***

***

By Dr. David Edward Marcinko MBA MEd

The phrase “Hobson’s choice” refers to a situation where a person is offered only one option disguised as a free choice. It’s the classic “take it or leave it” scenario—where declining the offer results in no alternative, making the choice effectively compulsory. Though it may sound paradoxical, Hobson’s choice is a powerful concept that reveals much about human decision-making, power dynamics, and the illusion of autonomy.

The term originates from Thomas Hobson, a 16th-century livery stable owner in Cambridge, England. Hobson rented horses to university students and townsfolk, but to prevent his best horses from being overused, he implemented a strict rotation system. Customers could only take the horse nearest the stable door—or none at all. While it appeared that Hobson was offering a choice, in reality, there was no real alternative. This practice became so well-known that “Hobson’s choice” entered the English lexicon as a metaphor for constrained decision-making.

In modern contexts, Hobson’s choice appears in various forms. In business, a company might present a single product or service as if it were part of a broader selection. In politics, voters may feel they are choosing between candidates, but if all options represent similar policies or ideologies, the choice is superficial. Even in personal relationships or workplace settings, individuals may be given decisions that seem voluntary but are shaped by pressure, necessity, or lack of alternatives.

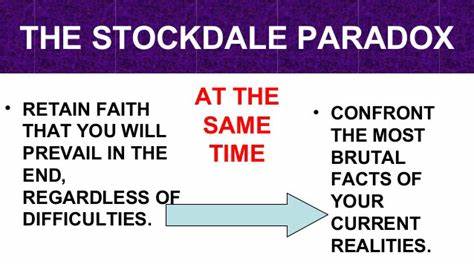

Philosophically, Hobson’s choice challenges the notion of free will. It forces us to ask: Is a decision truly free if the consequences of refusal are unacceptable? This dilemma is particularly relevant in ethical debates, such as informed consent in medicine or coercion in legal contracts. When someone is pressured to accept terms under duress or limited options, the legitimacy of their consent becomes questionable.

Moreover, Hobson’s choice is often used rhetorically to justify decisions that limit others’ autonomy. For example, a government might present a controversial policy as the only viable solution to a crisis, framing dissent as irresponsible. In such cases, the illusion of choice masks the exercise of power and control.

Despite its negative connotations, Hobson’s choice can also serve as a tool for efficiency and fairness. Hobson’s original intent was to protect his horses and ensure equal access for all customers. In systems where resources are limited, offering a single standardized option may prevent exploitation or favoritism.

In conclusion, Hobson’s choice is more than a historical anecdote—it’s a lens through which we can examine the boundaries of freedom, the ethics of decision-making, and the subtle ways power operates in everyday life. Whether in politics, business, or personal relationships, recognizing Hobson’s choice helps us navigate the complex terrain between autonomy and constraint.

COMMENTS APPRECIATED

SPEAKING: ME-P Editor Dr. David Edward Marcinko MBA MEd will be speaking and lecturing, signing and opining, teaching and preaching, storming and performing at many locations throughout the USA this year! His tour of witty and serious pontifications may be scheduled on a planned or ad-hoc basis; for public or private meetings and gatherings; formally, informally, or over lunch or dinner. All medical societies, financial advisory firms or Broker-Dealers are encouraged to submit an RFP for speaking engagements: CONTACT: Ann Miller RN MHA at MarcinkoAdvisors@outlook.com -OR- http://www.MarcinkoAssociates.com

Like, Refer and Subscribe

***

***

Filed under: Ask a Doctor, Ethics, Experts Invited, Glossary Terms, iMBA, Inc., LifeStyle | Tagged: consciousness, david marcinko, faith, free choice, free will, Hobson's choice, philosophy, Science, Thomas Hobson | Leave a comment »