How Would Life Change – Even if Prescience Possible?

By Somnath Basu PhD, MBA [www.clunet.edu/cif]

[www.clunet.edu/cif]

All medical professionals and ME-P readers should know that there’s about a 50% chance that someone will predict correctly when and how the domestic economy will recover. The chances of that person failing are the same, at 50%. There is very little chance (probability approaching zero) that nothing will change. Under these circumstances, it’s quite easy for the pundits to take a shot at being right. It is easy to be wrong because it’ll never be held against them, given the circumstances around the global financial crisis. There’s always a way out of being wrong.

Of Rumors, Guesses, Optimism and Pessimism

Of course being right has its rewards of reaping benefits without any downside. In the meantime, a whole nation is being held hostage as to what happens next. Rumors, guesses, optimism, pessimism abound as stock markets rise and fall, employment goes down by less or more than expected, price of oil suddenly becomes a leading economic indicator, China starts showing the way out, interest rates remain low, home (new, used, new construction, commercial vs. residential) sales increase and decrease in tandem, inflation is a problem but not deflation or vice versa and the economy grows as expected or not. The bewilderment at this state of things is taking a toll but the pundits keep going on. Politicians scream and bureaucrats moan. Obviously, this too is a crisis of sorts.

The Two Questions

There are two questions that fall out of this scenario. First, how does one predict the economy and how sound are the methodologies. Second, and more importantly, do we really need a prediction? I will explore these questions in the order presented above but the first one in more detail.

Let’s Begin the Evaluation

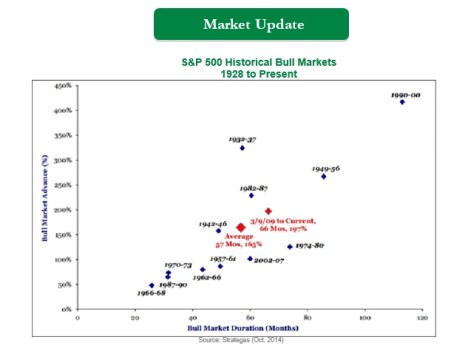

To begin with, it’s useful to evaluate the techniques used by our economic gurus who preach lofty sermons from their altars. These folks have a battalion of charts and graphs depicting why something is happening, ably backed up by rigorous mathematical models that have passed the test of their enlightened peers. These people consider economic indicators using complex models of GDP growth, change in unemployment, trade imbalances, flow of goods and services etc. etc. At the end of the day, they still have a 50% chance of being right. Of course they have a theory already explain this possibility (efficient market hypothesis, or EMH) which they use to explain why the market cannot be predicted with any certainty and the odds of predicting correctly are as good as repeatedly calling a coin toss right. However, it seems that this does not dampen their need in any way to keep on predicting.

The Comparisons

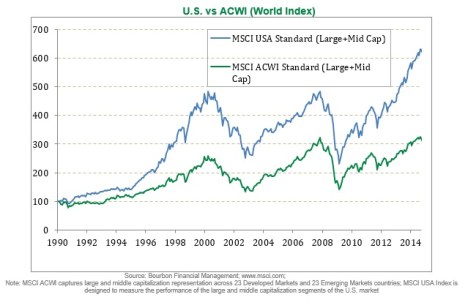

Compared to previous recessions, there is a marked difference with the one we just experienced. This difference is that the great recession of 2008-09 can be considered as the first true global recession where even remote countries in Africa experienced mild recessionary conditions.

Hence, one of the first requirements for the predicting community is to truly incorporate global economic conditions in predicting the future. The current emphasis on domestic economic conditions precludes to an extent our ability to comprehend the changes underlying this “one world” which is necessary to get closer to a more realistic prediction. Further, we should include not only the developed economies along with some of the major emerging markets, but literally all economies, in extending our analysis. As we will ponder later, our model for prediction should be much more inclusive of all countries, no matter how small or economically less developed the countries are. The understanding here is that given the fragile nature of the global economy at present, even a small non-economic ripple in a distant land can turn into something that encompasses the globe in some kind of economic turmoil.

