Is it Time to Harvest?

[By Lon Jefferies MBA CFP®]

Tax harvesting is the process of selling assets for the purpose of creating either long-term capital gains or losses to minimize your tax bill. This procedure is usually conducted near the end of a calendar year.

Tax harvesting is the process of selling assets for the purpose of creating either long-term capital gains or losses to minimize your tax bill. This procedure is usually conducted near the end of a calendar year.

While many people are familiar with the concept of tax loss harvesting, fewer physicians or clients are familiar with the more recently developed process of tax gain harvesting. Between these two procedures, virtually everyone with a taxable (not tax-advantaged) investment account should make adjustments to their portfolio before the year ends.

Who Qualifies For the 0% Capital Gains Rate?

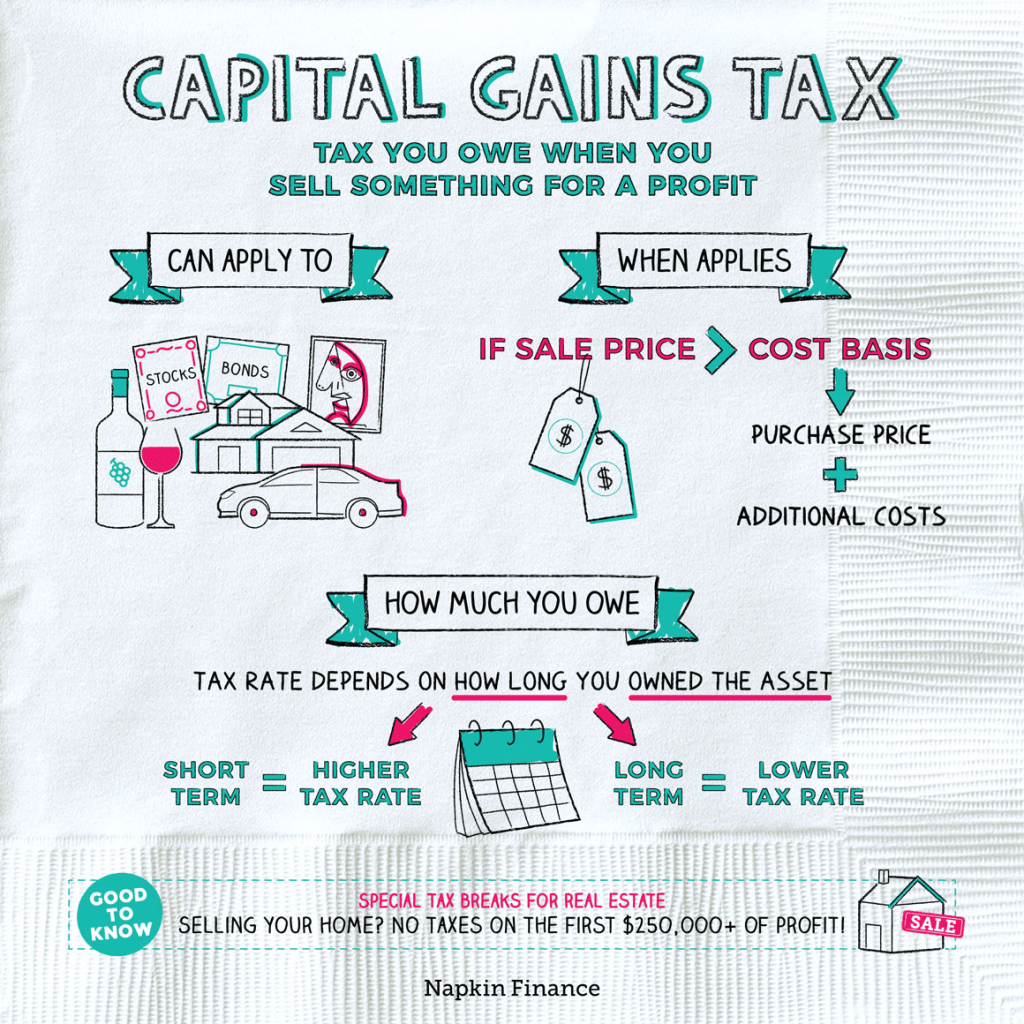

First, it is important to understand that capital gains (the growth on investments within a taxable, non retirement investment account) are taxed differently than ordinary income (wages, pensions, Social Security, IRA distributions, etc.). While short-term capital gains (recognized on the sale of assets held less than a year) are essentially considered ordinary income, long term capital gains, or recognized gains on assets held more than a year, are taxed at advantageous tax rates. While ordinary income tax rates range from 10% to 39.6%, capital gains tax rates range from 0% to 20%.

Second, it is crucial to understand what enables a taxpayer to qualify for the 0% capital gains rate. If a taxpayer is in the 10% or 15% ordinary income tax bracket, they qualify for the 0% long-term capital gains rate.

