Some Need-to-Know [Not Boring] Information for Doctors, Nurses and CXOs

By Dr. David Edward Marcinko FACFAS, MBA, CPHQ, CMP™

[Publisher-in-Chief]

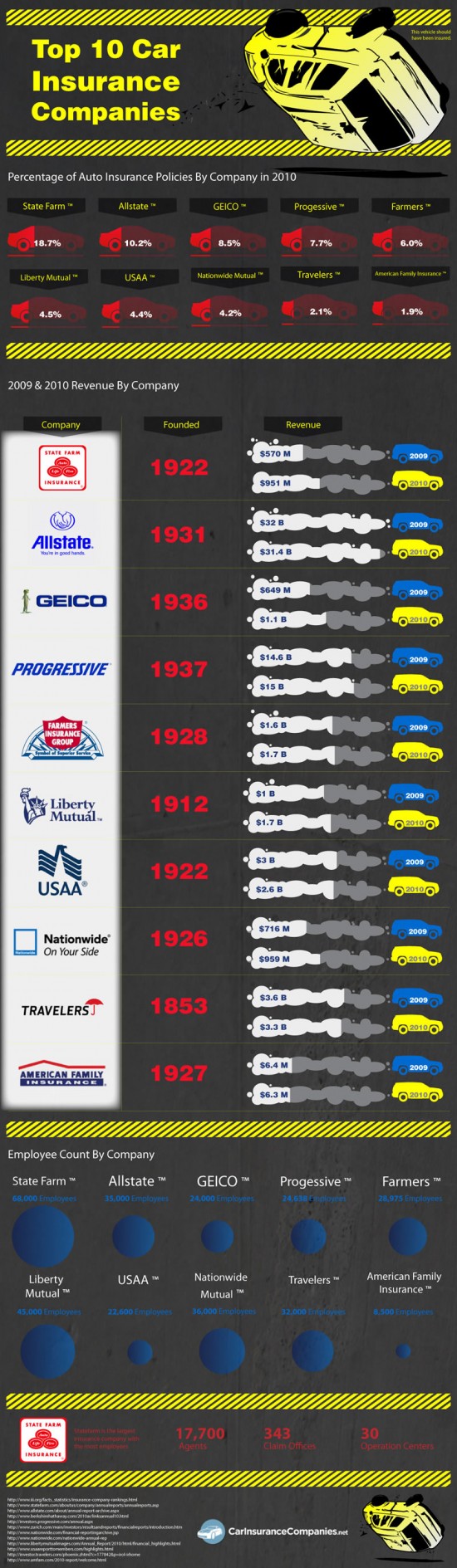

As regular ME-P readers know, I held a property and casualty insurance license for more than 15 years; this included homeowners and automobile insurance.

BTW: P&C also includes malpractice insurance [doctors and medical professionals] and E&O insurance [accountants, financial advisors, attorneys, etc]. Yep! Med-mal is classified under the property-casualty moniker. I even edited a handbook on the topic. But, I digress.

On the Importance of Automobiles

With the possible exception of the handgun, the automobile represents the greatest single item of ownership that is capable of inflicting death, injury and damage. I learned this first-hand after covering the ER for many years.

America’s fascination with the automobile has resulted in a marked increase in the power and potential speed of our vehicles. The aging trend in Sports Utility Vehicles (SUVs) has also witnessed a substantial increase in damage due to their higher ground clearance and heavier frames. The owners and operators of any vehicle must be financially able to respond to any resulting claims, or they need to transfer the risk through insurance. All states require some minimal coverage for personal vehicles.

The F.A.P.

The most frequently used policy to insure individual private passenger vehicle risks is the Family Automobile Policy (FAP). It provides two major types of coverage: liability and physical damage.

Liability coverage includes both bodily injury and property damage. Physical damage, on the other hand, includes comprehensive and collision coverage.

[A] Liability Coverage

The liability section of the FAP is contained within most policies as Part A – Liability and Part B -Personal Injury Protection.

[1] Bodily Injury

Bodily injury liability coverage generally includes sickness, disease and death, and is expressed in dual limits — per person and per occurrence. Nearly half of the states require minimums of $25,000 per person and $50,000 per occurrence. Higher limits of $100,000 per person and $300,000 per occurrence are often required for consideration of umbrella coverage.

