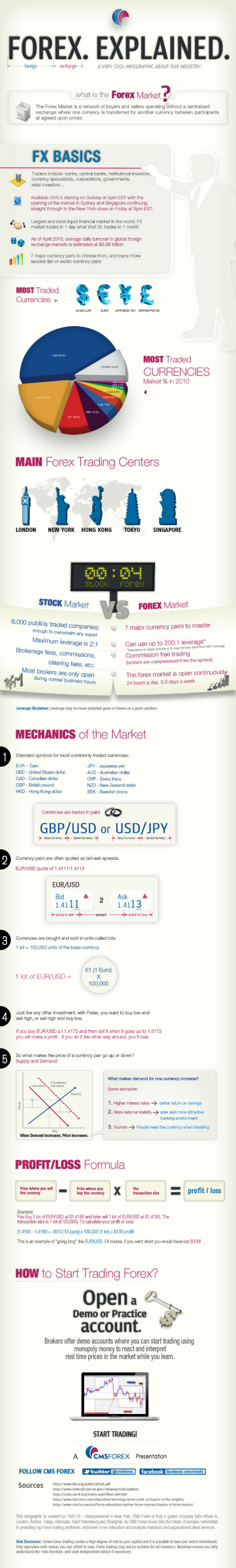

The 3-5-7 investing rule is a practical framework designed to help traders and investors manage risk, maintain discipline, and improve long-term profitability. Though not a formal financial regulation, it serves as a guideline for structuring trades and portfolios with clear boundaries. The rule is especially popular among retail traders and those seeking a simple yet effective way to navigate volatile markets.

At its core, the 3-5-7 rule breaks down into three components:

- 3% Risk Per Trade: This principle advises that no single trade should risk more than 3% of your total capital. For example, if your trading account holds $10,000, the maximum loss you should accept on any one trade is $300. This limit helps protect your portfolio from catastrophic losses and ensures that even a series of losing trades won’t wipe out your account.

- 5% Exposure Across All Positions: This part of the rule suggests that your total exposure across all open trades should not exceed 5% of your capital. It encourages diversification and prevents over-leveraging. By capping overall exposure, traders can avoid being overly reliant on a few positions and reduce the impact of market-wide downturns.

- 7% Profit Target: The final component sets a goal for each successful trade to yield at least 7% profit. This ensures that your winning trades are significantly larger than your losing ones. Even with a win rate below 50%, maintaining a favorable risk-reward ratio can lead to consistent profitability over time.

Together, these numbers form a balanced strategy that emphasizes risk control and reward optimization. The 3-5-7 rule is particularly useful in volatile markets, where emotional decision-making can lead to impulsive trades. By adhering to predefined limits, traders can stay focused and avoid common pitfalls like revenge trading or chasing losses.

One of the key advantages of the 3-5-7 rule is its adaptability. Traders can adjust the percentages based on their risk tolerance, market conditions, and account size. For instance, during periods of high volatility, one might reduce the per-trade risk to 2% or lower. Conversely, in stable markets, slightly higher exposure might be acceptable. The rule is not rigid but serves as a flexible foundation for building a disciplined trading strategy.

Moreover, the 3-5-7 rule promotes consistency. By applying the same criteria to every trade, investors can evaluate performance more objectively and refine their approach over time. It also helps in setting realistic expectations and avoiding the trap of overconfidence after a few successful trades.

In conclusion, the 3-5-7 investing rule is a simple yet powerful tool for managing risk and enhancing trading discipline. It provides a structured approach to position sizing, portfolio exposure, and profit targeting. Whether you’re a novice trader or a seasoned investor, incorporating this rule into your strategy can lead to more confident, calculated, and ultimately successful trading decisions.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com

Like, Refer and Subscribe

***

***

Filed under: "Ask-an-Advisor", finance, Investing, Marcinko Associates | Tagged: 3-5-7 investing, finance, Forex, Investing, investing rules, investing rules of thumb, Marcinko, profit, revenge trading, risk, stocks, trading | Leave a comment »