By Staff Reporters

***

***

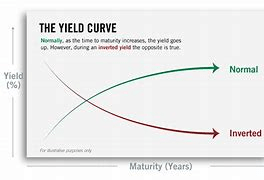

When economic trouble and/or uncertainty is brewing, it’s not uncommon for the US Treasury yield curve to flatten or even invert. A yield curve inversion, like we’re experiencing now, involves short-term-maturing bonds sporting higher yields than longer-dated Treasury bonds. It’s an indication that investors are worried about the U.S. economic outlook.

For the past 64 years, the Federal Reserve Bank of New York has used the Treasury yield spread between the 10-year bond rate and three-month bond rate to calculate the probability of a U.S. recession occurring within the next 12 months. Over these 64 years, the probability of a recession has topped 25% a dozen times and 40% on eight occasions.

With the exception of a peak probability of a recession of 41.14% in October 1966, the New York Fed’s recession-forecasting tool hasn’t been wrong if it’s surpassed 40%. In other words, if the New York Fed’s recession probability indicator surpasses 40%, we’ve had a recession within 12 months, without fail, for more than a half-century.

In December 2022, this recession probability tool hit 47.31%. That’s the highest reading since 1981, and a very clear indication that economic activity is expected to slow at some point in 2024?

***

***

COMMENTS APPRECIATED

***

COMMENTS APPRECIATED

Thank You

***

Filed under: "Ask-an-Advisor", Glossary Terms, Investing, Risk Management | Tagged: Federal Reserve, FOMC, Inverted yield curve, normal yield curve, recession, treasury bonds, yield curve inversion | 1 Comment »