Thus, hopefully, a globally inclusive model of understanding should definitely help us in the business of prediction.

Departure from the Traditional View

At this point I am going to depart from the traditional view that predicting the future of any economy should necessarily be an exclusive economic model. I shall argue that in this world we live in, such a model is inadequate if we realistically expect to beat the odds of a coin toss game. The point I seek to make is that in a world where we are so dependent of each other, how can we exclude factors like political or social conditions, geographic dispositions and historical interrelations, religion, world health, poverty or global climate change. I am going to elaborate upon some of these above contentions with some simple examples to support my view of an all inclusive understanding model before we go about the business of predicting the economy.

War- What is it Good For?

Consider the politics of wars in the world. Does it have an impact on our economy? It sure does. If we are directly involved, it has a huge cost in human suffering besides the direct dollar cost of war. The countries we are engaged in are similarly impacted by their casualties in human lives (and the subsequent economic effect of that) and the real time dollar costs of the real and financial economy being in shambles. If our country is not directly involved in some war overseas, then the whole defense and allied industries stands to gain – we are by far the largest suppliers of weapons in the world. Hence any war has economic consequences from tangible dollar costs to the associated costs of low morale, drops in consumer confidence, etc. An even simpler example would be to look at the wars we are engaged in (in Iraq and Afghanistan) and ask ourselves whether the economic consequences are not sufficient enough to be included in a predictive model.

Global Climate Change

What about global climate change? It is far too late to say it is not real. The main question is whether the economic consequences of global climate change are large enough to be included in any predictive model. What is the impact of climate change on our economy from the increased ravages of floods, and famines? Costs in crop loss, insurance claims, higher food prices etc. etc. are surely not trivial. Are we willing to say that in the future these extremes of weather will dissipate and not increase so that we do not need to consider their economic impacts? If the climate changes problem is real then we do need to do something about carbon emissions and fossil fuels even as we find larger and larger oil deposits.

However, it is not enough for us to move strongly in this direction. China and India are already crying foul as the world tries to persuade these two countries to slow down carbon emissions. It is a difficult pitch to sell since the retort is that the economic development in the western world is what caused this condition and it is unfair to ask these two countries to slow down their growth ambitions especially since they have waited so long to wait their turn.

Moreover, less consumption of commodities (e.g. of oil, steel, building material) by China and India will trigger economic events of their own since lower production levels in these countries would mean higher costs to us since we are the main consumers of their economic production. The irony of this argument is that if these countries are not halted from their frenetic economic activity and stepped up consumption of commodities, then there is a good chance of inflation creeping through the commodity sector.

However, the point to make is that the effects of global climate change certainly do have serious economic consequences and excluding it would surely denigrate the prediction.

Other Issues

There are other associate issues. What is the impact of global poverty on future economic activities? Should this be an issue at all? What we don’t observe is the staggering scope of this problem. Let me clarify with a simple example. There are roughly 1.2 billion people in India. Another rough estimate would be to state that about 5% of this population are millionaires (in dollar terms), especially when you factor in that for each Indian Rupee that is accounted for (in the economic system) there is at least two Indian Rupees that are unaccounted (money on which tax has not been paid and has not been laundered either (black money) for but that which circulates in the economy.

Another way of expressing the 5% is to say that there are more millionaires (60 million) in India than there are people in France!! Another 400 million can be considered the middle class. No wonder India is an attractive market to developed nations whose internal markets have become tepid. However, this also means that the rest of the Indians (about 750 million) live in abject poverty, on a dollar a day. Given that this is an average consumption value, there ought to be about 350 million Indians who live on a lot less than $1 a day. And, this entire population is growing. In China as in Indonesia; in Bangladesh and in Nigeria. In Brazil and Russia. A growing number of people who are hungry and clamoring for food. People who are adding to the others in claiming land to live on, away from agricultural production. Is there a limit of how many people the world can support before it breaks apart. Does this have any significant (other than the usual Malthusian one) economic impact? It does for sure; much more surely than climate change and swine flu. Yet our models and predictions are oblivious to these possibilities.

