By Dr. David Edward Marcinko MBA MEd

SPONSOR: http://www.MarcinkoAssociates.com

***

***

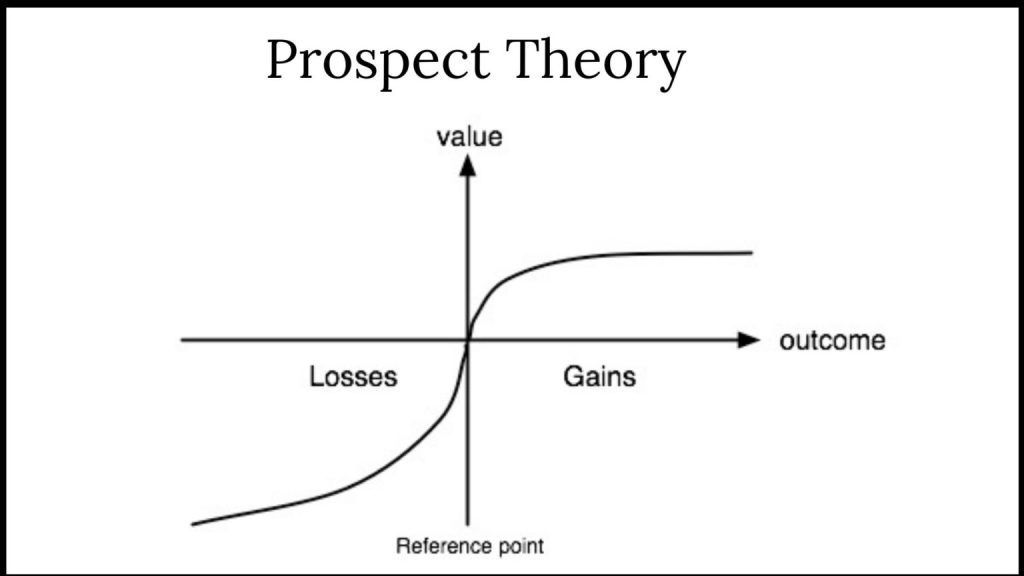

PROSPECT THEORY

In the early 1980s, Daniel Kahneman and Amos Tverskey proved in numerous experiments that the reality of decision making differed greatly from the assumptions held by economists. They published their findings in Prospect Theory: An analysis of decision making under risk, which quickly became one of the most cited papers in all of economics.

KAHNEMAN: https://medicalexecutivepost.com/2024/03/28/rip-daniel-kahneman-phd/

To understand the importance of their breakthrough, we first need to take a step back and explain a few things. Up until that point, economists were working under a normative model of decision making. A normative model is a prescriptive approach that concerns itself with how people should make optimal decisions. Basically, if everyone was rational, this is how they should act.

INVESTING PSYCHOLOGY: https://medicalexecutivepost.com/2025/02/21/investing-psychology/

***

***

REAL-LIFE EXAMPLE

Amanda, an RN client, was just informed by her financial advisor that she needed to re-launch her 403-b retirement plan. Since she was leery about investing, she quietly wondered why she couldn’t DIY. Little does her Financial Advisor know that she doesn’t intend to follow his advice, anyway! So, what went wrong?

The answer may be that her advisor didn’t deploy a behavioral economics framework to support her decision-making. One such framework is the “prospect theory” model that boils client decision-making into a “three step heuristic.”

According to colleague Eugene Schmuckler PhD MBA MEd CTS, Prospect theory makes the unspoken biases that we all have more explicit. By identifying all the background assumptions and preferences that clients [patients] bring to the office, decision-making can be crafted so that everyone [family, doctor and patient] or [FA, client and spouse] is on the same page.

INVESTING MIND TRAPS: https://medicalexecutivepost.com/2025/06/12/psychology-common-finance-and-investing-mind-traps/

Briefly, the three steps are:

1. Simplify choices by focusing on the key differences between investment [treatment] options such as stock, bonds, cash, and index funds.

2. Understanding that clients [patients] prefer greater certainty when it comes to pursuing financial [health] gains and are willing to accept uncertainty when trying to avoid a loss [illness].

3. Cognitive processes lead clients and patients to overestimate the value of their choices thanks to survivor bias, cognitive dissonance, appeals to authority and hindsight biases.

CITE: Jaan E. Sidorov MD [Harrisburg, PA]

Assessment

Much like in healthcare today, the current mass-customized approaches to the financial services industry fall short of recognizing more personalized advisory approaches like prospect theory and assisted client-centered investment decision-making.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like and Subscribe

***

***

Filed under: "Ask-an-Advisor", Ask a Doctor, Ethics, Experts Invited, finance, Glossary Terms, Health Economics, Healthcare Finance, Investing, Marketing & Advertising, mental health, Portfolio Management | Tagged: Amos Tverskey, Daniel Kahneman, david marcinko, economics, education, Eugene Schmuckler, financial, financial advisor, financial planner, financialk decision making, mental health, Portfolio Management, Prospect Theory, psychology, psychology psychiatry, tax | Leave a comment »