By Staff Reporters

SPONSOR: http://www.CertifiedMedicalPlanner.org

***

***

Classic: A pre-payment plan refers to health insurance plans that provide medical or hospital benefits in service rather than dollars, such as the plans offered by various Health Maintenance Organizations. A method providing in advance for the cost of predetermined benefits for a population group, through regular periodic payments in the form of premiums, dues, or contributions including those contributions that are made to a health and welfare fund by employers on behalf of their employees!

Modern: A Prepaid Group Practice Plan specifies health services are rendered by participating physicians to an enrolled group of persons, with a fixed periodic payment made in advance by (or on behalf of) each person or family. If a health insurance carrier is involved, a contract to pay in advance for the full range of health services to which the insured is entitled under the terms of the health insurance contract.

Examples:

- Pre-Paid Hospital Service Plan: The common name for a health maintenance organization (HMO), a plan that provides comprehensive health care to its members, who pay a flat annual fee for services.

- Pre-Paid Premium: An insurance or other premium payment paid prior to the due date. In insurance, payment by the insured of future premiums, through paying the present (discounted) value of the future premiums or having interest paid on the deposit.

- Pre-Paid Prescription Plan: A drug reimbursement plan that is paid in advance.

COMMENTS APPRECIATED

Refer and Like

***

***

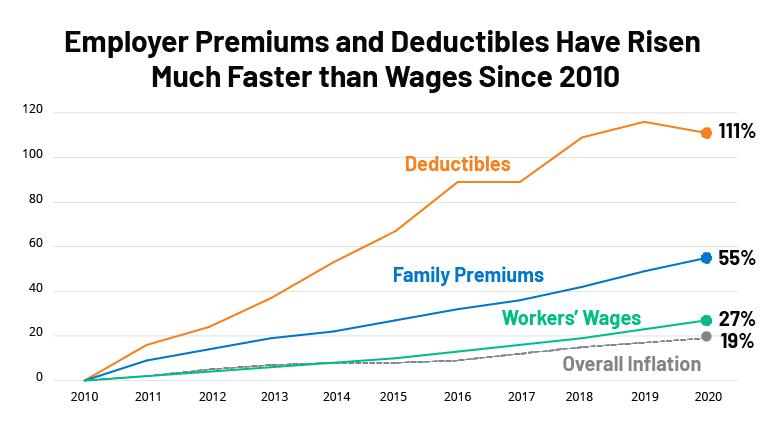

Filed under: "Ask-an-Advisor", CMP Program, Drugs and Pharma, Financial Planning, Glossary Terms, Health Economics, Health Insurance, Healthcare Finance | Tagged: CMP, deductibles, drug, Health Insurance, HMO, hospital plan, pho, PPO, premiums, Prepaid Group Practice Plan, prescription plan, Rx | Leave a comment »