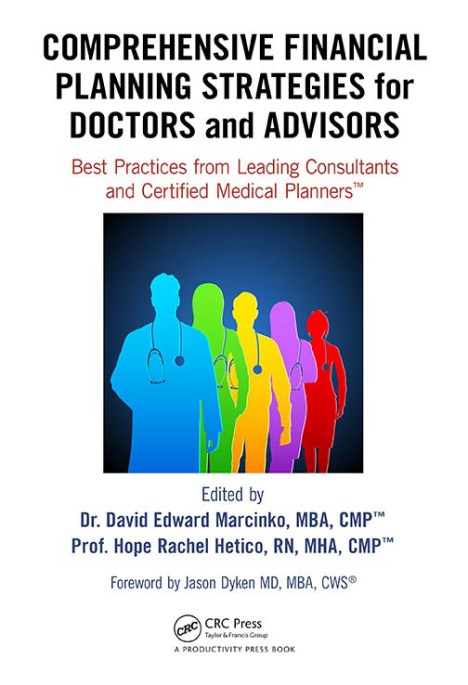

By Dr. David Edward Marcinko MBA MEd

***

***

SPONSOR: http://www.MarcinkoAssociates.com

Investment bankers are not really bankers at all. The fact that the word banker appears in the name is partially responsible for the false impressions that exist in the medical community regarding the functions they perform.

For example, they are not permitted to accept deposit, provide checking accounts, or perform other activities normally construed to be commercial banking activities. An investment bank is simply a firm that specializes in helping other corporations obtain money they need under the most advantageous terms possible. When it comes to the actual process of having securities issued, the corporation approaches an investment banking firm, either directly, or through a competitive selection process and asks it to act as adviser and distributor.

MORE: https://www.amazon.ca/Management-Liability-Insurance-Protection-Strategies/dp/1498725988

Investment bankers, or under writers, as they are sometimes called, are middlemen in the capital markets for corporate securities. The corporation requiring the funds discusses the amount, type of security to be issued, price and other features of the security, as well as the cost to issuing the securities. All of these factors are negotiated in a process known as negotiated underwriting. If mutually acceptable terms are reached, the investment banking firm will be the middle man through which the securities are sold to the general public. Since such firms have many customers, they are able to sell new securities, without the costly search that individual corporations may require to sell its own security.

Thus, although the firm in need of additional capital must pay for the service, it is usually able to raise the additional capital at less expense through the use of an investment banker, than by selling the securities itself. The agreement between the investment banker and the corporation may be one of two types. The investment bank may agree to purchase, or underwrite, the entire issue of securities and to re-offer them to the general public. This is known as a firm commitment.

When an investment banker agrees to underwrite such a sale; it agrees to supply the corporation with a specified amount of money. The firm buys the securities with the intention to resell them. If it fails to sell the securities, the investment banker must still pay the agreed upon sum.

Thus, the risk of selling rests with the underwriter and not with the company issuing the securities.

INVESTMENT BANKING: https://medicalexecutivepost.com/2024/04/17/understanding-tnvestment-banking-rules-securities-markets-brokerage-accounts-margin-and-debt/

***

The alternative agreement is a best efforts agreement in which the investment banker makes his best effort to sell the securities acting on behalf of the issuer, but does not guarantee a specified amount of money will be raised. When a corporation raises new capital through a public offering of stock, one might inquire where the stock comes from. The only source the corporation has is authorized, but previously un-issued stock. Anytime authorized, but previously un-issued stock (new stock) is issued to the public, it is known as a primary offering.

If it’s the very first time the corporation is making the offering, it’s also known as the Initial Public Offering (IPO). Anytime there is a primary offering of stock, the issuing corporation is raising additional equity capital.

A secondary offering, or distribution, on the other hand, is defined as an offering of a large block of outstanding stock. Most frequently, a secondary offering is the sale of a large block of stock owned by one or more stockholders. It is stock that has previously been issued and is now being re-sold by investors. Another case would be when a corporation re-sells its treasury stock.

STOCK BROKERS: https://medicalexecutivepost.com/2024/09/04/understanding-traditional-full-service-brokers/

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like and Subscribe

***

***

Filed under: "Ask-an-Advisor", business, Funding Basics, Investing, Marcinko Associates, Portfolio Management | Tagged: business, david marcinko, finance, firm committment, Initial Public Offering, Investing, investment bankers, IPO, primary offering, secondary offerings, SPARC, stock market, stock markets, stocks, underwriters, unissued stock | Leave a comment »