For a married couple filing jointly, the 15% tax bracket ends at $73,800 of taxable income ($36,900 for single taxpayers). Thus, if a married taxpayer has a taxable income (which includes long-term capital gains but is also after deductions and exemptions) of less than $73,800, all their long-term capital gains will be tax free. If the taxpayer is in a tax bracket anywhere between 25% and 35% (taxable income of $73,800 and $457,600, or between $36,900 and $406,750 for single tax filers), they will pay long-term capital gains taxes at 15%. Only those in the top tax bracket of 39.6% (married taxpayers with a taxable income over $457,600 and single taxpayers with taxable income over $406,750) will pay capital gains taxes at 20%.

Tax Loss Harvesting

During the calendar year, assets have been purchased and sold in most taxable investments accounts. The sale of an asset creates a net gain or loss, both having tax implications. Investors should have an understanding of what their long-term capital gains tax rate will be so they can determine whether a taxable gain or loss is preferable.

For instance, an individual who does not qualify for the 0% capital gains tax rate may wish to minimize the amount of taxable gains they recognize during the year, which would reduce their tax bill. If the investor currently has a net long-term capital gain (which is probable after the strong year the market had in 2013), then it is likely worthwhile to sell any assets in the portfolio that are currently worth less than the investor’s purchase price. This tax loss harvesting would reduce the net gain recognized during the year and lower the investor’s tax bill.

In some cases, by taking advantage of all potential losses within a portfolio an investor has the ability to negate all capital gains created during the year, completely eliminating their capital gains tax bill. Further, the IRS will allow investors to recognize a net capital loss of up to a -$3,000 per year. This -$3,000 loss can be used to lower the taxpayers ordinary income. This is particularly advantageous in that the capital loss reduces a type of income that is taxed at higher tax rates.

Harvesting Gains

Harvesting gains from a taxable portfolio is a more recently developed concept. Once the 0% long-term capital gains tax rate became a permanent part of the tax code with the passing of the American Taxpayer Relief Act of 2012 (signed January 2nd, 2013), in some scenarios it began making sense to recognize long-term capital gains on purpose to potentially avoid a larger tax bill in the future.

Suppose a taxpayer’s taxable income is consistently $65,000 a year. Additionally, suppose our hypothetical taxpayer won’t withdraw funds from his taxable account during the next few years, but may need a large lump sum distribution five years down the road. Recall that the 0% capital gains rate ends when a married taxpayer’s taxable income (which includes long-term capital gains) exceeds $73,800. Consequently, this hypothetical taxpayer has the ability to recognize $8,800 ($73,800 – $65,000) in long-term capital gains every year without increasing his tax bill. If this $8,800 in gains is recognized every year by simply selling and immediately repurchasing appreciated assets, he would raise the cost basis of his investment by $44,000 ($8,800 gain recognized annually for five straight years). He could then sell and withdraw that $44,000 without creating a tax liability.

Alternatively, if the investor does not harvest gains during the years when no distributions are taken, withdrawing $44,000 of gains five years down the road would create a sizable tax bill. He would still be able to recognize $8,800 of gains tax free in the year of distribution, but the remaining $35,200 of gains would cause his taxable income to be over the $73,800 limit, eliminating access to the 0% capital gains rate. That $35,200 would be taxed at the 15% capital gains rate, creating a federal tax bill of $5,280. With proper planning, this significant tax bill can be avoided.

***

***

The Bottom Line

Tax harvesting has no purpose in tax-advantaged retirement accounts such as IRAs and 401ks because all distributions from these accounts are taxed as ordinary income. However, taxable individual or trust investment accounts can almost certainly benefit from tax harvesting. Speak to your accountant and financial planner to understand whether capital gains or losses are desirable for you this year and determine the amount of taxable gains already recognized. This will help you determine what type of harvesting should take place.

Tax harvesting can be a difficult and confusing concept. However, a competent financial planner who utilizes this procedure within your taxable investment account can significantly lower your tax bill. Speak to your adviser to ensure you are reaping the tax benefits available to you.

Channel Surfing the ME-P

Have you visited our other topic channels? Established to facilitate idea exchange and link our community together, the value of these topics is dependent upon your input. Please take a minute to visit. And, to prevent that annoying spam, we ask that you register. It is fast, free and secure.

Conclusion

Your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

OUR OTHER PRINT BOOKS AND RELATED INFORMATION SOURCES:

Comprehensive Financial Planning Strategies for Doctors and Advisors: Best Practices from Leading Consultants

Filed under: Investing, Portfolio Management, Taxation | Tagged: capital gains, Investing, Lon Jefferies MBA CFP®, Tax harvesting | 3 Comments »