Measure of Expected Inflation

By Staff Reporters

SPONSOR: http://www.MarcinkoAssociates.com

***

***

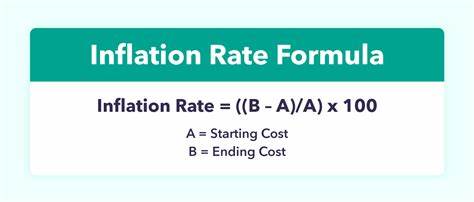

The breakeven inflation rate is the difference between the nominal yield (usually the market yield, which includes an inflation premium) on a fixed-income investment and the real yield (with no inflation premium) on an inflation-linked investment of similar maturity and credit quality.

So, if inflation averages more than the breakeven rate, the inflation-linked investment will outperform the investment with the nominal yield.

Conversely, if inflation averages below the breakeven rate, the investment with the nominal yield will outperform the inflation-linked investment.

Breakeven inflation rates are also considered useful measures of inflation expectations—higher breakeven rates represent higher inflation expectations (and higher relative prices for inflation-linked investments), while lower breakeven rates represent lower inflation expectations (and lower relative prices for inflation-linked investments).

Therefore, ideally, investors want to purchase inflation-linked investments when breakeven rates are relatively low because that’s typically when prices are also relatively low.

COMMENTS APPRECIATED

Thank You

***

***

Filed under: "Ask-an-Advisor", Accounting, Experts Invited, Financial Planning, Funding Basics, Glossary Terms, iMBA, iMBA, Inc., Investing, Marcinko Associates | Tagged: breakeven inflation rate, economy, finance, inflation, inflation rate formula, inflation rates, interest rates, Investing, IRS, Marcinko, Measure of Expected Inflation, yield, Yields | Leave a comment »