Collateralized Debt Obligations

versus

COLLATERALIZED MORTGAGE OBLIGATIONS

BY DR. DAVID E. MARCINKO MBA CMP®

SPONSOR: http://www.CertifiedMedicalPlanner.org

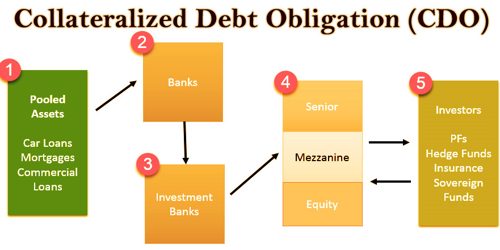

A collateralized debt obligation (CDO) is a type of structured asset-backed security (ABS). Originally developed as instruments for the corporate debt markets, after 2002 CDOs became vehicles for refinancing mortgage-backed securities (MBS).

Like other private label securities backed by assets, a CDO can be thought of as a promise to pay investors in a prescribed sequence, based on the cash flow the CDO collects from the pool of bonds or other assets it owns. Distinctively, CDO credit risk is typically assessed based on a probability of default (PD) derived from ratings on those bonds or assets.

CITE: https://www.r2library.com/Resource/Title/0826102549

***

***

Collateralized Mortgage Obligation

A CMO is a debt security backed by mortgages. These mortgage pools are usually separated into different maturity classes called tranches (from the French word for “slice”). The securities were issued by private issuers, as well as the Federal Home Loan Mortgage Corporation (Freddie Mac). As the mortgages were usually government-guaranteed, CMOs usually carried AAA ratings until their current financial meltdown. The early versions of CMOs were known as “plain vanilla,” but recent developments gave us PACs (planned amortization certificates) and TACs (targeted amortization certificates); among too many others. They were all variations on how principal repayments in advance of maturity date were treated.

CITE: https://www.r2library.com/Resource/Title/0826102549

***

YOUR THOUGHTS ARE APPRECIATED.

Thank You

***

Filed under: "Ask-an-Advisor", Alternative Investments, CMP Program, Glossary Terms, Investing, Touring with Marcinko | Tagged: CDO, CMO, collateralized debt obligation, David Edward Marcinko, Investing, Mortgage Backed Securities, Mortgage Bankers Association, PACS, TACs | Leave a comment »