[2] Property Damage

Property damage liability is coverage for damage or destruction to the property of others and includes loss of use. Liability coverage limits usually include property damage limits as the third number, i.e., $100/300/25. The coverage here would be for $25,000 of property damage. As automobiles become more expensive, however, coverage to $50,000 is not considered excessive.

[3] Personal Injury

Personal injury coverage is provided for medical expenses, funeral expenses and loss of earnings for anyone sustaining an injury while occupying your vehicle, or from being struck by your vehicle while a pedestrian.

Liability insurance follows the vehicle, not the driver. Coverage is extended to the vehicle owner and any resident in the same household. It also covers anyone using the insured vehicle with the permission of the owner and within the scope of that permission.

Newly acquired vehicles are usually covered automatically for liability for 15-30 [getting shorter] days after acquisition, but physical damage must have been on all currently covered vehicles to be included. Coverage is also typically extended to a temporary substitute automobile, but only if this vehicle is used in place of the covered automobile, because of its breakdown, repair, servicing, loss or destruction.

[B] Physical Damage Coverage

[1] Comprehensive

Comprehensive physical damage includes coverage for theft, vandalism, broken windshields, falling objects, riot or civil commotion, and even damage from foreign substances, such as paint. Comprehensive is often described as coverage for all those hazards other than collision.

[2] Collision

Collision involves the upset of the covered vehicle and collision with an object, usually another vehicle, and not enumerated in the discussion of comprehensive. Colliding with a bird or animal is considered under the comprehensive coverage.

The distinction between comprehensive coverage and collision coverage is more than technical. The deductible provisions of the FAP often show a considerable difference in these areas, with the collision deductible typically being much greater.

Damage to tires can be covered by provisions in either comprehensive or collision. Exclusions typically include normal wear and tear, rough roads, hard driving or hitting or scraping curbs.

[C] Repairs after the Accident

Following a collision, the insurance company will assign a claims adjuster to determine the extent of damage and the cost of repairs. If these repairs exceed the estimated value of the vehicle, it may be “totaled.” Experience tells me that the value of the vehicle to the owner nearly always exceeds that estimated by the insurance company.

[D] Uninsured / Underinsured Motorists Coverage

Uninsured motorist coverage provides protection from the other driver who is operating his/her vehicle without any insurance coverage. It covers expenses resulting from injury or death as well as property damage. There are currently a dozen states where it is estimated that over 20 percent of the vehicles on the highway are being operated without any insurance. This is not coverage that should be rejected when buying automobile insurance.

Underinsured motorist coverage provides protection from the other driver who purchased only the state-mandated minimum liability insurance coverage. Again, this is not coverage that the medical professional or healthcare practitioner should thoughtlessly reject when buying automobile insurance.

Assessment

The medical professional is strongly urged to consider purchasing replacement cost coverage rather than accepting actual cash value car insurance, which is the depreciated value of the vehicle. The cost may be higher for this coverage, but accepting a larger deductible will often make up the difference. Paying a little more towards the deductible could easily be worth it, if the damage is extensive.

Or, if you have a classic pristine Eurpean touring sedan [2000 pearl-white Jaguar, XJ-V8-L], built for the Queen in Coventry England, like I do. Jay Leno is my hero!

Conclusion

And so, your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Link: http://feeds.feedburner.com/HealthcareFinancialsthePostForcxos

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

Our Other Print Books and Related Information Sources:

Health Dictionary Series: http://www.springerpub.com/Search/marcinko

Practice Management: http://www.springerpub.com/product/9780826105752

Physician Financial Planning: http://www.jbpub.com/catalog/0763745790

Medical Risk Management: http://www.jbpub.com/catalog/9780763733421

Healthcare Organizations: www.HealthcareFinancials.com

Physician Advisors: www.CertifiedMedicalPlanner.com

Subscribe Now: Did you like this Medical Executive-Post, or find it helpful, interesting and informative? Want to get the latest ME-Ps delivered to your email box each morning? Just subscribe using the link below. You can unsubscribe at any time. Security is assured.

Link: http://feeds.feedburner.com/HealthcareFinancialsthePostForcxos

Sponsors Welcomed: And, credible sponsors and like-minded advertisers are always welcomed.

Link: https://healthcarefinancials.wordpress.com/2007/11/11/advertise

Filed under: Insurance Matters, Risk Management | Tagged: auto insurance, automobile insurance, Automobile Insurance Update for Medical Professionals, car insurance, david marcinko, Jaguar, jaguar XJ8-L, medical risk management | 7 Comments »