SPONSOR: http://www.CertifiedMedicalPlanner.org

Financial Advisor, Planner and Insurance Agent Information

By Staff Reporters

***

***

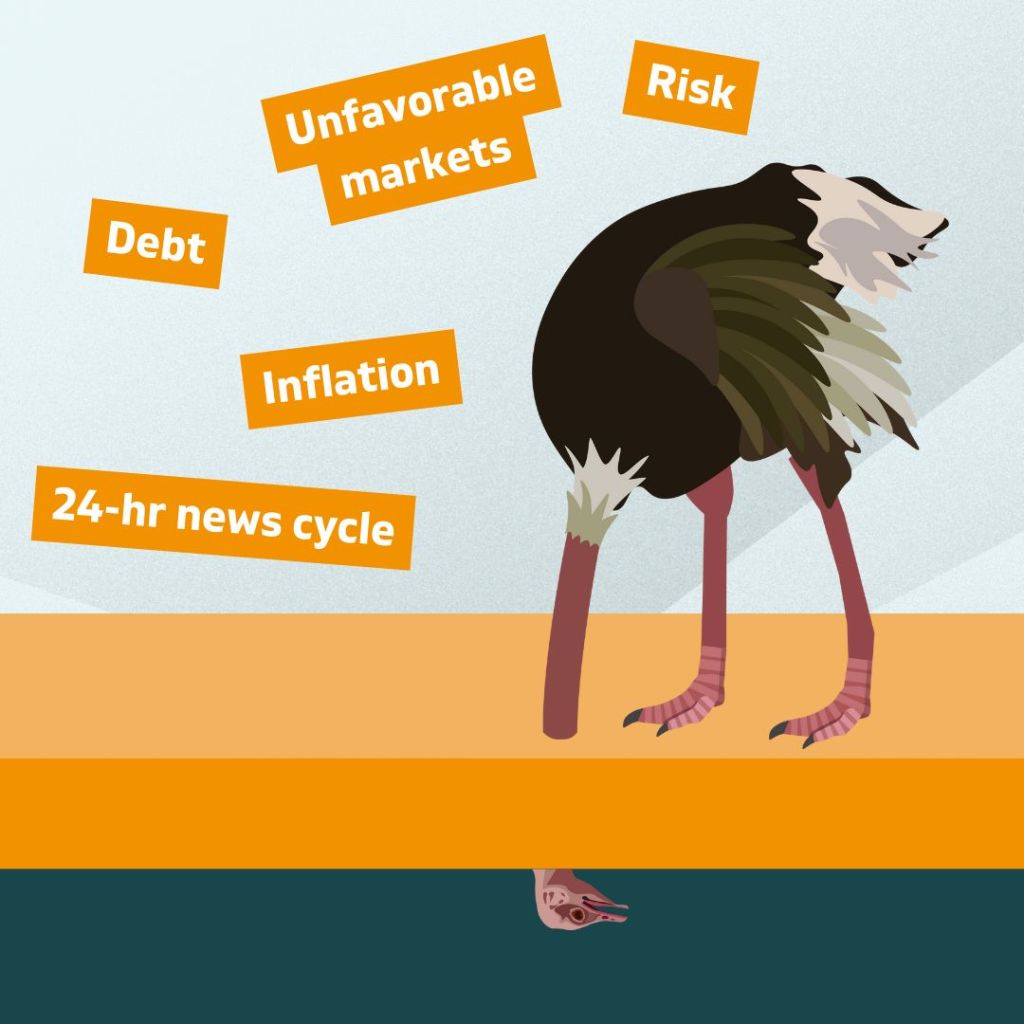

Ostrich Bias is a behavioral phenomenon describing the tendency of individuals to avoid or ignore information that they perceive as negative or threatening. This term is derived from the popular but inaccurate belief that ostriches bury their heads in the sand when faced with danger, even though they do not exhibit such behavior.

Evidence: There is neuro-scientific evidence of the ostrich effect. Sharot et al. (2012) investigated the differences in positive and negative information when updating existing beliefs. Consistent with the ostrich effect, participants presented with negative information were more likely to avoid updating their beliefs; wills, estate plans, investment portfolios, and insurance policies, etc..

Moreover, they found that the part of the brain responsible for this cognitive bias was the left IFG – inferior frontal gyrus – by disrupting this part of the brain with TMS – transcranial magnetic stimulation – participants were more likely to accept the negative information provided.

EXAMPLE: The Ostrich Bias can cause someone to avoid looking at their bills, because they’re worried about seeing how far behind they are on home mortgage payments, credit cards, education or auto loans, etc.

COMMENTS APPRECIATED

The Medical Executive-Post is a news and information aggregator and social media professional network for medical and financial service professionals.

Feel free to submit education content to the site as well as links, text posts, images, opinions and videos which are then voted up or down by other members. Comments and dialog are especially welcomed.

Daily posts are organized by subject. ME-P administrators moderate the activity. Moderation may also conducted by community-specific moderators who are unpaid volunteers.

Refer and Like

***

***

Filed under: Ask a Doctor, CMP Program, Ethics, Experts Invited, Glossary Terms, Health Economics, Investing, mental health, Risk Management, Touring with Marcinko | Tagged: avoidance, banker, brain, CMP, debt, financial advisor, financial planner, IFG, ignorance, inferior frontal gyrus -, inflation, insurance agent, interest rates, investment advisor, Marcinko, mental health, negative information, ostrich bias, ostrich effect, risk, sharot, TMS, transcranial magnetic stimulation | Leave a comment »