Moneywise?

By Somnath Basu; PhD, MBA

For those of us between the ages of 45 to 54, the thought of retirement should be popping up a few times these days. And, for doctors between ages 55 and 64, the thought may be taking on urgent tones. Many of us are reconciling to the idea that it may be a fact that we have to either postpone our retirements or live a much simpler life during retirement. Whatever the thoughts may be, what’s driving them is our preparedness to retire.

Preparedness Components

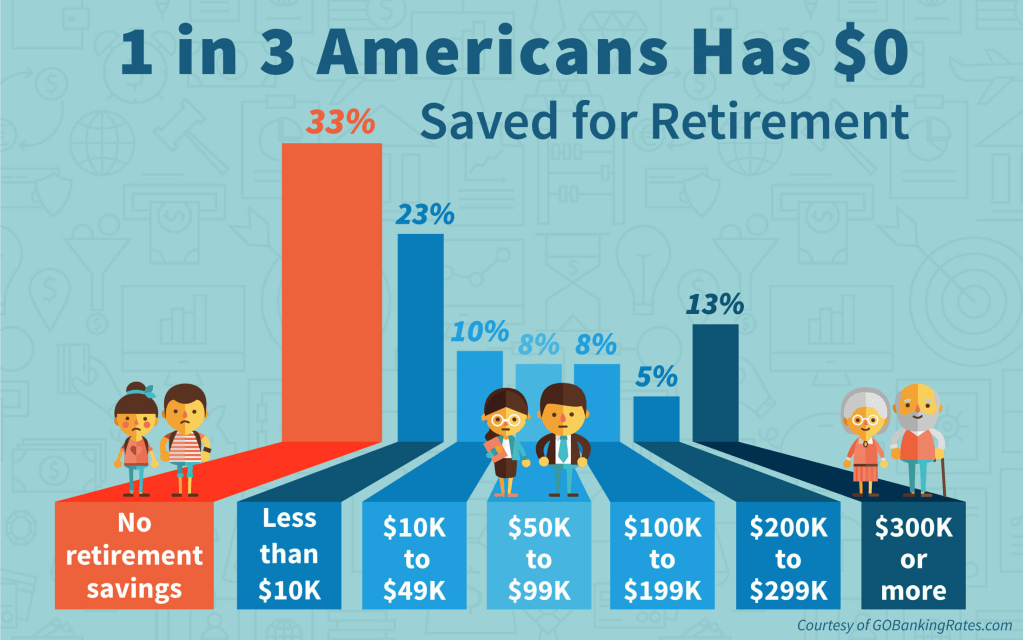

So, we will now examine what the component (dos and don’ts) may be for physicians, and others, to assess whether they are on the right path in their preparations to retire. It is somewhat easier if we consider the preparedness issues of the expectant retirees along the two age groups we tagged earlier. It is possible that we may find that the proper components of our retirement plans may already exist for us and we need to give them a good and disciplined effort to carry us through in the retirement years. It is also important to note, in this vein, that as a nation, our savings rate has gone from -0.6% in 2006 to about 5% today. While most of the increase in savings is the result of people building back an emergency nest egg, we can also take heart in the fact that the savings habit has not become obsolete or even rusty, and given the proper motivation (e.g. a sub-standard retired lifestyle), we can alter our destinies by riding on the same savings wave.

The Possibilities

Let us begin by describing the possibilities for the younger group (ages 45-54) doctors and employees pondering their retirement moves. There are two aspects of retirement that needs consideration. First is the contemplation of the needs associated with retirement lifestyles and the corresponding financial requirements required to sustain such lifestyles.

The second is to consider our current lifestyles, living standards (consumption), our income and savings and to assess whether we are set to achieve our retirement lifestyle targets. To understand the many possibilities, we will examine some typical scenarios using data from the Employee Benefits Research Institute (EBRI). Note that all calculations are only approximations for a typical individual.

Example:

If you are about 50 years of age, have worked and saved for about 20 years [401(k), or 403(b)] or other pension plan) and earn about $100,000 a year, you should have about $200,000 in your retirement account today. Assuming that Social Security (if the organization remains viable and makes its required payouts), covers about 27% of your needed retirement expenses. You could expect a Social Security payment of about $30,000 per year at age 65. This would mean that in about 15 years, you would need to generate an additional $80,000 per year from your own savings. While you may think that you are not consuming $110,000 worth of lifestyle today, it is useful to note that this estimate is in future (and inflated) dollar terms.

This brings us back to the second question of how much you may be consuming today. If you are paying about 25% as taxes and saving another 5%, then you are currently spending about $70,000 today. At a 3% inflation rate, in 15 years this amounts to a spending of $110,000 on an income of approximately $160,000.

Thus, if your 403(b) balance does not change from now till retirement and you estimate to plan for a 25 year retirement phase, then your 403(b) account will be equivalent to about an additional $8,000 per year, which itself will grow every year minimally at the inflation rate.

If you assume the 403(b) plan will itself grow at about 7% a year over the next 40 years (from ages 50 to 90) then at retirement (age 65) you’ll have about $550,000 and be able to withdraw about $50,000 per year. This will leave you with a shortfall of $30,000 per year. To be able to afford retirement to its fullest, you’ll need to save an additional $15,000 per year for the next 15 years. Before you begin thinking that is a doable task and start assessing which parts of current lifestyle to pare, note that many of the assumptions above may not hold true.

Average Rates of Return

For example, earning a 7% average rate of return over 40 years is no simple task; Social Security may not be able to deliver on its promise. Physician income and job security is a political issue. Paring current lifestyle is a bigger issue. Healthcare and leisure types of costs during retirement may increase by more than 3%, even as you consume more of these retirement lifestyle services.

Therefore, you may want to continue enjoying your current medical practice lifestyle and consider worrying about retirement about 10 years (or more) later or you may take stock of your current situation. If your situation is worse than the average portrayed above, a big issue for you is to keep your physical and mental health well balanced and not depressed and medicated; plan to postpone retirement and practice or work longer, albeit in good health.

Assessment

If you are about 60 years of age, have worked for about 25-30 years, earn $100,00 per year and have about $350,000 in your retirement accounts, your problems are more exacerbated and your fears (of postponing retirement, paring current or future lifestyle or not being able to make up shortfalls) are much more real. The strategies remain the same from earlier in that you have to make some urgent and difficult decisions. These are decisions that cannot be postponed any longer.

Note: First released “All Things Financial Planning Blog” on December 18, 2009.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Link: http://feeds.feedburner.com/HealthcareFinancialsthePostForcxos

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

Filed under: Financial Planning, Investing, Retirement and Benefits | Tagged: 401(k), 403(b), EBRI, Financial Planning, physician investing, Physician retirement, social security, Somnath Basu, wealth management | 7 Comments »