SAARS

Physicians and ME-P readers may recalls that about 5-6 years ago, we saw the advent of SAARS, a lethal infection in China and Taiwan, beginning to spread in other parts of the world. There was an immediate and sharp economic impact on many of the industrialized nations. Fortunately for us, the spread of the infection was arrested and the global economy quickly got back in track. Surely, we were lucky. A few years ago, the world witnessed bird flu, an even more lethal viral infection. This too was quickly contained. At some point during the financial meltdown of 2008-09 we witnessed the advent of swine flu, a close relative of the bird flu. This time too we were lucky.

Of course, it is important to note that these infections are one step away from being an epidemic of immense proportions where 100s of millions may perish. If the swine flu was not contained when it appeared in late 2008 – early 2009, the financial meltdown we experienced would seem like a tame event. What happens if the next time and next viral mutation around) we are not that lucky? Should we consider the economic consequence of such an event, albeit within a probability framework?

Non-Economic Issues

As we can see, there are many other noteworthy non-economic issues that can have serious economic impacts. As a matter of fact, we can all conjure up other examples of non-economic issues at will and make a case for their inclusion because we can so easily rationalize their economic impact. But I have made the point to wrap up the answer to my first question – how good are the economic models? Not much, really.

Educated ME-P Readers

Since my readers possess financial knowledge and acumen, it is worthwhile for me to allude to the various predictions that are flying about in the economy without having to explain them in great detail. This time around, predictions of economic recovery are in the form of shapes. So now the big question is whether the recovery will look like the shape of a V (a sharp recovery) as compared to a U (a prolonged recession followed by a fairly sharp recovery) or a W (a second round of recession followed by another sharp recovery or like a pair of conjoint Vs (V V). The latest one I had the misfortune to hear about was a square root (√, a V-shaped recovery till a point after which the economy changes very little for a considerable period of time). What is also quite obvious that we can make up many other shapes like the above, using economic (and non-economic) arguments as mentioned earlier but at the end of the day, any one of them has a 50% chance of being right. Because our theories say (yes, the very ones we constructed) that markets are efficient and predictions are futile.

Which brings us to the second question: knowing all this, how important are predictions in the way we live. How much better would our lives be, knowing that one or two of these predictions are right and all others are not? Can we identify the ones that are right? Most likely not, and definitely much harder than finding good or bad stocks.

Assessment

How would our lives change if we could find that handful of people who predicted correctly and consistently more often than not, if there were such people? Surely, armed with this knowledge, we would be able to exploit the predictions for gain. But, given the odds, it is also quite plain and obvious that finding such people is as difficult as winning the lottery. We know the odds. We continue to admonish our clients who stray in these extreme speculative peripheries. Yet, when it comes to reading about predictions, we continue to play the lottery, in hopes of a windfall. The windfall wills make us richer, but will it make us better or happier?

Note: Dr. Somnath Basu is a professor of Finance at California Lutheran University and the President of Financial Health Technology (www.financialhealthtechnology.com), a personal financial software company.

Channel Surfing the ME-P

Have you visited our other topic channels? Established to facilitate idea exchange and link our community together, the value of these topics is dependent upon your input. Please take a minute to visit. And, to prevent that annoying spam, we ask that you register. It is fast, free and secure.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

Filed under: Financial Planning, Op-Editorials, Quality Initiatives | Tagged: behavioral finance, california lutheran university, economic recovery, EMH, GDP, global climate change, recession types, SAARS, Somnath Basu, war, www.FinancialHealthTechnology.com | 11 Comments »