SOME DIFFERENT REASONS WHY DOCTORS DON’T GET RICH

“Physicians have a significantly low propensity to accumulate substantial wealth.”

Thomas Stanley – Author “The Millionaire Next Door”

[New York Times]

How come doctors fail to get rich? Re-read the above!

http://www.MarcinkoAssociates.com

By Dr. David Edward Marcinko MBA CMP®

SPONSOR: http://www.CertifiedMedicalPlanner.org

The Institute of Medical Business Advisors Inc identified several reasons based on observations working with medical professional and physician clients over the years.

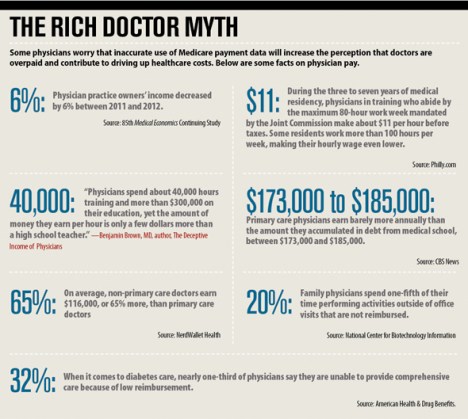

A late start

By the time doctors finish medical school and residency they’re typically in their middle or late thirties. Many have families to feed, and substantial student loans to pay off. It will be years before they can even start accumulating wealth. Consider that physicians typically enter careers at later ages, often with larger debts from training. Some specialties may not lead a case until 10 years of practice, and many specialties have limited longevity. Peak earning years may also be shorter for health care providers than other professionals. Financial survival skills are paramount for converting the limited earnings time period to personal financial security.

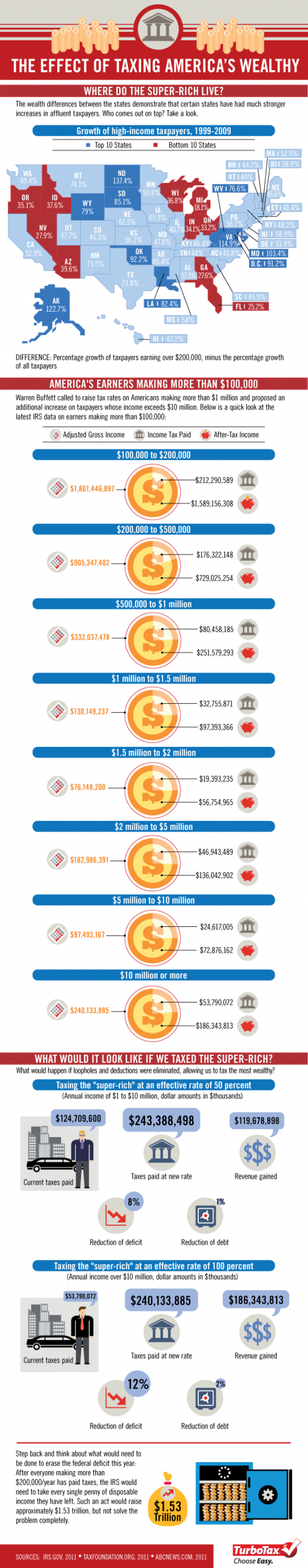

Challenging socio-political environment

It is increasingly challenging to practice medicine. With the Medicare Trust Fund slated to go bust in 2019, the Center for Medicare and Medicare Service (CMS) is increasingly resorting to cutting physician reimbursements and implementing capitation and bundled value based medical payments models. The medical reimbursement effects of the PP-ACA are not yet fully discerned; but appear to continue the decline in compensation. And to illustrate this potential governmental control, in what other industry can participants debate the simple question, “who is the customer?”

Lifestyle expectations

Society expects a doctor to live like a doctor, dress like a doctor, and drive like a doctor. Meeting social expectations can be quite expensive.

Time and energy

A doctor can’t be just a doctor any more. S/he also has to deal with ever increasing regulatory mandates, paperwork requirements by state and federal agencies and capricious insurance companies. It is estimated that for every hour spent on patient care, and additional half-hour is spent on paperwork. To-date, the use of electronic medical records has exacerbated; not ameliorated this problem. The demand on their time is mind-boggling. A typical doctor works a ten- to twelve-hour day. After work and family, they simply don’t have time and energy left to do comprehensive financial planning.

Financially naïve

Doctors are smart. They’re highly trained in their area of expertise. But, that doesn’t translate into understanding about finance or economics. Because they are smart, it’s easy for them to think they can easily master and execute concepts of personal financial planning, as well. Often, they don’t.

Lack of trust and delegation

Many doctors don’t trust financial advisors working for major Wall Street banks. They have the good instinct to realize that their interests are not aligned. Not knowing there are independent advisors out there who observe a strict fiduciary standard, they tend to do everything by themselves.

In fact, Paul Larson CFP®, President-CEO of the firm LARSON Financial Group LLC, noted a disquieting trend among physician client in his firm [personal communication]. Almost 90% of them fail to take care of their own family finances in a comprehensive manner; while only 10% are succeeding. The strategies in this chapter and book are common to their success.

Too Trusting

Another aspect of naivety, many physicians do not realize that the financial advisory industry lacks the same discipline and regulation that the average physician operates in. A primary care doctor would never even attempt a complicated surgery on a patient, but is trained to refer such patients to a specialist in the field with the proper training and experience. Financial Advisors often come from a sales background and are trained to keep a client in house even if the advisor is lacking in expertise. Also, many physicians are not trained to discern a qualified financial advisor from a sales person dressed up like a financial advisor. It is illegal to call yourself a physician in the United States unless you have the credentials to back it up; yet, anyone in the US can legally call themselves a financial advisor or a financial planner.

Your thoughts are appreciated.

SECOND OPINIONS: https://medicalexecutivepost.com/schedule-a-consultation/

INVITE DR. MARCINKO: https://medicalexecutivepost.com/dr-david-marcinkos-bookings/

DOCTORS ARE VERY DIFFERENT: https://marcinkoassociates.com/doctors-unique/

DIY Textbook Order: https://www.amazon.com/Comprehensive-Financial-Planning-Strategies-Advisors/dp/1482240289/ref=sr_1_1?ie=UTF8&qid=1418580820&sr=8-1&keywords=david+marcinko

THANK YOU

***

Filed under: "Doctors Only", Career Development, Experts Invited, Interviews, Investing, Touring with Marcinko | Tagged: financial planning doctors, financial planning physicians, investing physicians, Marcinko, Marcinko Associates, poor doctors, rich doctors | 3 Comments »