By Staff Reporters

SPONSOR: http://www.MarcinkoAssociates.com

DEFINITION

***

***

Swaps (a.k.a. swap agreements) are two-party contracts entered into primarily by institutional investors for periods ranging from a few weeks to more than one year.

In a standard “swap” transaction, two parties agree to exchange the returns (or differentials in rates of return) earned or realized on particular predetermined investments or instruments. The gross returns to be exchanged or “swapped” between the parties are generally calculated with respect to a “notional amount,” i.e., the return on or increase in value of a particular dollar amount invested at a particular interest rate, in a particular foreign currency, or in a “basket” of securities representing a particular index.

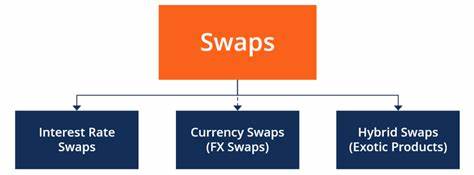

Forms of swap agreements include interest rate swaps (under which fixed- or floating-rate interest payments on a specific principal amount are exchanged) and total return swaps (under which one party agrees to pay the other the total return of a defined underlying asset in exchange for fee payments).

In addition, credit default swaps enable an investor to buy/sell protection against a credit event of a specific issuer. The seller of credit protection against a security or basket of securities receives an up-front or periodic payment to compensate against potential default(s).

COMMENTS APPRECIATED

Thank You

***

***

Filed under: "Ask-an-Advisor", Financial Planning, Funding Basics, Glossary Terms, iMBA, Inc., Investing, Marcinko Associates | Tagged: credit default swaps, economics, economy, finance, hybrid swaps, interest rate, interest rate swaps, Marcinko, rate swaps, swap transactions, swaps | Leave a comment »