BREAKING NEWS

By Staff Reporters

***

***

WASHINGTON, Feb 25 (Reuters) – U.S. President Donald Trump signed an executive order on Tuesday aiming to improve price transparency on healthcare costs by directing federal agencies to strictly enforce a 2019 order he signed during his first term.

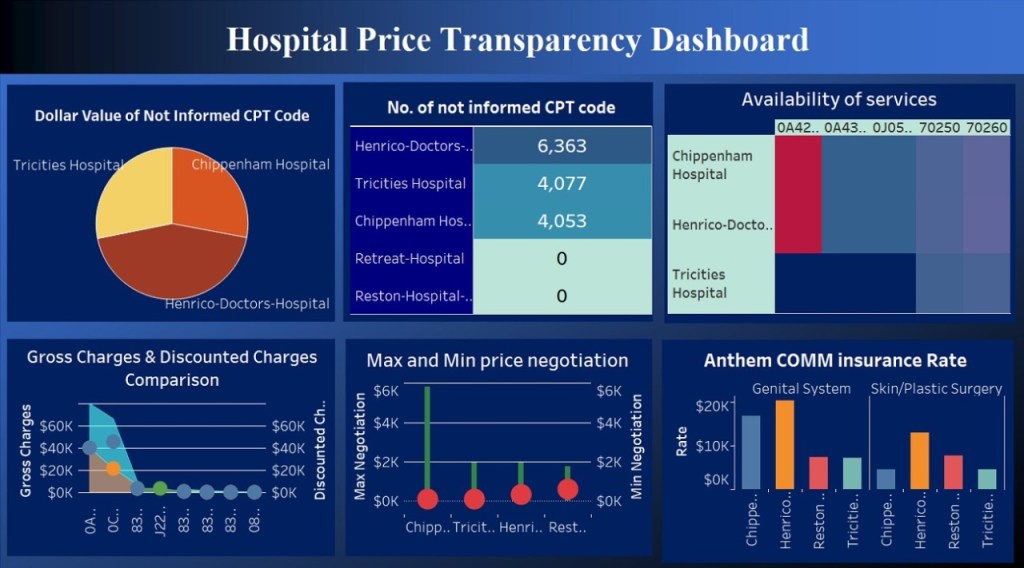

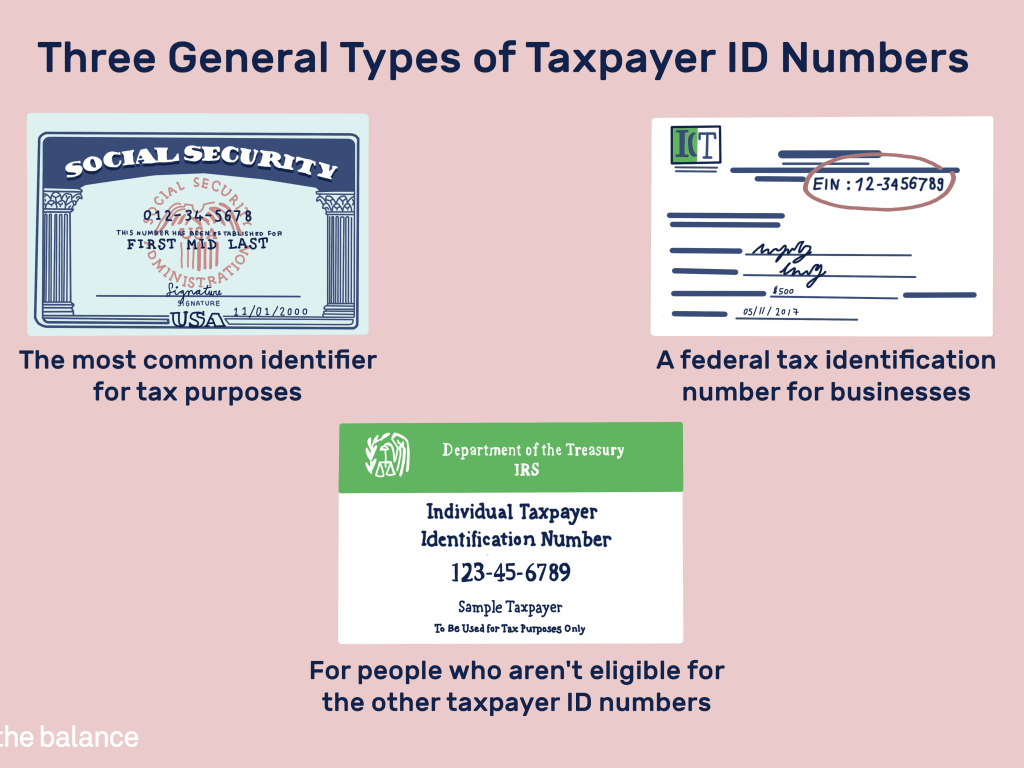

The order directs the Departments of the Treasury, Labor, and Health and Human Services to within 90 days come up with a framework to enforce Trump’s 2019 executive order forcing health insurers and hospitals to disclose healthcare cost details.

***

***

This includes requiring the disclosure of actual prices not estimates, update existing guidance or proposing new regulations that ensure price information is standardized, and updating or issuing enforcement policies that guarantee compliance.

“You’re not allowed to even talk about it when you’re going to a hospital or see a doctor. And this allows you to go out and talk about it,” Trump told reporters as he signed the order. “It’s been unpopular in some circles because people make less money, but it’s great for the patient.”

Cite: https://pubmed.ncbi.nlm.nih.gov/22239329/

More: https://medicalexecutivepost.com/2023/01/19/podcast-sage-transparency-on-hospital-prices/

COMMENTS APPRECIATED

Read, Like and Subscribe

***

***

Filed under: "Advisors Only", "Ask-an-Advisor", Accounting, Breaking News, Ethics, Glossary Terms, Health Economics, Health Insurance, Health Law & Policy, Healthcare Finance | Tagged: Department Labor, department treasury, DJT, Executive Order, Health Human Services, HHS, Hospital Price Transparency, Marcinko, price transparency, Reuters, Trump | Leave a comment »