LLM

By Staff Reporters

***

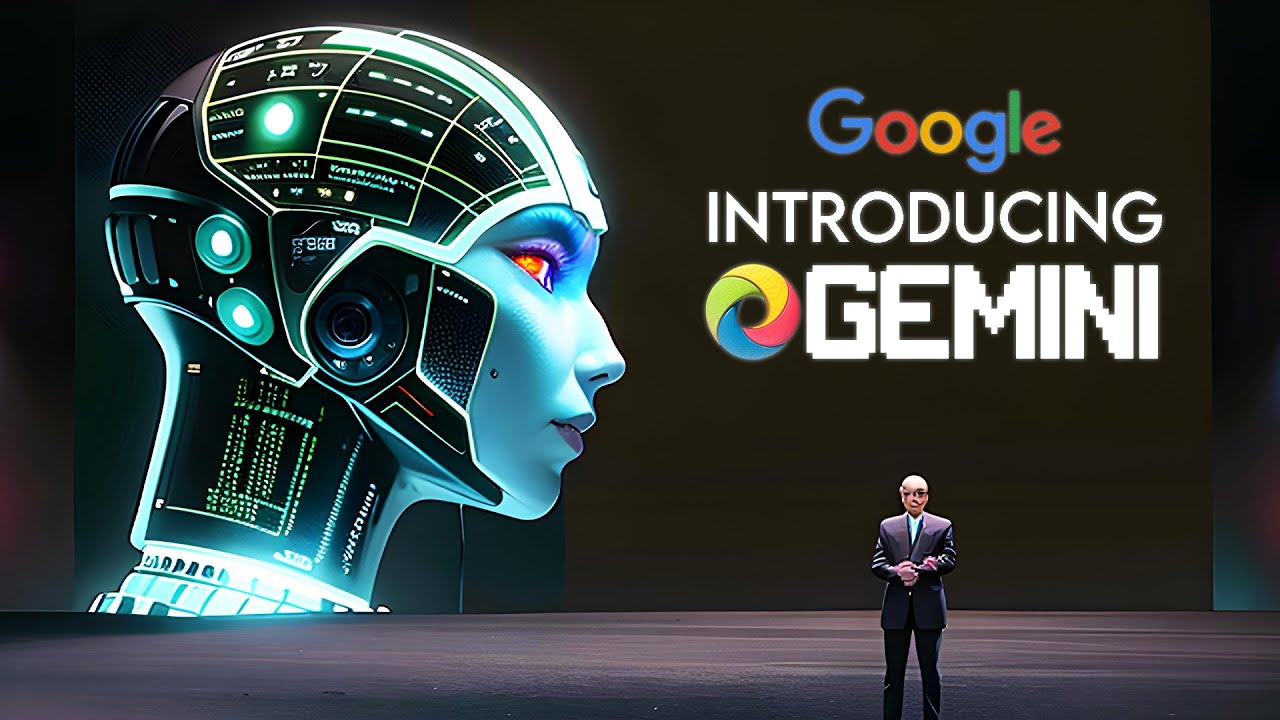

- About a year after OpenAI’s launch of ChatGPT brought the simmering artificial intelligence race to a boil, Google’s highly anticipated AI model, Gemini, has finally joined the competition. Released yesterday, Gemini is a large language model (LLM) that Google CEO Sundar Pichai and executives at the company’s DeepMind AI division say will revolutionize generative technology for business and daily life.

The tech is a family of three models that Google is slowly looping into its suite of services:

- Gemini Nano is mainly for mobile devices. As of yesterday, Google Pixel 8 Pro owners could enlist Gemini Nano to summarize audio recordings or draft automatic message replies.

- Gemini Pro is a midsize offering designed for more complex tasks. Pro now powers Google’s chatbot, Bard, but the AI tech isn’t available to Google Cloud customers until Dec. 13.

- Gemini Ultra, the powerhouse version geared toward data centers and large companies, will launch next year and underpin “Bard Advanced,” a new chatbot that will be able to simultaneously process text, images, audio, and video, according to Google’s prerecorded demonstrations.

If Gemini can do what Google promises, it could chip away at OpenAI’s lead in the LLM space.

COMMENTS APPRECIATED

Thank You

***

***

Filed under: Breaking News, Career Development, Experts Invited, Glossary Terms, Information Technology | Tagged: AI, artificial intelligence, ChatGPT, DeepMind, Gemini, google, large language model, LLM, openAI, Pichai, Sundar | Leave a comment »