By A.I and Dr. David Edward Marcinko MBA MEd CMP™

SPONSOR: http://www.CertifiedMedicalPlanner.org

***

***

Introduction

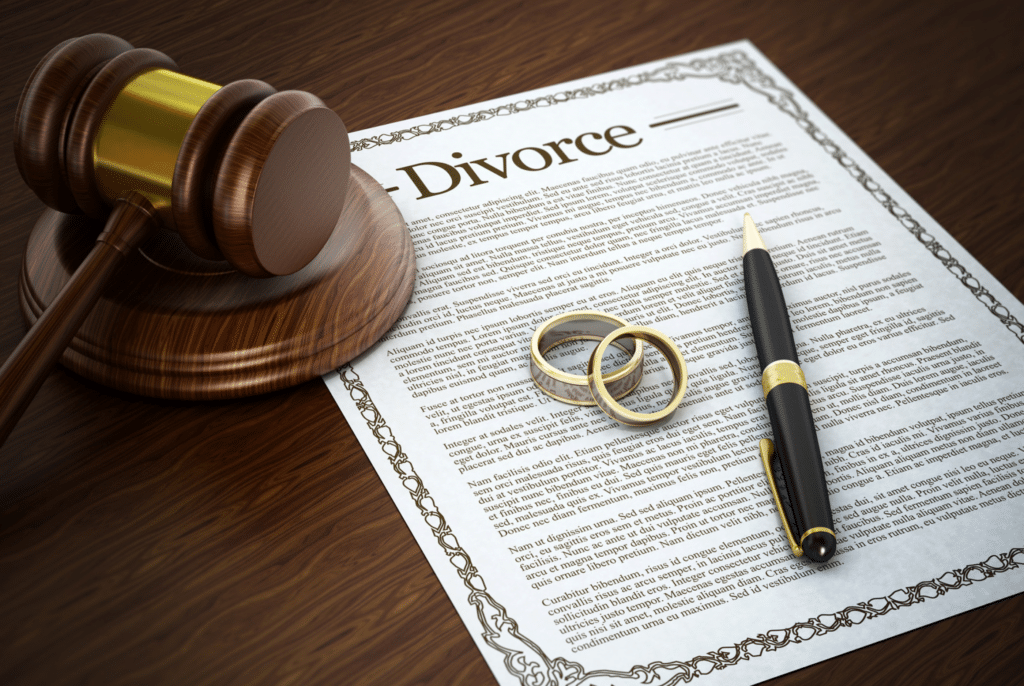

It is normal for physician litigants to develop a case of “buyer’s remorse” after any mediation or divorce settlement. They may feel disappointed after entering into a settlement agreement or feel that they received a bad deal.

PHYSICIAN DIVORCE: https://medicalexecutivepost.com/2025/08/14/physician-divorce-within-the-medical-profession/

Mediation: Some advantages of divorce mediation over divorce litigation include:

◊ Mediation is generally faster and less costly.

◊ Mediation is voluntary, private and confidential.

◊ Mediation facilitates creative and realistic solutions.

◊ Mediation allows parties to control their agreements.

◊ Mediation eliminates a win-lose atmosphere and result.

◊ Mediation provides a forum for addressing future disputes.

◊ Mediation fosters communication and helps mend relationships.

***

***

Settlement

And so, in a vast majority of cases, mediation and settlement is probably a good deal. In fact, it is probably a great deal because you are receiving something without having to risk losing. Remember, trial can be a crap-shoot, and nothing is worse than losing it all at the time of trial.

- Bench trial verdict by a trial judge.

- Jury trial verdict by your “peers.”

Instead, you entered into a settlement agreement and now your divorce case is over.

But beware since trying to get out of a settlement agreement reached at mediation or settlement is virtually impossible.

Why? Well, there is a strong interest by the court to enforce mediation and settlement agreements. The court wants your divorce case to be over and off its docket. There are a few very narrow exceptions; for example, if one party was truly coerced because someone held a gun to their head. But that rarely happens, and it certainly doesn’t happen to most doctors or dentists.

Re-litigate?

Of course, you can fight against your mediation or settlement agreement if you like, but you won’t get too far. There’s an old adage in the law that a bad settlement is better than a great trial. That’s because no one knows how a judge or jury will rule come time of trial.

***

***

This buyers remorse phenomenon also isn’t uncommon among people who receive sudden wealth, whether through divorce settlements, inheritances, lottery winnings, or other windfalls.

Assessment

Financial advisors often see clients struggle with “sudden wealth syndrome”—the inability to properly manage a large sum of money they’re not accustomed to having.

Common mistakes include:

- Lifestyle inflation without sustainable income to support it.

- Poor investment decisions or lack of investment planning.

- Emotional spending following traumatic life events like divorce.

- Failure to set aside money for taxes on the settlement.

- Not creating a long-term financial plan for the money.

So, do not let these mistakes happen to you!

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like and Subscribe

***

***

Filed under: "Doctors Only", CMP Program, Ethics, Financial Planning, Glossary Terms, Health Economics, Healthcare Finance, Investing, LifeStyle, Marcinko Associates | Tagged: bench trial divorce, buyers remorse, certified medical planner, CMP, david marcinko, divorce, divorce mediation, doctor divorce, jury divorce trial, law, mediation, news, physician divorce, politics, settlement divorce, sudden wealth syndrome | Leave a comment »