By Staff Reporters

***

***

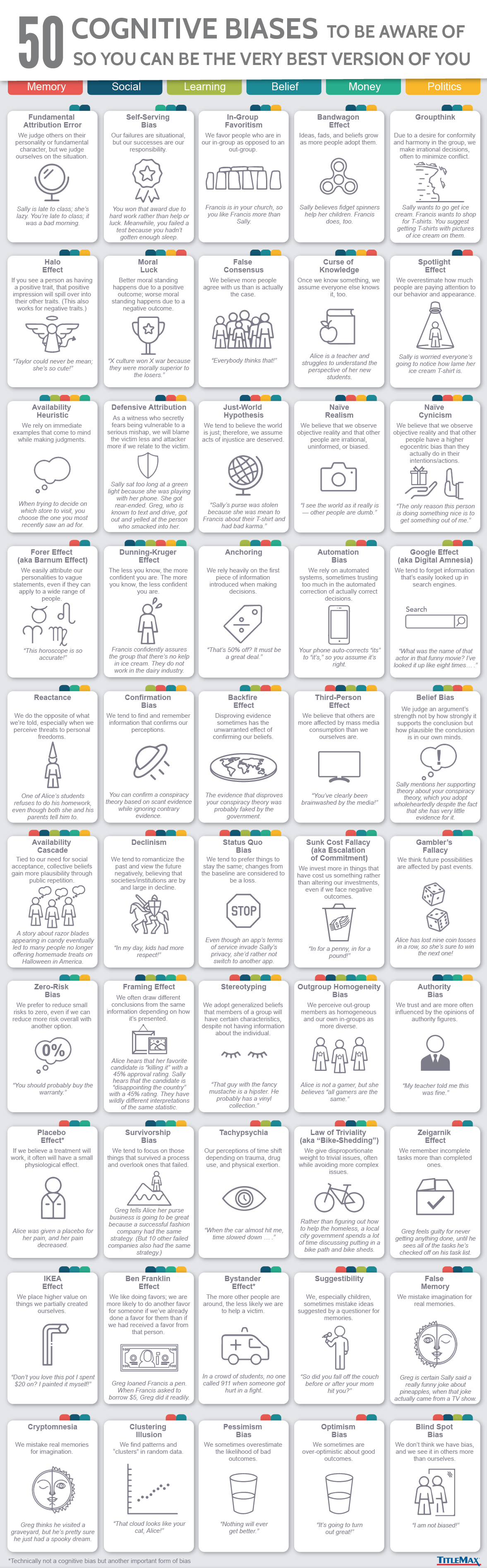

Negativity bias is not totally separate from pessimism bias, but it is subtly and importantly distinct. In fact, it works according to similar mechanics as the sunk cost fallacy in that it reflects our profound aversion to losing. We like to win, but we hate to lose even more.

And so, according to cognitive scientist Mackenzie Marcinko PhD, when we make a decision, we generally think in terms of outcomes—either positive or negative. The bias comes into play when we irrationally weigh the potential for a negative outcome as more important than that of a positive outcome.

***

***

Pessimism bias on the other hand, is a cognitive bias that causes people to overestimate the likelihood of negative things and underestimate the likelihood of positive things, especially when it comes to assuming that future events will have a bad outcome.

For example, the pessimism bias could cause someone to believe that they’re going to fail an exam, even though they’re well-prepared and are likely to get a good grade.

According to colleague Dan Ariely PhD, The pessimism bias can distort people’s thinking, including your own, in a way that leads to irrational decision-making, as well as to various issues with your mental health and emotional well being.

COMMENTS APPRECIATED

Subscribe Today!

***

***

Filed under: "Doctors Only", Ethics, Experts Invited, Glossary Terms, iMBA, Inc., LifeStyle, mental health | Tagged: bias, biasopedia, cognitive bias, Dan Ariely PhD, Mackenzie Marcinko, negativity, negativity bias, optimism, pessimism, pessimism bias, psychology | Leave a comment »