By Dr. David Edward Marcinko MBA MEd

***

***

Alternative health coverage models like Short-Term Duration Plans, Health Care Sharing Ministries (HCSMs), and Individual Coverage Health Reimbursement Arrangements (ICHRAs) offer flexible, cost-conscious options for individuals and employers seeking alternatives to traditional insurance.

As the landscape of American healthcare continues to evolve, many consumers and employers are exploring non-traditional coverage models to address rising costs, limited access, and regulatory complexity. Among the most prominent alternatives are Short-Term Duration Plans, Health Care Sharing Ministries (HCSMs), and Individual Coverage Health Reimbursement Arrangements (ICHRAs)—each offering distinct advantages and trade-offs.

Short-Term Duration Plans are designed to provide temporary coverage for individuals experiencing gaps in insurance, such as between jobs or during waiting periods. These plans are typically less expensive than ACA-compliant insurance but come with significant limitations. They often exclude coverage for pre-existing conditions, maternity care, mental health services, and prescription drugs. While they offer affordability and quick enrollment, they lack the comprehensive protections mandated by the Affordable Care Act (ACA), making them a risky choice for those with ongoing health needs.

Health Care Sharing Ministries (HCSMs) represent a faith-based approach to healthcare financing. Members contribute monthly fees into a shared pool used to cover eligible medical expenses for others in the group. These arrangements are not insurance and are not regulated by state insurance departments, meaning they are not required to cover essential health benefits or guarantee payment. However, HCSMs appeal to individuals seeking community-based support and lower costs. They often include moral or religious requirements for membership and may exclude coverage for lifestyle-related conditions or services deemed inconsistent with their beliefs.

***

***

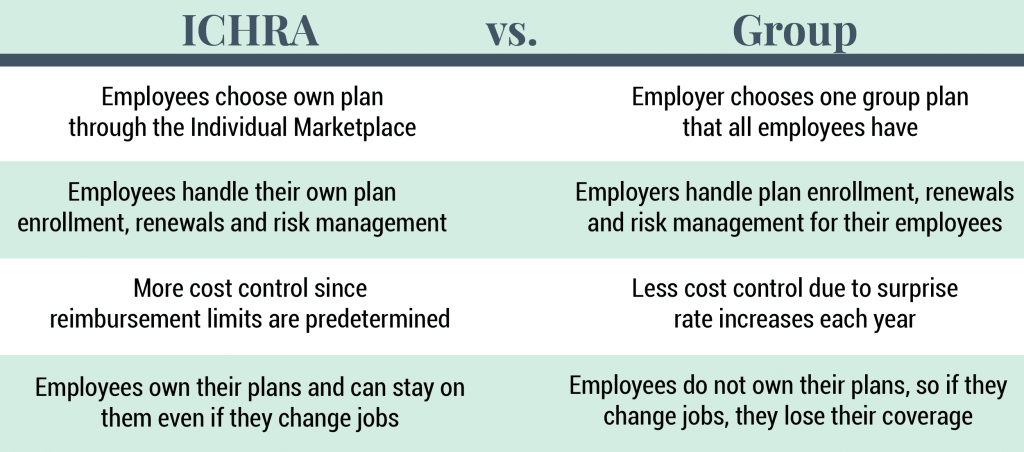

Individual Coverage Health Reimbursement Arrangements (ICHRAs) are employer-sponsored programs that allow businesses to reimburse employees for individual health insurance premiums and qualified medical expenses. Introduced in 2020, ICHRAs offer flexibility for employers to control costs while giving employees the freedom to choose plans that suit their needs. Unlike traditional group health insurance, ICHRAs shift the purchasing power to employees, promoting consumer choice and market competition. However, they require employees to navigate the individual insurance marketplace, which can be complex and variable depending on location and income.

Other emerging models include Direct Primary Care (DPC), where patients pay a monthly fee for unlimited access to a primary care provider, and Health Savings Accounts (HSAs) paired with high-deductible plans, which encourage consumer-driven healthcare spending. These models emphasize affordability, personalization, and preventive care, but may not offer sufficient protection against catastrophic health events.

In conclusion, alternative health coverage models provide valuable options for individuals and employers seeking flexibility and cost savings. However, they often come with trade-offs in coverage, regulation, and consumer protection. As ACA subsidies fluctuate and healthcare costs rise, these models are likely to gain traction—but consumers must carefully assess their health needs, financial risks, and eligibility before choosing a non-traditional path.

COMMENTS APPRECIATED

SPEAKING: Dr. Marcinko will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com

Like, Refer and Subscribe

***

***

Filed under: Ask a Doctor, Drugs and Pharma, Glossary Terms, Health Economics, Health Insurance, Healthcare Finance, Insurance Matters, Managed Care, Touring with Marcinko | Tagged: ACA, david marcinko, DPC, HASs, HCSMs, health, Health Care Sharing Ministries, Health Insurance, healthcare, HSA, ICHRAs, Individual Coverage Health Reimbursement Arrangements, insurance, medicare, Obama care | Leave a comment »