MEDICAL EXECUTIVE-POST – TODAY’S NEWSLETTER BRIEFING

***

Essays, Opinions and Curated News in Health Economics, Investing, Business, Management and Financial Planning for Physician Entrepreneurs and their Savvy Advisors and Consultants

“Serving Almost One Million Doctors, Financial Advisors and Medical Management Consultants Daily“

A Partner of the Institute of Medical Business Advisors , Inc.

http://www.MedicalBusinessAdvisors.com

SPONSORED BY: Marcinko & Associates, Inc.

***

http://www.MarcinkoAssociates.com

| Daily Update Provided By Staff Reporters Since 2007. How May We Serve You? |

| © Copyright Institute of Medical Business Advisors, Inc. All rights reserved. 2025 |

REFER A COLLEAGUE: MarcinkoAdvisors@outlook.com

SPONSORSHIPS AVAILABLE: https://medicalexecutivepost.com/sponsors/

ADVERTISE ON THE ME-P: https://tinyurl.com/ytb5955z

Your Referral Count -0-

CITE: https://www.r2library.com/Resource

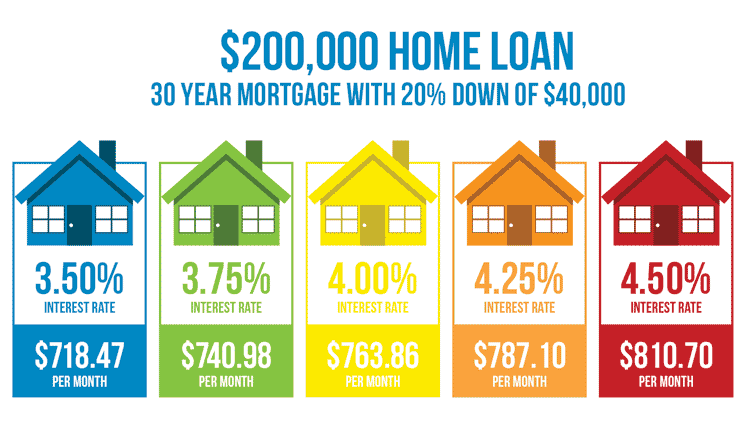

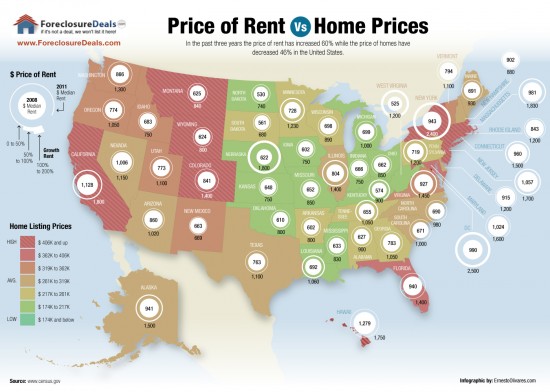

The median home price jumped 1.6% YoY last month and is sitting at $431,931. Meanwhile, mortgage rates for a 30-year fixed loan (the most common) are still hovering just under 7%. The chief economist of the National Association of Realtors said lower mortgage rates are the key to getting buyers to buy homes again.

CITE: https://tinyurl.com/2h47urt5

What’s up

- Ulta Beauty is sitting pretty, up 11.78% after the cosmetics retailer crushed earnings expectations and raised its fiscal guidance for the year ahead.

- Costco Wholesale rose 3.12% after beating Wall Street’s earnings expectations, though same-store sales did slip a bit.

- Zscaler climbed 9.79% on strong earnings for the cybersecurity company, including 23% revenue growth.

- Palantir popped 7.73% on a report from the New York Times that the Trump administration has asked the company to help the government compile data on US citizens.

What’s down

- Nvidia slipped 2.92% as rhetoric between the US and China over semiconductor import restrictions reignited investor fears.

- Gap plunged 20.18% after the retailer revealed that tariffs will cost between $100 and $150 million.

- Marvell Technology fell 5.55% after the chip maker barely beat Wall Street expectations last quarter, failing to impress shareholders.

- Regeneron Pharmaceuticals tumbled 19.01% thanks to mixed results for its new respiratory drug in late stage trials. The medication is made in partnership with Sanofi, which also dropped 5.61%.

- Dell Technologies sank 2.08% after missing earnings expectations last quarter, though it did manage to beat on revenue.

- Elastic NV beat analyst forecasts last quarter, but still fell 12.09% after the software company issued lower-than-expected revenue guidance.

- PagerDuty, which is in fact a cloud computing company and not a seller of 1990s tech, lost 11.43% after issuing lower second-quarter guidance than Wall Street forecast.

CITE: https://tinyurl.com/tj8smmes

23andMe peaked at a $6 billion valuation in 2021 but never made a profit. It filed for bankruptcy on March 23rd and was put up for auction.

Visualize: How private equity tangled banks in a web of debt, from the Financial Times.

COMMENTS APPRECIATED

PLEASE SUBSCRIBE: MarcinkoAdvisors@outlook.com

Thank You

***

***

***

***

EDUCATIONAL TEXTBOOKS: https://tinyurl.com/4zdxuuwf

***

Filed under: Drugs and Pharma, Ethics, Information Technology, Investing, Marcinko Associates, Recommended Books, Sponsors | Tagged: 23andMe, DJIA, DOW, finance, home prices, Investing, Marcinko, markets wobble, mortgage rates, NAR, NASDAQ, PBMs, Realtors, S&P 500, stocks, textbooks | Leave a comment »