By Dr. David Edward Marcinko MBA MEd CMP™

SPONSOR: http://www.MarcinkoAssociates.com

***

***

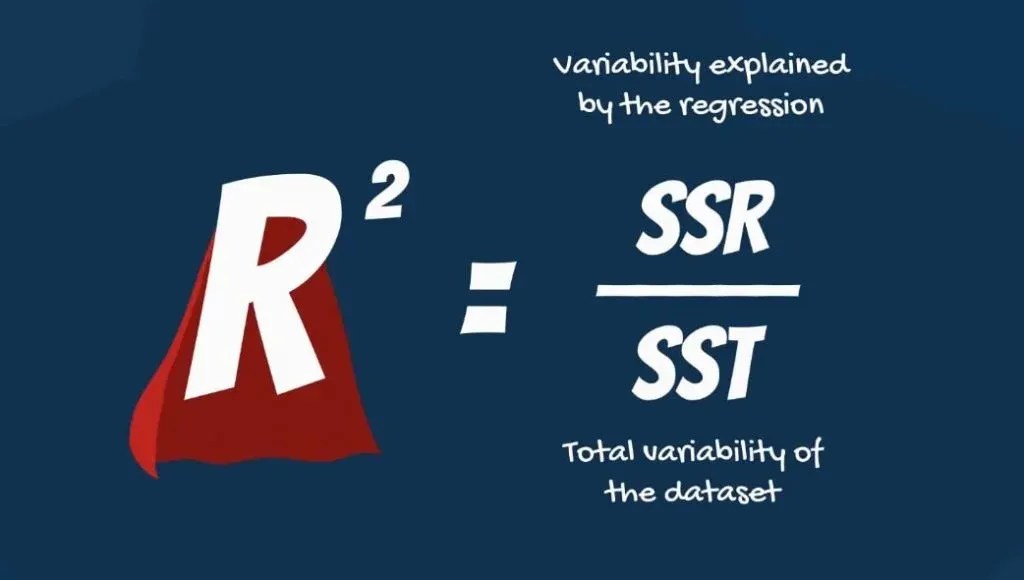

R-squared is an investment portfolio performance and risk measure that indicates how much of a portfolio’s performance fluctuations were attributable to movements in the portfolio’s benchmark index. R-squared can range from 0-100%.

CITE: https://www.r2library.com/Resource/Title/0826102549

IOW: R Squared, also known as the coefficient of determination, is a statistical measure used in the context of regression analysis. It represents the proportion of the variance in the dependent variable that is predictable from the independent variable(s). Essentially, it provides a measure of how well the observed outcomes are replicated by the model, based on the proportion of total variation of outcomes explained by the mode

For example, an R-squared of 100% indicates that all portfolio performance movements were attributable to movements in the benchmark index—they correlate perfectly to the benchmark.

Conversely, an r-squared of 0% indicates that there is no correlation between the performance movements of the portfolio and the benchmark.

Cite: http://www.CertifiedMedicalPlanner.org

COMMENTS APPRECIATED

Subscribe Today!

***

***

Filed under: CMP Program, iMBA, iMBA, Inc., Investing, Marcinko Associates | Tagged: CMP, coefficient of determination, iMBA, Institute Medical Business Advisors, medical business advisors, R squared | Leave a comment »