By Dr. David Edward Marcinko MBA MEd

***

***

Investing in Butterfly Spreads

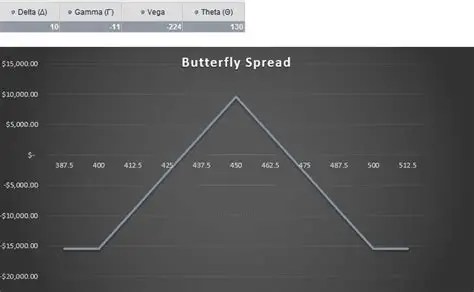

Options trading provides investors with a wide range of strategies to suit different market conditions. One of the more refined approaches is the butterfly spread, a strategy designed to profit from stability in the price of an underlying asset. It combines multiple option contracts at different strike prices to create a position with limited risk and limited reward. The name comes from the shape of its profit-and-loss diagram, which resembles the wings of a butterfly.

Structure of the Strategy

A typical butterfly spread involves four options contracts with three strike prices. In a long call butterfly spread, the investor buys one call at a lower strike, sells two calls at a middle strike, and buys one call at a higher strike. This creates a payoff that peaks if the underlying asset closes at the middle strike price. Losses are capped at the initial premium paid, while profits are capped at the difference between the strikes minus the premium.

Variations of Butterfly Spreads

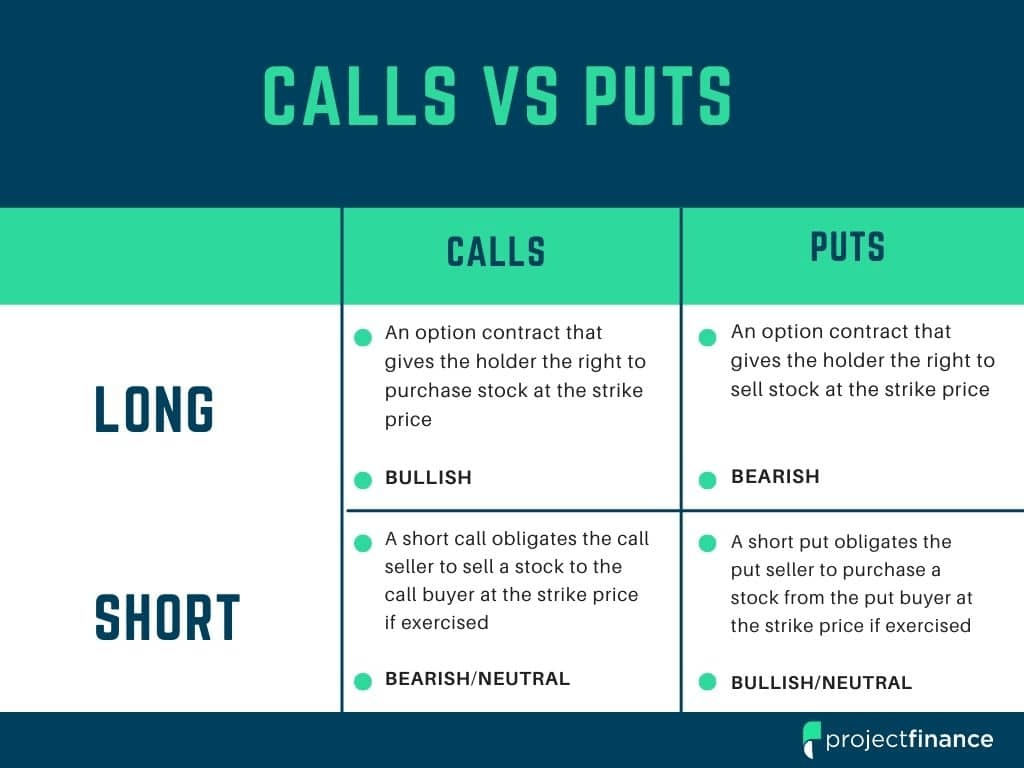

Butterfly spreads can be built with calls, puts, or a mix of both:

- Long Call Butterfly: Profits if the asset stays near the middle strike.

- Long Put Butterfly: Similar structure but using puts.

- Iron Butterfly: Combines calls and puts, selling an at-the-money straddle and buying protective wings.

- Reverse Iron Butterfly: Designed to benefit from sharp price movements and volatility.

Each variation adapts to different market expectations, but all share the principle of balancing risk and reward.

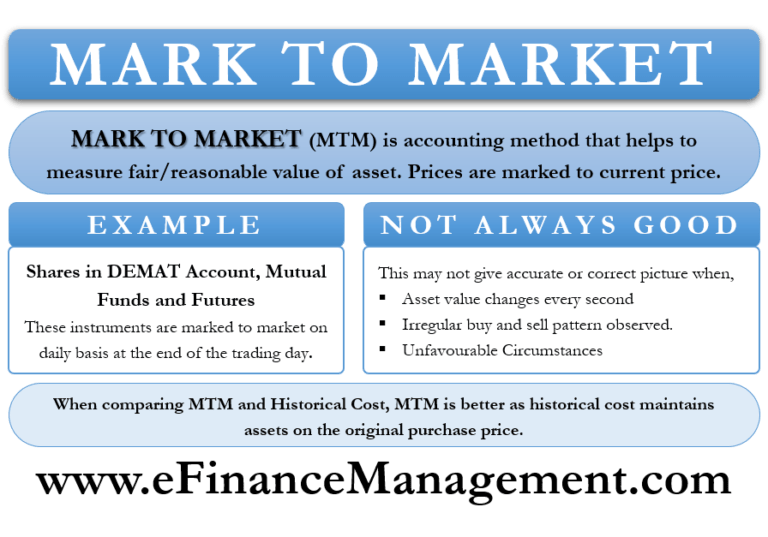

Benefits of Butterfly Spreads

- Defined Risk: The maximum loss is known upfront.

- Cost Efficiency: Requires less capital than outright buying options.

- Neutral Outlook: Works best when the investor expects little price movement.

- Flexibility: Can be tailored to different market conditions with calls, puts, or combinations.

Drawbacks and Risks

- Limited Profit Potential: Gains are capped, which may not appeal to aggressive traders.

- Dependence on Timing: The strategy works only if the asset closes near the middle strike at expiration.

- Complexity: Requires careful planning of strike prices and expiration dates.

Example in Practice

Suppose a stock trades at $100, and the investor expects it to remain near that level. They could set up a butterfly spread with strikes at $95, $100, and $105. If the stock closes at $100, the strategy delivers maximum profit. If the stock moves significantly away from $100, the investor’s loss is limited to the premium paid. This makes the butterfly spread particularly useful in calm, low-volatility markets.

Conclusion

The butterfly spread is a disciplined options strategy that thrives in stable markets. It offers a balance between risk control and profit potential, making it attractive to traders who prefer structured outcomes. While the rewards are capped, the defined risk and cost efficiency make butterfly spreads a valuable tool for investors who anticipate minimal price movement and want to manage their exposure carefully.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like, Refer and Subscribe

***

***

Filed under: "Ask-an-Advisor", finance, Financial Planning, Funding Basics, Glossary Terms, Investing, Portfolio Management, Touring with Marcinko | Tagged: butterfly spread, BUTTERFLY SPREAD INVESTING, david marcinko, finance, Investing, iron butterfly, long call, long put, options, personal-finance, stock market, stocks, strike price | Leave a comment »

***

***