Essay on the Eight-Hundred Pound Gorilla in the Medical Treatment Room

By Dr. David E. Marcinko MBA MEd CMP

[Editor-in-Chief]

According to economist Austin Frakt PhD, and others, there is a school of thought that says Congress is incapable of controlling costs in the Medicare and Medicaid System [CMS].

And, then there is the reality known by all practicing medical professionals regardless of specialty orientation or degree designation. That is to say, CMS really can control healthcare costs and with great ferocity and efficiency, and to non-public sectors as well …. PARADOXICAL?

On Getting What You Wish For

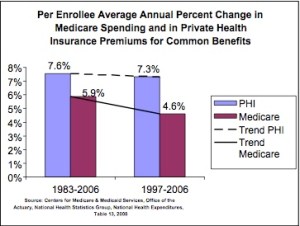

Blogger Ezra Klein opines that one of the dirty little secrets of the health-care system is that Medicare has done a much better job controlling costs than private health insurers.

http://voices.washingtonpost.com/ezra-klein/2010/11/what_happens_when_medicare_con.html

A Forehead-Palm Moment

Of course, we doctors know that the real problem is that Medicare seemingly [think Seinfeld’s character George Costanza] controls costs all too well; but not really. It is just that CMS pays doctors too little and thus it appears costs are controlled. What really is happening is that physician fees are being reduced carte’ blanche.

Nevertheless, and regardless of semantics, CMS will never control costs much more efficiently than private insurance companies or doctors will simply abandon Medicare for related payment models like direct reimbursement or concierge medicine. This is happening right now. Physicians, osteopaths and podiatrists etc, are opting out of Medicare in increasingly large numbers. In a world where there’s only Medicare and Medicare to control costs, doctors can either take the pay cut or stop seeing patients, and stop being doctors. “Taking what they are given – because they’re working for a livin.”

So sorry that this seems like a forehead-palm moment for Ezra, but not for healthcare practitioners or the ME-P!

Too Much Demand Elsewhere

And, as we see from other countries, many young bright folks want to be doctors, even if being a doctor doesn’t make one particularly wealthy [high demand and high eventual supply produces lower provider costs in the long term?]. Think medical tourism.

Not so much the case anymore in this country [lower demand and lower eventual supply produces higher reimbursement costs to the doctor survivors in the very long term?].

Our Domestic World

But, we are not elsewhere. In fact, in our present domestic healthcare ecosystem, when Medicare decides to control costs, many doctors can simply stop accepting Medicare patients, and the politicians will lose their jobs. One political party then declares that Medicare is rationing and will hurt senior citizens. The other party capitulates and pays MDs more [SGR]. Then, the federal budget looks bad as it does now. The circle is complete when one party asserts that Medicare actually can’t contain costs but the private insurance companies will. It all fails, in an unending circular Boolean-like loop of illogic.

Listen Up!

So, listen up AARP, politicians, CMS and seniors as I admonish you to be careful what you wish for [medical cost controls]. It might just come true. As Ezra rightly says; rinse, repeat – rinse, repeat – ad nausea. You simply can’t have it both ways. You either choose to spend less and offend certain cohorts, or spend more and offend different factions. Either way, you’re going to piss someone off. A good healthcare reimbursement system would try to make that decision rationally [a-politically]. But, at least it would make an economics driven decision; wouldn’t it?

Assessment

Is CMS really the eight hundred pound cost-controlled gorilla in the increasingly large Medicare treatment room? Why or why not? Now, relative to the ACA of 2010, please read: The Case for Public Plan Choice in National Health Reform [Key to Cost Control and Quality Coverage], by Jacob S. Hacker, PhD. Link: Jacob Hacker Public Plan Choice

Conclusion

And so, your thoughts and comments on this ME-P are appreciated. Do we have a Medicare cost control efficiency paradox? Or, are the economists just reveling in the publication banal? Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

Speaker: If you need a moderator or speaker for an upcoming event, Dr. David E. Marcinko; MBA – Publisher-in-Chief of the Medical Executive-Post – is available for seminar or speaking engagements. Contact: MarcinkoAdvisors@msn.com

Subscribe Now: Did you like this Medical Executive-Post, or find it helpful, interesting and informative? Want to get the latest ME-Ps delivered to your email box each morning? Just subscribe using the link below. You can unsubscribe at any time. Security is assured.

Sponsors Welcomed: And, credible sponsors and like-minded advertisers are always welcomed.

Link: https://healthcarefinancials.wordpress.com/2007/11/11/advertise

Filed under: "Ask-an-Advisor", Accounting, Career Development, Drugs and Pharma, Ethics, Experts Invited, Health Economics, Health Insurance, Healthcare Finance, Managed Care, Op-Editorials, Practice Management, Touring with Marcinko | Tagged: Austin Frakt, Case for Public Plan Choice in National Health Reform, CMS, david marcinko, Ezra Klein, health insurers, HMOs, Jacob Hacker, Medicaid, medical cost controls, medicare, medicare paradox, paradox | 8 Comments »

***

***