By Staff Reporters

FINANCIAL / INVESTMENT ADVISORS & STOCK BROKERS

SPONSOR: http://www.MarcinkoAssociates.com

***

***

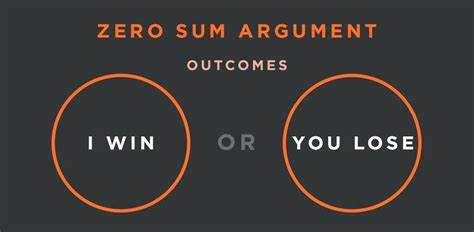

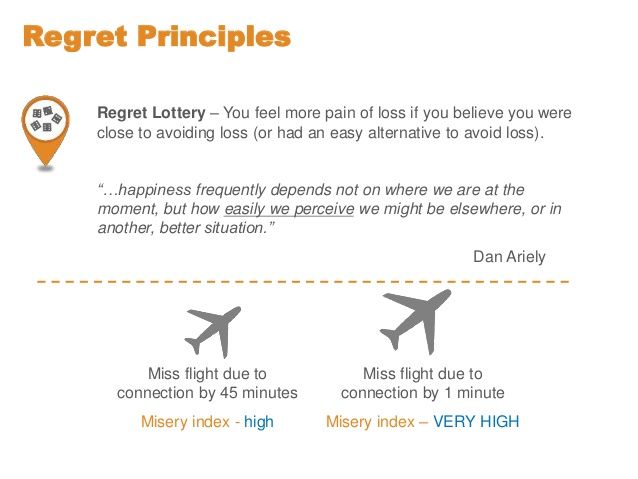

According to colleague Dan Ariely PhD, a Zero Sum Bias [ZSB] is the mistaken belief that one person’s gain is another’s loss. It’s like thinking the world is a giant pie with only so many slices. This mindset fuels competition and jealousy, making us forget that collaboration can create more pie. It’s why we sometimes root against others instead of working together.

Question: Is the stock market a zero-sum game? You frequently hear media refer to games and markets as zero-sum games.

Answer: Well, yes, we define the stock market as a zero-sum game, both in the short and in the long term, although it technically is incorrect. A zero-sum game is where one person’s gain is another person’s loss – thus there is no wealth created and the overall benefit is zero. This doesn’t apply to stocks, but it’s a zero-sum game in relation to a stock market benchmark.

For example, short-term trading in stocks is theoretically not a zero-sum game, and neither is long-term investing. But short-term trading is close to a zero-sum game, and long-term investing is a zero-sum game if we use a broad index as a benchmark.

Essentially, in other words, the stock market functions as an expansive network of zero-sum transactions; each trade engages a buyer and a seller–their perspectives on a security’s future value contrasting. These opposing views propel market prices: they mirror not only risk transfer but also potential reward—a dynamic process indeed! Traders and investors must grasp the crucial zero-sum aspect; it underscores trading’s inherent competitiveness. Effectively anticipating market trends and actions from other participants: therein lies success in this environment.

CITE: https://www.r2library.com/Resource/Title/0826102549

So, next time you feel like someone else’s success diminishes your own, remember: there’s more than enough pie to go around.

COMMENTS APPRECIATED

Thank You

***

***

Filed under: "Ask-an-Advisor", Experts Invited, Glossary Terms, Investing, Marcinko Associates, Risk Management | Tagged: Dan Ariely PhD, finance, financial advisors, Investing, investmeht advisors, Marcinko, personal-finance, stock brokers, stock market, stocks, zero sum bias, zero sum game | Leave a comment »

***

***