THE “FIVE-FIVE” FINANCIAL RULE

By Staff Reporters

***

***

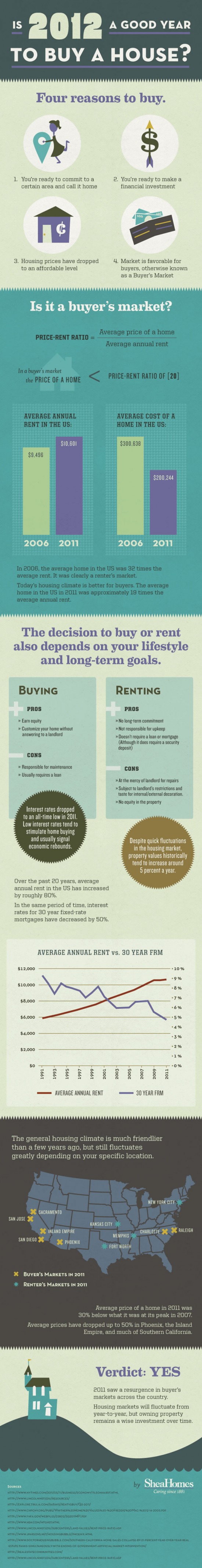

Many of the pros of home ownership will appeal to medical retirees for whom their home is their castle and who appreciate being settled both financially and geographically:

- 1. Building equity in your home: Each mortgage payment you make brings you closer to owning your house free and clear with no payments. If you can buy a new home or condo outright by selling your current home, you can still build equity in your new home over time.

- 2. Predictability: If you have a fixed-rate mortgage, your mortgage payments will remain consistent for years and you don’t have to worry about a landlord ever making you move.

- 3. Tax benefits: You can deduct mortgage interest and property taxes up to certain limits.

- 4. Customization: You don’t need a landlord’s permission to alter and improve your home.

- 5. Home appreciation: Homes generally increase in value, so you can increase your net worth by owning a property.

***

***

Renting also has five significant upsides, particularly for physician retirees who want greater freedom to travel and to make bigger moves — potentially across the country or even abroad:

- 1. Extreme flexibility: You can leave your property after giving notice and go wherever you want much more easily than with an illiquid home you’d have to sell first.

- 2. Lower upfront costs: You only have to pay first and last month’s rent and a security deposit to move into a rental, not make a large home down payment.

- 3. No maintenance concerns: If something breaks, your landlord is responsible for the cost of fixing it and the actual repairs. You don’t have to build up an emergency fund for maintenance.

- 4. Predictable expenses: For the duration of your lease, your monthly housing costs including utilities will remain consistent, even if the cost of energy goes up, for example.

- 5. Lack of worry: If you’re in a rental apartment, you won’t have to concern yourself with shoveling snow, mowing grass or other matters of upkeep.

COMMENTS APPRECIATED

Like and Subscribe

***

***

Filed under: "Ask-an-Advisor", Financial Planning, Funding Basics, Glossary Terms, Investing, LifeStyle | Tagged: 5-5 rule, appreciation, DO, DPM, equity, home, home ownership, home rentals, homeownership, homes, Investing, lease, MD, medical, own versus rent, physician, property, real-estate, renting, tax | Leave a comment »