By Staff Reporters

***

***

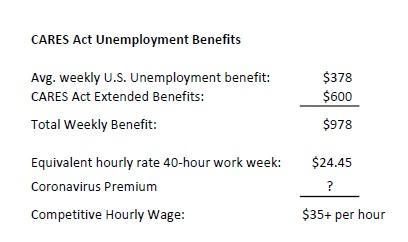

The CARES Act, a COVID relief law that was enacted in March of 2020, made it easier to pull money from one’s 401(k) or IRA It allowed people to take up to $100,000 out of their accounts and have three years to pay it back without the normal 10% early withdrawal penalty and tax payment. For Americans who needed cash quickly, their 401(k) was a tempting well to dip into that wouldn’t have been otherwise available.

In the spring of 2020, nearly 20% of all withdrawals from 401(k)’s, between April 6th and June 26th were related to COVID, according to CNBC. CNBC reported that at Fidelity Investments, the largest provider of 401(k) plans in the U.S., more than 700,000 people took from their 401(k) or their 403(b) plan. The median amount was about $5,000, while more than 18,000 people asked for the full $100,000 amount.

And Vanguard’s How America Saves report from 2021 found that more than 7% of people withdrew from their 401(k) or a 401(b) — similar to a 401(k) but available to not-for-profit companies — in 2020.

READ: https://oig.treasury.gov/cares-act

***

Here is where the major indexes settled:

- The S&P 500 Index was down 65.41 (1.6%) at 4071.63; the Dow Jones industrial average was down 344.57 (1.0%) at 33,530.83; the NASDAQ Composite was down 238.05 (2.0%) at 11,799.16.

- The 10-year Treasury yield was down about 12 basis points at 3.394%.

- CBOEs Volatility Index was up 1.99 at 18.92.

Transportation stocks also had a rough day after United Parcel Service’s (UPS) shares dropped some 10% after its results missed analysts’ forecasts. Energy companies were lower after WTI crude oil futures dropped under $77 a barrel for the first time this month. Small-cap companies, which are considered to have greater recession exposure than larger businesses, were also under pressure, with the Russell 2000 index falling more than 2% and nearing a five-week low.

***

CITE: https://www.r2library.com/Resource

***

***

COMMENTS APPRECIATED

Thank You

***

Filed under: iMBA, Inc. | Tagged: CARES Act, CBOE, CNBC, corona, DJIA, DOW, gold, NASDAQ, oil, S&P 500, Treasury yields, UPS, Vanguard, VIX<, WTI | Leave a comment »