“Massively Confused Investors Making Conspicuously Ignorant Choices”

By Somnath Basu PhD, MBA

How well we make investment decisions depends in part on how reasoned or emotional the decision was. The greater the emotional content the more likely will be the mistake. It is useful for all of us to understand the emotional pitfalls of financial decision-making.

Financial Psychologists

An appropriately titled study by a financial psychologist Michael S. Rashes, “Massively Confused Investors Making Conspicuously Ignorant Choices” cites that the widespread phenomenon witnessed in the market, whereby several stocks with similar ticker symbols all went up in value when positive news was announced about any one of them.

Example: http://ideas.repec.org/a/bla/jfinan/v56y2001i5p1911-1927.html

A case in point is the parallel movement between two entirely unrelated stocks, MCIC (ticker symbol for the telecommunications firm, MCI, bought by Worldcom in 1997), and MCI (ticker symbol for the Massmutual Corporate Investors fund). The acquisition of MCI, the telecommunications firm, in 1997-8 caused an upward movement in its stock (MCIC). That movement was also closely correlated with the upward movement in the stock of Massmutual Corporate Investors (MCI), whose ticker symbol was the same as the telecommunications company’s name. Rampant confusion of this sort strongly supports the notion that irrationality, not rationality, rules the financial markets. Another noted scientist, B. Malkiel suggests that when it comes to investing, people generally follow their emotions, not their reason, their hearts, not their minds.

Behavioral Finance and Economic Gurus

This line of argument has been gaining credibility over the last decade or so, not only among behavioral finance experts, but also economists themselves, as well as stock market pundits and the population at large. There is a strong sense among all these groups that greed, exuberance, fear and herding behavior affect markets as much as or more than calculations of P/E ratios, profit projections, or market benchmarks. The bursting of the stock market bubbles of 2000 and 2008 only confirmed these long-held suspicions. As a result, widely used economic models based on rational investor behavior require some reevaluation and could be found to be unreliable at best and irrelevant at worst.

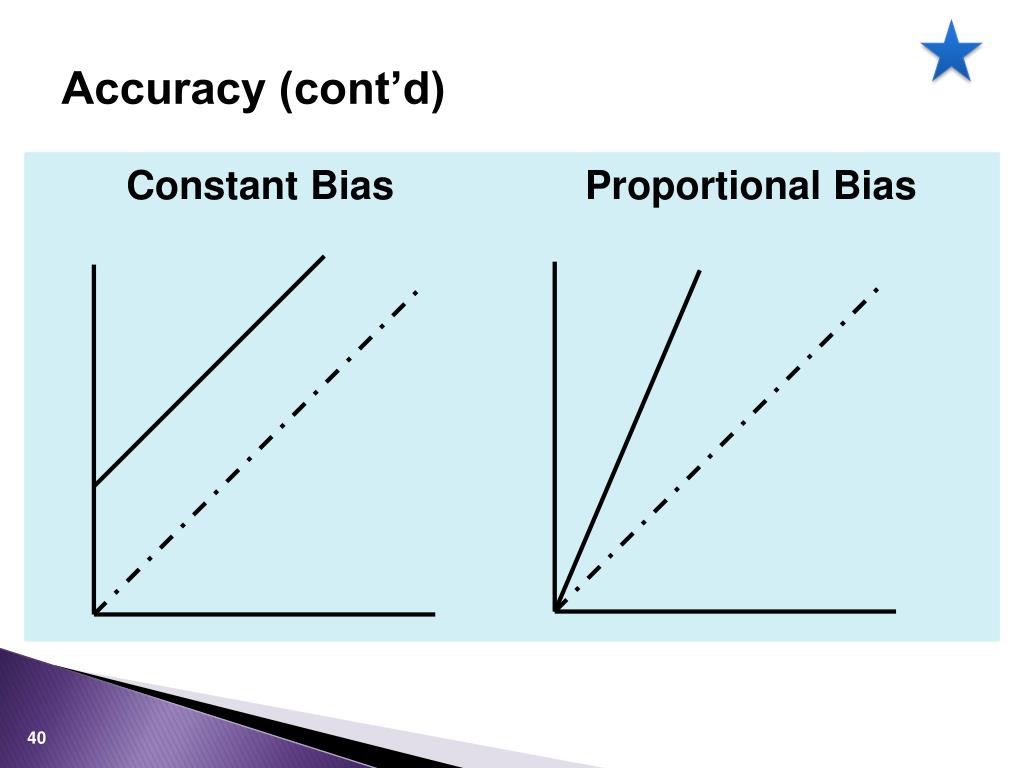

The Decision Biases

The following is only a partial list of the biases that may be induced in you if the financial decisions you make are based on emotion and not on reason. The list includes the bias name, a descriptive definition and an example of application error. Before closing that next trade you make, a good question to ask yourself is whether any of the biases from the list were included in your financial decision. If so, these decisions too need further evaluation.

1. Over-Confidence:

Over-estimating the chances of correctly predicting the direction of price changes!

Example: Attribute good outcomes (i.e., gains) to your skill while attributing bad outcomes (i.e., losses) to your bad luck.

2. Pride and Regret:

Investors often over-estimate their powers of discerning stock winners from losers. Some physicians and other investors (essentially, active traders) may rapidly sell and buy back stocks, in order to capture expected gains.

Example: Selling your winning picks early and holding onto losers hoping they rebound. Studies show that doing the opposite can increase your annual returns by 3-4%.

3. Cognitive Dissonance:

Suggests that investors experience an internal conflict when a belief or assumption of theirs is proven wrong

Example: It’s easier to remember your winning picks than your losing ones since the latter outcomes disagreed with your earlier beliefs.

4. Confirmation Bias:

Suggests that they try to seek out information that will help confirm their existing views whether those views be right or wrong.

Example: When you hear someone agreeing with your investment decision you feel that person is much more knowledgeable than one who disagrees with you.

5. Anchoring:

A phenomenon whereby people stay within range of what they already know in making guesses or estimates about what they do not know.

Example: The Dow Jones Industrial Average (DJIA), which grew from a value of 41 in 1896 to 9,181 in 1998, does not include dividends. They then value the index in 1998, including dividends, at a whopping 652,230. When asked, investors estimate the value of the DJIA would be if dividends were included, all were way off the mark, keeping their answers close to its familiar value of 9,181. The highest guesses came in at under 30,000, less than 5% of the actual value.

6. Representative Heuristics:

An over-reliance on familiar clues, such as past performance of a stock!

Example: most investors assume that the stock of a company with strong earnings will perform well and that the stock of a company with weak earnings will perform poorly. The law of large numbers suggests however that the exact opposite is much likelier to be true.

Conclusion

And so, your thoughts and comments on this ME-P are appreciated. Feel free to review our top-left column, and top-right sidebar materials, links, URLs and related websites, too. Then, subscribe to the ME-P. It is fast, free and secure.

NOTE: Somnath Basu is a Professor of Finance at California Lutheran University and the creator of the innovative AgeBander (www.agebander.com) retirement planning software.

Filed under: Financial Planning, Investing, Portfolio Management, Research & Development | Tagged: Anchoring, behavioral economist, behavioral finance, Confirmation Bias, Decision Biases, DJIA | 5 Comments »